Buy Gravita India Ltd for the Target Rs. 2,200 by Motilal Oswal Financial Services Ltd

Subdued volumes; better growth expectations in 2H

Earnings in line with our estimates

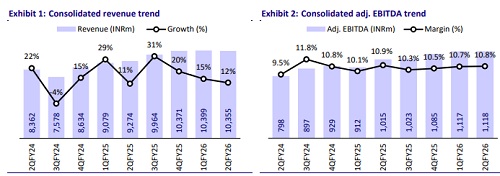

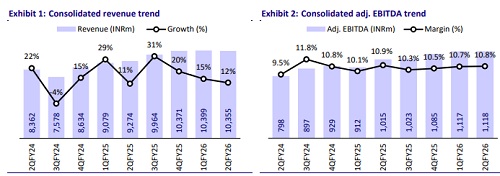

* Gravita India (GRAVITA) reported 12% YoY revenue growth in 2QFY26, driven by a 4% YoY rise in total volumes, mainly led by 5% YoY volume growth in Lead. Aluminum business volumes surged 27% YoY, while plastic volumes declined 32% YoY. EBITDA grew only ~10% YoY, owing to muted volume growth and a 4% YoY increase in overall EBITDA/kg.

* However, GRAVITA remains on track to achieve its ‘Vision 2029’ targets, aided by capacity expansion (700KTPA by FY28) initiatives for domestic and overseas markets. Future growth will be driven by its continued focus on increasing the share of value-added products (50%+ by FY29) and higher contribution (30%+) from non-lead business segments. .

* We broadly maintain our FY26E/FY27E/FY28E EPS and reiterate our BUY rating on the stock with a TP of INR2,200 (premised on 30x FY27E EPS).

Steady operating performance despite lower volumes

* Consolidated revenue grew 12% YoY to INR10.4b (in line) in 2QFY26. Consolidated sales volume rose 12% YoY to 51KMT.

* Adjusted EBITDA margin contracted 15bp YoY to 10.8% (est. 11.0%), while adjusted EBITDA grew ~10.1% YoY to INR1.1b (est. INR1.2b). Adj. PAT grew 33% YoY to INR960m (in line).

* Lead business revenue grew 11% YoY to INR9.3b, led by 5% YoY volume growth. Volume stood at 44.2KMT in 2Q. EBITDA/kg wasINR23.2 (+7% YoY).

* Aluminum business revenue jumped 37% YoY to INR942m. Volumes surged 27% YoY to 4.5KMT, while EBITDA/kg declined 20% YoY to INR15.

* Plastic business revenue declined 32% YoY to INR130m, and its volume dipped 32% YoY to 2.0KMT. EBITDA/kg stood at INR10 (down 4% YoY).

* For 1HFY26, revenue/adj. EBITDA/adj. PAT grew 13%/16%/36% to INR20.8b/INR2.2b/INR1.9b.

* Gross debt stood at INR4.4b as of Sep’25 as against INR2.8b as of Mar’25. Further, company had a a negative cash outflow of INR505m as of Sept’25 as against CFO of INR684m as of Sept’24

Highlights from the management commentary

* Outlook: The company maintains its ‘Vision 2029’ targets of a CAGR of ~25%/35% in sales volume/PAT, with RoIC of more than 25%. Further, it aims to increase its non-lead business/value-added products (VAP) mix to 30%/50% over the next three to four years. For FY26, the company considers INR19-20 of EBITDA/kg as sustainable, while INR22-23 of EBITDA per kg can be achieved through some compromise on volumes.

* Rubber: Mundhra rubber plant is expected to be commissioned in FY26, with revenue contributions expected to come from FY27. Even without the VAP mix, GRAVITA expects EBITDA per kg of INR7-8 (i.e. EBITDA margins of ~30%).

* Capex: Capex guidance is lowered to INR12.3b from INR15b earlier, as the company is planning a similar capex through the brownfield route. It plans to spend INR8.5b on existing verticals and the balance capex on new verticals.

Valuation and view

* As a leading player in India’s rapidly expanding recycling industry, GRAVITA is well-positioned to deliver strong earnings growth over the medium term, supported by: 1) strategic capacity expansion across verticals and geographies, 2) an increased focus on VAPs, and 3) increased domestic scrap availability, driven by favorable regulatory tailwinds.

* We expect a CAGR of 25%/28%/29% in revenue/adj. EBITDA/adj. PAT over FY25- 28. We broadly retain our FY26E/FY27E/FY28E EPS and reiterate our BUY rating on the stock with a TP of INR2,200 (premised on 30x FY27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)