Buy JSW Energy Ltd for the Target Rs. 655 by Motilal Oswal Financial Services Ltd

EBITDA in line; higher-than-expected DDA and interest hurt PAT

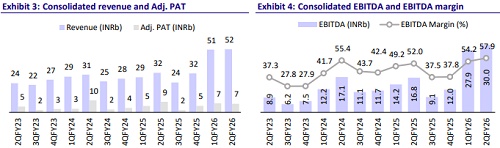

* Higher-than-expected depreciation and interest costs dampen PAT: JSW Energy (JSWE)’s consolidated revenue at INR51.8b missed our est. by 9%. However, EBITDA was in line at INR29.9b, supported by a higher EBITDA margin of 58% vs. our est. of 53%. Adj. PAT was 16% below our estimate at INR7b, primarily due to lower-than-estimated other income and higher interest/depreciation expenses arising from additional capitalization of new assets during the quarter. The earnings impact was partly mitigated by a lower tax rate of 13.8%.

* Strong EBITDA run rate amid contributions from KSK and O2Power: In 2QFY26, the company commissioned 443MW (240MW Kutehr Hydro plant, 148MW Wind, and 56MW Solar) of organic RE capacity and reiterated its FY26 capacity addition target of 3GW (excluding 1.3GW O2 Power) with ~1GW of organic capacity added YTD. The company’s open capacity exposure has now reduced to ~8% of its total installed base and is expected to decline further to 5% once the 400MW capacity under the Utkal plant (700 MW) is converted to a power purchase agreement (PPA), thereby improving cash flow visibility. JSWE remains on track to reach 30GW of generation and 40GWh of storage capacity by FY30.

* Valuation and view: We cut our FY26E APAT by 14% as we are building in increased depreciation and interest to align with the current run rate. We continue to like the stock and highlight that: 1) the full benefit of lower interest costs is yet to come through, and 2) JSWE has a strong RE pipeline backed by PPA, which gives visibility on growth. Reiterate BUY with a TP of INR655, valuing the company’s core renewable business at 12x FY28E EBITDA and its thermal business at 9x Dec’27E EBITDA.

EBITDA in line; miss on APAT

Consolidated performance:

* JSWE’s consolidated revenue missed our est. by 9% at INR51.8b (+60% YoY, flat QoQ), but EBITDA was in line with our estimate at INR29.9b (+78% YoY, +7% QoQ), supported by a higher EBITDA margin of 58% vs. our est. of 53%.

* Adj. PAT was 16% below our estimate at INR7b (-17% YoY, -5% QoQ) primarily due to lower-than-estimated other income and higher interest/depreciation expenses arising from additional capitalization of new assets during the quarter. The impact was partially offset by a lower effective tax rate of 13.8%.

Operational highlights:

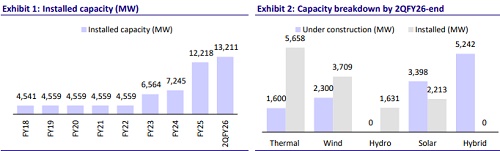

* The total installed capacity stood at 13.2GW at the end of 2QFY26, up ~71% YoY.

* Net generation was up 52% YoY to 14.9 BUs. RE generation rose 42% YoY to 7.1BUs, led by organic wind capacity additions and contribution from O2 Power.

* Total contracted capacity under construction for which PPA is signed stood at 11.1GW, with 1.6GW/2.3GW/3.4GW/3.8GW coming from Thermal/Wind/ Solar/Hybrid.

Other highlights:

* The company completed the strategic acquisition of KSK Water Infrastructure, locking in the Mahanadi plant’s water resource security.

* JSWE entered into a Scheme of Arrangement with GE Power India to acquire its boiler manufacturing business, critical for its thermal business.

* The company signed an agreement with Statkraft to acquire the 150 MW underconstruction Tidong HEP, at an EV of INR17.28b.

* The company is targeting 30GW of generation capacity and 40GWh of energy storage by 2030, of which 29.4GWh is locked in, coming primarily from PSP.

* JSW Energy (Utkal) Limited (subsidiary) has received an LoA from the Power Company of Karnataka Limited for a 400 MW, 25-year power supply arrangement from 1st Apr’26.

Highlights of JSWE’s 2QFY26 performance

* Installed capacity: The quarter saw 443MW of organic renewable additions, comprising 240MW from the Kutehr Hydro Plant, 148MW of wind, and 56MW of solar capacity.

* Generation performance: Net generation increased 52% YoY to 14.9BUs, supported by a 42% YoY rise in renewable generation to 7.1BUs, driven by incremental wind capacity and contributions from O2 Power.

* Project pipeline: The contracted capacity under construction stood at 11.1GW, including 1.6GW thermal, 2.3GW wind, 3.4GW solar, and 3.8GW hybrid projects. The total under-construction portfolio stands at 12.5GW, fully backed by longterm PPAs, which will nearly double the total capacity to 26GW upon completion.

* Financial highlights:

* PAT stood at INR 7 billion, down 17% YoY, primarily due to higher interest and depreciation from recent asset capitalization.

* Cash profit increased 27% YoY to over INR15b.

* Capex during the quarter stood at INR35b.

* Key developments:

* The company received an LoA for 400MW linked to its 700MW Utkal plant, which currently operates as open capacity. Conversion to a PPA will enhance cash flow visibility and reduce open capacity exposure from 8% to 5%.

* Of the total capacity under pending LoAs with PPAs yet to be signed, 900MW corresponds to pure solar projects.

Valuation and view

* The valuation of JSWE is based on SoTP:

* Thermal is valued at 9x Dec’27E EBITDA, and renewable energy at 12x FY28E EBITDA.

* Hydro is at 2x Dec’27E book value, and green hydrogen equity is at a 2x multiple.

* Additionally, the company's stake in JSW Steel is valued at a 25% discount to the current market price, acknowledging the strategic significance of this holding while incorporating a conservative valuation approach.

* By aggregating the values from these different components, the total equity value of JSWE was determined, leading to a TP of INR655.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412