Sell Tata Motors Passenger Vehicles Ltd for the Target Rs. 312 by Motilal Oswal Financial Services Ltd

JLR faces multiple headwinds across regions

US tariffs and China luxury tax to structurally hurt future performance

* Tata Motors Passenger Vehicles Ltd (TMPV) delivered one of its worst financial performance in recent times recording a consolidated loss of INR 55b largely due to significantly weak performance at JLR (EBITDA margin at - 1.6% Vs our estimate of 7%) even as India PV business performance was largely in line.

* Given a significantly weak Q2 and a continued impact expected in Q3, management has sharply lowered its FY26 EBIT margin guidance to 0-2% and FCF at GBP -2.2b to -2.5b. The bigger cause of concern is the fact that demand continues to be weak in key regions including China, US and Europe and hence VME is likely to remain elevated, atleast in the near term. While they refrained from giving guidance for FY27, management signaled that both US tariff increases and China’s luxury tax are likely to have a structural impact on medium-term profitability. We now lower our EBIT margin assumptions for JLR to 2% for FY26E and expect the same to improve to about 5% by FY28E (earlier estimate of 6.5% for FY28E). Given the significant challenges at JLR, we initiate coverage on the recently demerged India PV business with a Sell rating and a SoTP based TP of INR 312 per share. We lower our target multiple for JLR to 2x EV / EBITDA from 2.5x earlier to reflect the multiple headwinds it is currently facing. We continue to value the India PV business at 15 x EV/EBITDA.

Sharp deterioration in JLR performance

* Tata Motors Passenger Vehicles Ltd (TMPV) delivered one of its worst financial performance in recent times recording a consolidated loss of INR 55b largely due to significantly weak performance at JLR (well below our estimates) even as India PV business performance was largely in line.

* JLR faced one of the most challenging quarters in recent history and posted -1.6% EBITDA margin (well below our estimate of 7%) which was at a multiyear low due to impact of reduced volumes led by the cyber incident, carryover effect of US tariffs (GBP 74m), higher VME (at 6.9% Vs 4% YoY), increased warranty costs, and lower engineering capitalization

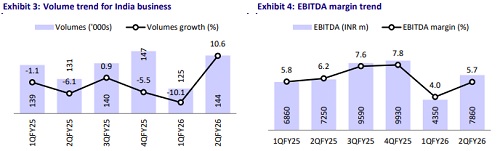

* India PV business delivered an in-line performance with EBITDA margins at 5.7%.

* On account of the weak performance at JLR, the consolidated business has posted FCF outflow of INR 83b in Q2.

* Exceptional expenses worth GBP 238m in Q2 include cyber related costs amounting to GBP 196m and voluntary redundancy program costs of GBP 42m. Another exceptional charge (albeit lower) related to the cyber incident is expected in Q3 as well

* Hence, the consolidated auto business posted a FCF outflow of INR 83b.

* Net consolidated automotive debt rose to INR201b, from net cash position of 10b as of March25 end.

Highlights from the management commentary

* Management indicated that Q3 will also see some impact of the cyber incident although production has now normalized in November (October production was just at 17k units). While about 20k of lost production was in Q2, the balance is expected to be accounted in Q3

* Q2 capex stood at GBP 828m. This is below their quarterly run-rate and management expects to pick-up capex spend in H2

* The Range Rover Electric and upcoming Jaguar relaunch remains on schedule, as engineering delays during the shutdown have largely been compensated through accelerated testing and validation

* The consolidated net auto debt has increased sharply to INR 201b from net cash of INR 10b as of FY25 end. Bulk of this increase in debt has been at JLR which has seen net debt rise to INR 208b from net cash of INR 32b

* India PV business has seen a marked revival in demand post GST rate cuts with wholesales growing 10% YoY. TTMT posted over 100k units retails in this festive period (+33% YoY)

* Market share recovered to 12.8% in Q2 and further strengthened to 13.7–14% during the festive period

* Management expects PV ICE profitability to remain muted for one more quarter due to continued pricing pressure led by competitive intensity and commodity inflation, before improving in Q4 driven by Sierra launch as also expectation of price hikes wef Jan26.

* On the back of the positive sentiment in the market, management expects the PV industry to post double digit growth in H2 and thereby end FY26E with midsingle digit growth

* Also, while discounts have continued to be high even post festive, management expects the same to reduce in Q4 as most of the industry peers would start the new year with very lean stock levels

* India PV margins have been under pressure over the last couple of years as the industry mix has shifted more towards compact SUVs (sub 4 mtr), high discounts as also its inability to pass on rising cost pressure. However, they have earmarked a clear long term roadmap to move back to double digit margin.

Valuation and view

While the India PV business performance is in line with expectations, JLR is facing significant challenges in its key markets, even beyond the cyber incident. JLR management has indicated that Q3 will also see some impact of the cyber incident although production has now normalized in November (October production was just at 17k units). While JLR lost 20k units production in Q2, it has lost another 30k units production in Q3. Given a significantly weak Q2 and a continued impact expected in Q3, management has sharply lowered its FY26 EBIT margin guidance to 0-2% and FCF guidance to GBP -2.2b to -2.5b. The bigger cause of concern is the fact that demand continues to be weak in key regions including China, US and Europe and hence VME is likely to remain elevated, atleast in the near term. While they refrained from giving guidance for FY27, management signaled that both US tariff increases and China’s luxury tax are likely to have a structural impact on mediumterm profitability. We now lower our EBIT margin assumptions for JLR to 2% for FY26E and expect the same to improve to about 5% by FY28E (earlier estimate of 6.5% for FY28E). Given the significant challenges at JLR, we initiate coverage on the recently demerged India PV business with a Sell rating and a SoTP based TP of INR 312 per share. We lower our target multiple for JLR to 2x EV / EBITDA from 2.5x earlier to reflect the multiple headwinds it is currently facing. We continue to value the India PV business at 15 x EV/EBITDA.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412