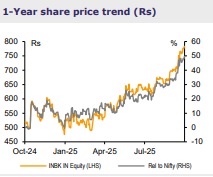

Buy Indian Bank Ltd For Target Rs. 900 By Emkay Global Financial Services Ltd

Superlative performance reinforces re-rating momentum

Indian Bank (INBK) maintains its superior performance, with PAT at Rs30bn and RoA at 1.3%, backed by strong growth of ~14% YoY, stable margins (@3.2%), and contained provisions. Despite the steady improvement in asset quality, INBK made prudent standard provisions of Rs1.8bn/13bps of loans and some ECL buffer on stage 1&2 assets. INBK expects growth momentum to remain healthy, and NIMs to moderate a bit in 3Q due to MCLR down-pricing and then stabilizing at 3.2-3.3%. The bank has positively revised its GNPA ratio guidance to <2% from <3%, given benign asset quality outcomes. Considering its higher specific PCR of 94% and additional provision buffers against restructured/standard loans, we believe impact of ECL norms could be the lowest for INBK among PSBs. Factoring in its consistently superior RoA/RoE delivery (1.2-1.3%/16-18%), best-in-class asset-quality performance, strong capital buffer, and credible management, we retain BUY while hauling up our TP by 20% to Rs900, and now value INBK at 1.3x Sep-27E ABV (vs 1.2x earlier).

Strong business growth with resilient margins

INBK reported strong credit growth, at 14% YoY/3.6% QoQ, well above peers’ (incl PVB), driven by continued strong momentum in its high-yielding RAM book. Within retail, the bank VF, mortgages, and gold loan portfolio growth remain healthy. Unlike peers facing margin compression, INBK maintained stable margins at ~3.2%, benefiting from the lower cost of funds and better yield on investments. The bank expects NIM to moderate a tad in 3Q due to lumpy MCLR portfolio repricing (40% of the MCLR portfolio), partly offset by better CoF and some benefit from the recent CRR cuts as well.

Robust asset quality and provision buffers

Slippage remains well contained at Rs11.6bn/0.9% of loans, which, alongside higher technical write-offs, led to a sharp 41bps QoQ improvement in GNPA ratio to 2.6%/NNPA at 0.2%. The SMA-2 book too declined sharply, by ~55bps QoQ to Rs14.5bn/0.2% of loans, driven by recoveries from two government-backed PSU accounts (~Rs33bn) that had slipped in the previous quarter. The bank has limited exposure to MSMEs exporting to the US, thereby limiting any significant NPA risk from this segment. INBK aims to keep GNPA below 2% and NNPA at current levels in FY26; its industry-high 94% specific PCR and additional buffers should limit the impact of ECL norms.

Indian Bank remains our preferred pick among PSBs

We revise FY26-28E earnings by 2-5%, factoring in better growth/asset quality outcomes, and expect INBK to log superior RoA at 1.2-1.3%/RoE at 16-18% over FY26- 28E. This, along with healthy CET 1 at ~15% (similar to that of large PVBs) and credible management, would call for continued re-rating. We retain BUY on INBK and raise TP by 20% to Rs900 (earlier Rs750 at 1.2x), now valuing the bank at 1.3x Sep-27E ABV. Key risks: macro dislocation hurting growth/asset quality, and merger of any other weak PSB.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354