Neutral Tata Communications Ltd for the Target Rs. 1,750 by Motilal Oswal Financial Services Ltd

Steady 2Q; data EBITDA margin improves, but TCR contracts

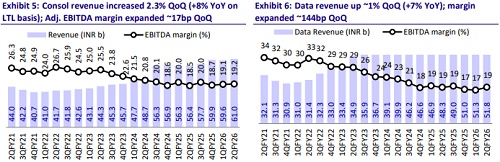

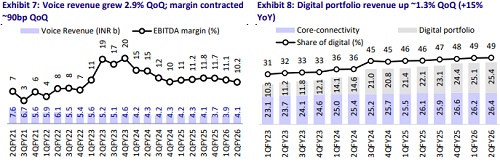

* Tata Communications (TCOM) delivered steady 2Q, with ~7% YoY (~1% QoQ) growth in data revenue and 145bp data EBITDA margin expansion.

* TCOM’s consol. EBITDA grew 4% YoY (3% QoQ), but came in ~3% below our estimate as margin expanded by a modest 17bp QoQ to 19.2% (75bp miss), due to a sharp ~28pp contraction in TCR margins (linked to implementation of new incentivized payout structure).

* Management indicated that the order book was stable in 1HFY26 (on high base of 1HFY25) as healthy deal wins in Enterprise were offset by headwinds in service provider segment. The funnel remains robust, with a 60% contribution from the digital portfolio.

* As per management, rising data center (DC) investments bode well for TCOM in multiple ways – through its leadership in DC-to-DC connectivity, investments in AI Cloud, Multi Cloud Connect and potential monetization of land parcels, among others. However, there is currently no agreement with TCS for its recent announcement on AI data center investments.

* We build in ~8% data revenue CAGR over FY25-28E, with data revenue reaching INR246b by FY28. We believe the ambition of doubling data revenue (INR280b by FY28) remains a tall ask without further acquisitions.

* We also believe reaching 23-25% EBITDA margin by FY28 would be difficult and build in ~21.3% consolidated EBITDA margin in FY28.

* Our FY26-28 revenue and EBITDA estimates are broadly unchanged. We build in ~11% consolidated EBITDA CAGR over FY25-28E.

* We value TCOM’s data business at 9.5x Dec’27E EV/EBITDA and the voice and other businesses at 5x EV/EBITDA to arrive at our revised TP of INR1,750. We reiterate our Neutral rating. Acceleration in data revenue growth, along with margin expansion, remains key for re-rating.

Steady quarter, reported margins weaker despite improvement in data margins

* Consolidated gross revenue grew ~2.3% QoQ (+8.1% YoY on like-for-like basis) to INR61b (1% higher). However, adjusted for FX benefits, the growth was modest at ~0.4% QoQ.

* Data revenue at INR51.8b (in line) grew 7.3% YoY (+1% QoQ), driven by ~15% YoY (~1% QoQ) growth in digital portfolio and modest ~1% YoY/QoQ growth in core connectivity.

* Consolidated net revenue (a proxy for gross margin) at INR34.1b continued to grow at slower pace, rising ~3% YoY (+4% QoQ) due to continued weakness in net revenue growth for data portfolio (up 7% YoY vs. 15% YoY gross revenue growth).

* Consolidated adjusted EBITDA grew 3% QoQ (+13% YoY on like-for-like basis) to INR11.7b (3% miss) due to higher other expenses (up 7% QoQ).

* Consolidated adjusted EBITDA margin expanded 15bp QoQ (75bp YoY) to 19.2%, but came in ~75bp lower than our estimate as improvement in data EBITDA margins was offset by weaker margins in voice and other subsidiaries (especially TCR).

* Reported Consol. PAT came in at INR1.8b (-19% YoY, -4% QoQ).

* Net debt inched up INR12b QoQ to INR113b, due to dividend payments and investments in STT. Net debt/EBITDA rose to 2.45x (vs. 2.1x in Mar’25).

* Committed capex increased to ~INR6b in 2Q (vs. INR4.4b in 1QFY26), while cash capex declined ~20% QoQ to INR5.1b (though up ~13% YoY).

* Reported RoCE (annualized) declined further to 15.1% vs. 15.4% in 1QFY26.

* FCF stood at INR2.2b in 2QFY26 (vs. outflow of INR6.2b QoQ).

* For 1HFY26, revenue/EBITDA grew 7%/6%. Based on our estimates, the 2HFY26 implied revenue/EBITDA run rate stands at 7%/13%.

Key takeaways from the management interaction

* Strategic bets: TCOM is seeing strong progress both in product and capability build-out as well as receiving good early customer traction. The company launched Voice AI platform to strengthen its Kaleyra.ai platform value proposition. Further, AI Cloud is seeing good customer traction, with early deal wins for its sovereign AI cloud from a large payments player. TCOM’s digital fabric tool enabled a large contract win with the GST Appellate Tribunal. Management expects strategic bets to contribute at least 10% of the incremental digital revenues in FY26, which will scale up to INR100b by FY30.

* Order book and funnel: TCOM’s enterprise order book grew in double digits; however, overall order book was flat due to headwinds in the service provider segment. Management noted that 1HFY25 had the benefit of several large deal wins, and 1HFY26 order book was better than 2HFY25, which faced macro headwinds, with cloud/international order books growing in healthy midteen/double digits in 2Q. The funnel remains robust, with digital portfolio accounting for ~60%.

* Potential collaboration with TCS on data centers: Management noted that TCOM and TCS have been collaborating in various areas for a long period of time. Rising DC capacity in India will be beneficial for TCOM’s core connectivity (DC to DC connectivity), digital fabric (Multi Cloud Connect, AI Cloud with liquid cooling) as well as from potential monetization of land parcels. However, there is no firm agreement at the moment.

* FX benefits: Normalizing for FX movement, consolidated revenue growth was up by a modest 0.4% QoQ (vs. reported 2.3% QoQ growth).

* Data EBITDA margins: ~140bp QoQ improvement in data EBITDA margin was driven by 1) improvement in Vayu Cloud portfolio, 2) right-sizing in certain verticals in line with the growth, and 3) operating leverage with rising scale. However, near-term margins are likely to be impacted by the revenue loss and costs associated with the Red Sea cable cut and a change in the payout structure in TCR.

Valuation and view

* We currently model ~14% CAGR in digital revenue over FY25-28 and expect digital to account for ~54% of TCOM’s data revenue by FY28 (vs. ~49% currently). Acceleration in digital revenue remains key for re-rating.

* Our FY26-28E revenue remains broadly unchanged and believe TCOM’s ambition of doubling data revenue by FY28 remains a tall ask without further acquisitions. Overall, we build in ~8% data revenue CAGR over FY25-28, with data revenue reaching INR246b by FY28 (vs. TCOM’s ambition of INR280b).

* We lower our FY26E EBITDA by a modest 1% while keeping our FY27-28E EBITDA broadly unchanged. We believe that margin expansion to 23-25% by FY28E could be challenging, given the rising share of inherently lower-margin businesses in TCOM’s mix amid weakness in core connectivity. Our FY28 margin estimate is ~21.3%.

* We roll forward our valuations to Dec’27E (from Sep’27) and ascribe 9.5x EV/EBITDA to the data business and 5x EV/EBITDA to voice and other businesses. We ascribe an INR37b (or INR132/share) valuation to TCOM’s 26% stake in STT data centers to arrive at our revised TP of INR1,750 (earlier INR1,685).

* After the recent run-up (TCOM: +15% in last five day), the stock now trades at ~12.5x one-year forward EV/EBITDA (~22% premium to the LT average).

* We reiterate our Neutral rating as we await sustained acceleration in data revenue growth, along with margin expansion, before turning more constructive on TCOM.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)