Neutral One 97 Communications Ltd for the Target Rs. 1,200 by Motilal Oswal Financial Services Ltd

Healthy performance; GMV growth on track

Revenue slightly ahead of our estimate; one-off loss hurts profitability

* One 97 Communications (Paytm) reported a strong operational performance with adj. net profit of INR2.1b (vs. our estimate of INR1.3b). However, its reported PAT stood at INR210m due to a one-time impairment of INR1.9b on its loan to JV First Games.

* Paytm’s revenue performance remained robust, growing 24% YoY / 8% QoQ to INR20.6b (3% ahead of our estimates), driven by healthy trends across both payments and financial services.

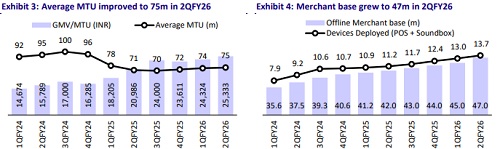

* Payment revenue grew 21% YoY / 10% QoQ to INR11.5b, aided by higher merchant activity, a festive season uptick in EMI-based transactions, and strong traction in device deployment.

* Financial services revenues surged 63% YoY / 9% QoQ to INR6.1b, supported by sustained momentum in merchant loans and lending partnerships.

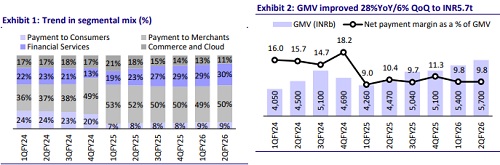

* Net payment margin improved 12% QoQ (up 28% YoY) to INR5.9b/10bp of GMV vs. 10bp in 1QFY26. However, the contained DLG costs led to a 5% QoQ growth in contribution profit to INR12.1b (up 35% YoY, largely in line).

* We marginally raise our contribution margin assumptions for Paytm, driven by stronger revenue traction and prudent opex control. Despite the one-off impairment charge in 2Q, we maintain our profitability estimates. We project a PAT of INR6.4b in FY26 and INR12.7b in FY27. We value Paytm at INR1,200, based on 22x FY30E EBITDA discounted to FY27E, translating into 8.2x FY27E sales. We reiterate our NEUTRAL rating on the stock.

Merchant expansion on track; AI capabilities contributing to cost control

* Paytm reported an adj. net profit of INR2.1b (vs. our estimate of INR1.3b). Reported PAT came in at INR210m (as the company has taken a one-time charge of full impairment). GMV increased by 28% YoY/ 6% QoQ at INR5.7t.

* Revenue grew by 24% YoY/ 8% QoQ to INR20.6b (3% beat), aided by growth in payment and financial services (up 33% YoY/ 9% QoQ), while payments revenue grew by 21% YoY/ 10% QoQ.

* Revenue from marketing services declined 25% YoY and 8% QoQ to INR2.3b.

* The payment processing margin was comfortably above the guided range of 3bp. Paytm continues to see an improvement in payment processing margin amid the higher growth of credit cards on UPI and other offerings such as EMI. Net payment margin expanded 28% YoY/12% QoQ to INR5.9b/10bp vs. 10bp in 1Q.

* Management highlighted AI as a key growth and efficiency lever, driving sharper cross-sell opportunities, cost optimization, and deeper merchant engagement. AI-led automation across sales and risk functions is expected to structurally improve operating metrics over time.

* Direct expenses grew 12% QoQ (up 12% YoY, largely in line), amid lower DLG cost. Contribution profit rose 5% QoQ (up 35% YoY), with the contribution profit margin standing at 58.5% (vs. 58.7% in 1QFY26). EBITDA was INR1.8b (vs. our estimated loss of INR1.3b). This was aided by contained opex and a healthy revenue. ESOP costs were lower at INR350m vs. our estimate of INR540m.

Highlights from the management commentary

* GMV growth has been margin-accretive, with gains in both consumer and merchant market share alongside improving economics. If UPI grows at 20%, Paytm expects its GMV growth to surpass that level.

* The postpaid opportunity is large, though it is currently at a nascent stage. The company expects strong growth as it expands consumer adoption and bank partnerships. The business benefits from high throughput and lower cost of capital.

* Market share in credit card-linked UPI has increased. The company foresees subscription revenue eventually being overtaken by MDR-based revenue.

* Indirect expenses have declined and are expected to remain range-bound in 2H. Marketing and software expenses have improved. The company plans to invest selectively in sales personnel while optimizing other cost areas.

Valuation and view: Reiterate NEUTRAL with a TP of INR1,200

* Paytm delivered a healthy quarter, largely in line with estimates, supported by robust revenue growth and disciplined cost management, resulting in a strong adjusted profit.

* It continues to make steady progress toward sustainable profitability, aided by its cost control measures and improving operating leverage, translating into better EBITDA margins, while GMV growth remains consistent.

* Contribution margin stood at a healthy 58.5%, and momentum in the financial services segment is expected to remain strong amid improving tailwinds in unsecured lending and the relaunch of Paytm Postpaid.

* AI-led differentiation remains a key strategic pillar, with Paytm leveraging its technology stack to enhance distribution, cross-sell opportunities, and merchant-level monetization efficiency. Postpaid business offers a large scalable opportunity, as Paytm deepens consumer adoption by leveraging its prior experience and strong data insights in credit origination.

* With a robust cash balance of INR167b, the company maintains ample flexibility to fund growth initiatives and potential international expansion, which could start contributing meaningfully over the medium term (2–3 years).

* We marginally raise our contribution margin assumptions for Paytm, driven by stronger revenue traction and prudent opex control. Despite the one-off impairment charge in 2Q, we maintain our profitability estimates. We project a PAT of INR6.4b in FY26 and INR12.7b in FY27. We value Paytm at INR1,200, based on 22x FY30E EBITDA discounted to FY27E, translating into 8.2x FY27E sales. We reiterate our NEUTRAL rating on the stock.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412