Buy Blue Jet Healthcare Ltd for the Target Rs. 770 by Motilal Oswal Financial Services Ltd

Delayed revenue recognition impacts quarterly performance Earnings below estimates

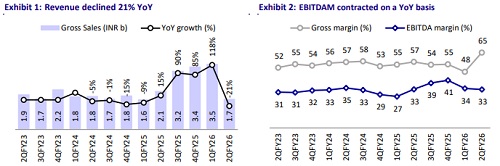

* Blue Jet Healthcare (BLUEJET) reported revenue of INR1.7b, marking a decline of 21% YoY, primarily due to a higher proportion of goods remaining in transit, which led to delayed revenue recognition. Consequently, only 55% of the goods produced during the quarter were recognized as revenue. The de-stocking of channel inventory in Pharma intermediates also impacted the operational performance of the company.

* Going ahead, we expect recovery in Pharma intermediates in 2HFY26, led by growth in cardiovascular drugs across geographies, coupled with a consistent rise in prescriptions. Hence, bempedoic acid (a key intermediate for cardiovascular products) is likely to show healthy growth, backed by long-term contracts and the expanding market size of its key drugs.

* Factoring in the weak 2QFY26 performance, we cut our FY26/FY27/FY28 earnings estimates by 19%/20%/16% and value the stock at 30x FY27E EPS to arrive at our TP of INR770. Reiterate BUY.

Declines in contrast media and pharma intermediates drag operating performance

* The company reported revenue of INR1.6b, declining 21% YoY and 53% QoQ (est. INR2.8b). Contrast media/pharma intermediates revenue declined 29%/27% YoY to INR807m/INR434m, while revenue from highintensity sweeteners grew 8% YoY to INR340m.

* Gross margin stood at 65%, compared to 57% in 2QFY25 and 48% in 1QFY26, primarily due to inventory changes, higher levels of finished goods, and a reduction in the cost of goods sold (COGS) from overhead allocation.

* Employee costs as a % of sales stood at ~11% YoY compared to ~7% in 2QFY25, while other expenses as a % of sales stood at ~21% vs. ~16% in 2QFY25.

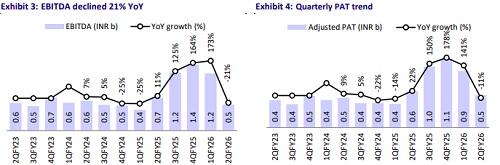

* EBITDA declined 21% YoY and 55% QoQ to INR549m (est. INR1.5b). EBITDA margin contracted 20bp YoY and 90bp QoQ to 33.2% (est. 32.6%).

* Adj. PAT stood at INR521m (declining 11% YoY, declining 43% QoQ) in 2QFY26, below our estimate of INR709m.

* Other income surged 2x YoY to INR243m, led by a higher net foreign exchange gain of INR154m, on account of USD appreciation and treasury income of INR74m.

* In 1HFY26, Revenue/EBITDA/Adj. PAT grew 40%/55%/49% YoY to INR5.2b/INR1.8b/INR1.4b.

* The cash flow from operations in Sep’25 stood at ~INR2.1b, compared to INR620m in Sep’24

Highlights from the management commentary

* Pharma intermediates: The end cardiovascular drug continues to demonstrate strong growth and traction across all geographies, supported by a steady rise in prescriptions as per customer data. This positive trend is expected to translate into consistent growth throughout the product’s patent lifecycle. The company received a New Request for Proposal (RFP) for one high-conviction phase 3 product and two for products already commercialized, potentially enabling lateral entries.

* Contract media: The business is expected to remain stable in the second half of the year, with performance likely to align with last year’s trend. The MRI segment reported robust growth in regulated markets, leading to a strong order book.

* High-intensity sweeteners: A key customer has approved a new product with an estimated target market size of USD1b. The product offers healthy margins, and the company will be the sole manufacturer in India. It aims to capture around 10% of the global market share, providing a significant growth opportunity.

* Capacity expansion: The company plans to add 1,000 KL of capacity over the next 2-3 years, including blocks for CMI, high-intensity sweeteners, and MMP at its newly acquired 102-acre Vizag site. The development will take place in three phases and is expected to strengthen API manufacturing, including bempedoic acid.

Valuation and view

* We expect a recovery in pharma intermediates in the coming quarter, led by growth in cardiovascular drugs across geographies, coupled with a consistent rise in prescriptions. Bempedoic acid (a key intermediate for cardiovascular products) is also likely to show healthy growth, backed by long-term contracts and the increasing market size of its key drugs.

* Further, operational performance is expected to be driven by strong order visibility in the MRI segment of contrast media and the approval of a new product in the high-intensity sweeteners segment.

* We expect a revenue/EBITDA/PAT CAGR of 21%/23%/22% over FY25-28, led by structural tailwinds resulting from the de-risking of supply chains by global innovators and the increasing adoption of complex APIs and NCE intermediates.

* Factoring in the weak 2QFY26 performance, we cut our FY26/FY27/FY28 earnings estimates by 19%/20%/16% and value the stock at 30x FY27E EPS to arrive at our TP of INR770. Reiterate BUY.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)