Buy IndiaMART Ltd for the Target Rs. 2,900 by Motilal Oswal Financial Services Ltd

Battling in familiar waters

Churn in silver accounts continues

* IndiaMART (INMART) reported 2QFY26 revenue growth of 12% YoY vs. our estimate of 9.5% YoY growth. Deferred revenue rose 17% YoY to INR17.5b. EBITDA margin was down ~260bp QoQ to 33.2%, in line with our estimate of 34%. PAT stood at INR830m, down 39% YoY, below our estimate of INR1,176m due to lower other income.

* For 1HFY26, revenue/EBITDA grew 12.4%/3.6% and PAT declined 5.2% YoY. We expect revenue to grow 13%, whereas EBITDA/PAT would decline 0.5%/9.0% YoY in 2HFY26. We reiterate our BUY rating on the stock, citing undemanding valuations, with a TP of INR2,900.

Our view: Gold and platinum account cohorts anchor stability

* Collections slightly soft; deferred revenue steady: Standalone collections grew 7% YoY to INR3.6b, reflecting some softness sequentially due to seasonality and the impact of the Silver-tier price hike. Deferred revenue, however, remained steady, rising 17% YoY to INR17.5b. We believe the overall deferred-revenue trajectory remains healthy due to resilience in gold-platinum premium cohorts even as near-term collection trends stay modest.

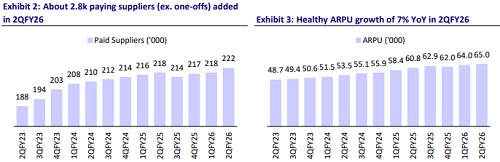

* ARPU growth consistent; silver churn to stay elevated in near term: ARPU grew 7% YoY, continuing its long-term 7-8% CAGR despite subdued supplier additions in recent years. Management implemented a ~10% price hike for Silver plans (first since 2019), which we think could lead to a temporary dip in new additions and retention over the next couple of quarters. Churn in Silver accounts remained elevated (~7% monthly), while Gold/Platinum churn was stable (~1%). We continue to view ARPU as the key near-term growth lever while the supplier base expansion remains gradual. We have accordingly built in 8% growth for FY26.

* Several initiatives underway to address churn: INMART continues to refine its platform to improve buyer-supplier interactions. Key initiatives include requiring buyers to provide more detailed inquiries (enhancing lead quality), localizing search to city-level listings, and reducing seller competition per buyer. While these measures have yet to materially reflect in churn data, we believe they lay the foundation for improved supplier satisfaction and retention over time.

* Margins impacted by one-offs: EBITDA margin stood at 33.2%, down 260bp QoQ, primarily due to one-off ESOP-related expenses (~INR900m grant spread over 1Q-2Q) and a fair valuation charge (~INR160m) on investment. Core margins, otherwise, remained stable. We factor in stable performance marketing spends of INR80-100m per quarter (focused on demand generation in top categories), which could keep margins in the 32-33% range through FY26. Management remains focused on RoI and intends to recalibrate spending based on outcomes.

Valuation and changes to our estimates

* We continue to view INMART as a key beneficiary of the growing technology adoption by India’s MSME universe and the ongoing shift toward a formalized ecosystem. We keep our estimates largely unchanged. We expect INMART to deliver a 13% revenue CAGR over FY25-27. We estimate the EBITDA margin at 32.6%/32.8% for FY26/FY27.

* Currently, INMART is trading at an undemanding valuation, in our view, as the valuations reflect uncertainties surrounding the churn rate, product-market fit, and subscriber growth. We value INMART on a DCF basis to arrive at our TP of INR2,900, assuming 11.5% WACC and 6% terminal growth. Reiterate BUY.

Beat on revenues and margins in-line; ARPU rises 7% YoY

* 2Q revenue of INR3.9b grew 12% YoY vs. our estimate of 9.5%.

* Collections stood at INR4.0b (+14% YoY). Deferred revenue rose 17% YoY to INR17.5b.

* It added 4k paying subscribers QoQ (one of the highest additions in recent quarters). ARPU grew 7% YoY to INR65k. .

* EBITDA margin was 33.2%, down 260bp QoQ in line with our estimate of 34.0%.

* PAT was INR830m, down 39% YoY, below our estimate of INR1,176m due to lower other income.

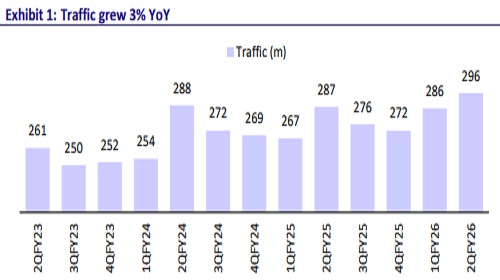

* Traffic grew 3% YoY to 296m. The total number of suppliers on the platform stood at 8.6m, up 6% YoY.

* Total cash and investments stood at INR28.7b.

Highlights from the management commentary

* Collections stood at INR4.0b, up 14% YoY, while deferred revenue rose 17% YoY to INR17.5b.

* Traffic growth was 3% YoY, though the company plans to discontinue reporting this KPI in the next quarter due to data reliability concerns. Automated bot activity, especially from Chinese and Russian sources, has made it increasingly difficult to distinguish genuine user traffic from web-scraped data.

* Total paying suppliers are 222,000, with 2.8k net additions during the quarter, excluding a one-time addition of 1,200 suppliers resulting from a streamlined onboarding process for Silver clients.

* The supplier onboarding process has been fully digitized. Earlier, sales teams manually collected payments and waited for GST verification before activation— typically a 5-7-day delay. Now, real-time verification enables instant activation upon payment (about 80% of which are now online). The pilot launched in DelhiNCR has been scaled nationwide.

* Gold and Platinum customers continue to exhibit strong upsell and retention rates.

* Other income declined, impacted by mark-to-market (MTM) losses on the company’s treasury portfolio amid rising bond yields. Over the longer term, treasury income is expected to remain in the 6-7% range.

* Performance marketing spends totaled INR60m (INR6cr) in the quarter, focused on the top 10-15 categories. Initial results have been encouraging, and the company plans to maintain a budget of INR80-100m (INR8-10cr) per quarter going forward.

Valuation and view

* We are confident of strong fundamental growth in operations, propelled by: 1) higher growth in digitization among SMEs, 2) the need for out-of-the-circle buyers, 3) a strong network effect, 4) over 70% market share in the underlying industry, 5) the ability to improve ARPU on low price sensitivity, and 6) higher operating leverage.

* We value INMART on a DCF basis to arrive at our TP of INR2,900, assuming 11.5% WACC and 6% terminal growth. Reiterate BUY.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)