Buy ICICI Prudential Life Insurance Ltd for the Target Rs. 720 by Motilal Oswal Financial Services Ltd

Strong VNB margins; GST cut to impact cost ratios

Product mix gradually shifting to non-par and protection

* ICICI Prudential Life Insurance (IPRU) reported APE of INR24.2b (in-line), reflecting a decline of 3% YoY. In 1HFY26, APE declined 4% YoY to INR42.9b.

* VNB margin for the quarter stood at 24.4% vs. our estimate of 23.5%, reflecting an expansion of 100bp YoY. Absolute VNB grew 1% YoY to INR5.9b (in-line) in 2QFY26. For 1HFY26, VNB was largely flat YoY at INR10.5b, reflecting an improvement in VNB margin to 24.5% (23.7% in 1HFY25).

* IPRU reported an EV of INR505b at the end of 1HFY26, growing 10% YoY. PAT grew 19% YoY to INR3b (in-line) in 2QFY26 (26% YoY growth for 1HFY26).

* With a benign base for 2HFY26, management expects to build growth momentum, aided by the GST cut benefits. A short-term uptick in cost ratios is expected due to the loss of input tax credit, but management anticipates a gradual improvement as GST exemptions boost volumes and operational cost-efficiency initiatives take effect.

* We have maintained our APE growth estimates for FY26/FY27. However, we have raised our cost assumptions for 2HFY26 due to the loss of input tax credit, reducing our FY26 VNB margin estimates by 20bp while keeping FY27/28 estimates intact. Additionally, we have factored in a 1% EV hit on the back book owing to the GST ITC impact. This has resulted in a 1% decline in our FY26/27/28 EV estimates. Rolling over to Sep’27 EV leads us to a TP of INR720 (based on 1.6x Sep’27E EV). Reiterate BUY.

Cost efficiency and product mix shift driving profitability

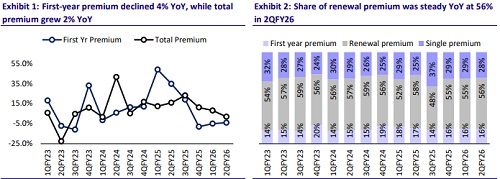

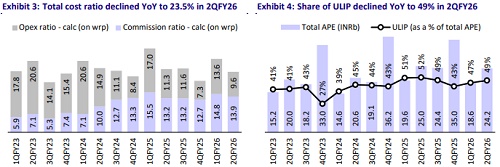

* IPRU’s gross premium grew 2% YoY to INR123b (8% below estimates) in 2QFY26, driven by a 14% YoY growth in single premium, while renewals declined 2% YoY.

* APE declined 3% YoY in 2QFY26, largely due to a 9%/47% YoY decline in ULIP/ annuity segments due to a high base. The non-linked segment maintains momentum, growing 12% YoY. Meanwhile, 88% YoY growth in the lumpy group business softened the overall APE decline. The protection business witnessed a flat performance, with retail protection growing 2% YoY.

* The 90bp YoY expansion in VNB margin to 24.4% was driven by a higher contribution from the non-linked business at 22.1% (19.1% in 2QFY25), along with continued growth in retail protection contribution from 6.6% in 2QFY25 to 7% in 2QFY26.

* Commission expenses witnessed a slight increase of 3% YoY to INR12.7b, while operating expenses declined 17% YoY, driven by cost optimization measures. Total expenses declined 54% YoY due to a 6% YoY decline in benefits paid as well as a decline in actuarial liabilities. Going forward, profitability may be impacted by commission structure renegotiations aimed at curbing the input tax credit impact following the GST exemption.

* On the distribution front, agency/direct channels saw a decline of 23%/9% YoY due to the high base of ULIP and annuity last year. The bancassurance channel witnessed slow growth of 1% YoY but continued to contribute the highest to the mix (30.6% for 2QFY26). The group business posted strong growth of 21% YoY, largely due to the lumpy group business during the quarter. Corporate agents also witnessed 23% YoY growth.

* On a premium basis, persistency declined in 2QFY26, with 13th month persistency at 82.4% (86.4% in 2QFY25) and 61st month persistency at 59.4% (63.1% in 2QFY26).

* AUM was largely flat YoY at INR3.2t, while solvency improved to 213.2%.

Highlights from the management commentary

* APE in Sep’25 showed flat growth despite most business occurring later in the month. The linked business has started to see recovery, with initial signs of traction post-GST exemption reflected in increased website traffic and improved conversion rates.

* The higher mix of protection and non-par products, increasing rider attachment, and favorable yield curve movement have offset GST-related drag. The GST hit has already been reflected in 1HFY26 VNB. If the company cannot offset further impact through levers like cost optimisation and commission renegotiations, VNB margin will be affected temporarily. However, management expects to see recovery through higher volumes and absolute VNB growth.

* In the savings segment, ULIP returns and non-par IRRs are already trending higher post-exemption, while protection volumes are expected to rise meaningfully in the coming quarters.

Valuation and view

* IPRU’s cost optimization measures and product mix shift have resulted in continued YoY expansion with respect to VNB margin. Going forward, while a short-term impact on profitability is expected due to the loss of input tax credit, the severity of this impact will depend on effective cost optimization and commission rationalization measures. In the longer term, higher volumes driven by GST exemption, increased traction of non-linked products, and improved product-level margins will support the company’s profitability.

* We have maintained our APE growth estimates for FY26/FY27. However, we have raised our cost assumptions for 2HFY26 due to the loss of input tax credit, reducing our FY26 VNB margin estimates by 20bp and keeping FY27/28 estimates intact. Moreover, we have factored in a 1% EV hit on the back book due to the GST ITC impact. This resulted in a 1% decline in our FY26/27/28 EV estimates. Rolling over to Sep'27 EV results in a TP of INR720 (based on 1.6x Sep'27E EV). Reiterate BUY.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412