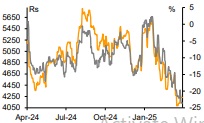

Add L&T Technology Services Ltd For Target Rs.4,750 By Emkay Global Financial Services Ltd

LTTS noted a weak operating performance in Q4. Revenue rose 10.5% QoQ in CC terms, falling short of our expectations (of 13.3%). EBITM contracted by 270bps QoQ due to integration of Intelliswift’s financials, SWC seasonality, and additional cost in supporting customer-related investments. LTTS achieved the highest-ever deal booking TCV in Q4, and saw market share gains across top accounts. It remains cautiously optimistic for the next few quarters due to ongoing headwinds from tariffs and macro-related uncertainties. With recently secured deals and a strong pipeline, the management expects to fare better in FY26 vs FY25, even on organic basis. It has guided to double-digit CC revenue growth for FY26, factoring in the Intelliswift acquisition. The company expects to improve EBIT margin to mid-16% levels between Q4FY27 and Q1FY28. We cut FY26-27E EPS by ~4-9%, factoring in the Q4 performance. We retain ADD on LTTS while cutting our TP by 4% to Rs4,750, at 28x Mar-27E EPS.

Results Summary

LTTS’s revenue grew 0.6% QoQ (10.5% CC) to USD345mn, below our estimate of 13.3% CC. Revenue growth was led by Tech (28% QoQ) and Sustainability (1.8%), while Mobility (-0.3%) saw a decline. All geographies witnessed growth – North America (11.5% QoQ), Europe (0.3%), and India (18.9%), and RoW (4.8%). Revenue grew across the top-5 and top 6-10 clients by 9.9% and 2.1%, respectively. Reported EBITM saw a sharp decline of 270bps QoQ to 13.2%, primarily due to consolidation of Intelliswift’s financials (-150bps impact), macro headwinds leading to revenue shortfall (particularly in the highmargin segments of sustainability and mobility), and additional costs incurred to support select strategic clients. Headcount grew 3.4% QoQ to 24,258. Attrition inched up, to 14.3% from 14.4% in Q3FY25. The company proposed a final dividend of Rs38/sh. What we liked: Strong deal intake. What we did not like: Margin miss, weakness in Mobility.

Earnings Call KTAs

1) LTTS faced unexpected macro headwinds in Q4, impacting anticipated revenue and deal ramp-ups. 2) A few large deals saw delayed ramp-up and signing, which was deferred to the end of the quarter. 3) Mobility is expected to stay muted in the near term, with a potential recovery by the end of Q2. 4) Plant engineering continues to see strong demand in Oil & Gas and CPG, led by capex projects, plant modernization, digital twins. 5) LTTS saw strong demand for greenfield and brownfield projects in plant modernization, digitization, and safety in CPG. 6) It closed a large deal wins with the highest TCV in Q4, including one +USD80mn, one +USD50mn, one +USD30mn, one +USD20mn, and three +USD10mn deals. The large-deal pipeline remains strong, with multiple USD100mn and USD50mn deals in advanced stages. 7) Sustainability margins declined as the company absorbed costs to support select strategic customers. 8) Tech segment margins were impacted by the Intelliswift consolidation, SWC seasonality, and lower than expected revenue. 9) Intelliswift added 43 active clients. 10) Three hyperscaler accounts in the US are now ~USD20mn each on an annualized basis.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354