Neutral Eris Lifesciences Ltd For Target Rs.1,270 by Motilal Oswal Financial Services Ltd

Recovery in base business, acquisitions drive operational performance

Preparing to benefit from GLP1 opportunity

* Eris Lifescience’s (ERIS) 3QFY25 performance came in below our estimates. Lower-than-expected revenue growth led to lower operating leverage, which affected the overall performance. The base business witnessed some recovery in growth owing to new launches and price hikes.

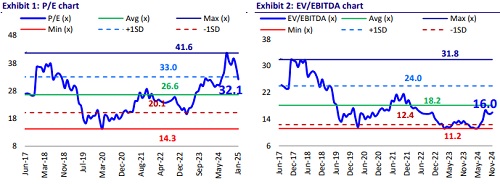

* We reduce our FY25 EPS estimate by 4% (factoring in lower sales from biologics business) and largely maintain our estimates for FY26/FY27. We value ERIS at 25x 12M forward earnings to arrive at a TP of INR1,270.

* ERIS is building the GLP1 franchise by ensuring the sourcing of API for synthetic peptide and subsequently conducting clinical trials/enhancing manufacturing capacity for recombinant semaglutide. It continues to launch combination products in the SGLT2 space. Considering this and a reduction in financial leverage, we estimate a CAGR of 16%/42% in EBITDA/earnings over FY25-27. However, the current valuation leaves limited upside. Reiterate Neutral.

Business mix impact offset partly by better operating leverage (YoY)

* 3QFY25 revenue grew 49.6% YoY to INR7.3b (our est. INR7.7b). After the addition of Biocon II business, total domestic business grew 35% YoY to INR6.3b. Organic base domestic business grew 12% YoY to INR5.3b on the back of new product launches and price increases.

* Gross margin contracted 560bp YoY to 75.7% due to higher raw material costs and a change in the business mix.

* EBITDA margin contracted 170bp YoY to 34.4% (our est. 35.3%), owing to a change in the business mix, offset by lower employee expenses/other expenses (-300bp/-130bp as % of sales).

* EBITDA, however, increased by 43% YoY to INR2.5b (our est. INR2.7b).

* Adj. PAT declined 18.6% YoY to INR836m (our est. INR1b), due to higher interest (up 2.1x YoY) and depreciation (up 77% YoY).

* For 9MFY25, revenue/EBITDA grew 50.1%/45.3%, whereas PAT declined 19.5% YoY.

Highlights from the management commentary

* ERIS expects net debt at INR21b as of FY25 end vs. earlier guidance of INR26b.

* ERIS maintains its FY25 revenue/EBIDTA margin guidance of INR30b/35%

* ERIS aims to achieve 22% ROCE in FY25 (vs. 19% in FY24) through base business growth, operating leverage, and the addition of newer growth levers.

Acquisitions, new launches to drive growth in medium term

Gearing up to leverage the GLP-1 market opportunities

* As of Dec’24, Eris has 6% market share in overall diabetes therapy. Eris is the largest Indian company in the insulin market with a 10% market share.

* After the acquisition of Levim and Chemman labs, Eris received capabilities to develop analogies, GLP-1 agonists, rDNA and other monoclonal anti-bodies, enhancing its presence in niche and complex segments.

* Eris’ first GLP-1 product, Liraglutide, launched in Sep’24 ramped up to monthly sales of INR10m.

* Moreover, Eris launched three first-in-market Dapagliflozin combinations in 3QFY25 – a differentiated play in the fast-growing SGLT2 space.

* Eris entered into a strategic partnership for the launch of Semaglutide, where Eris will be among the few players to launch it first in India.

* Further, Eris is preparing its Bhopal facility for “form-fill-finish” recombinant Sema for FY26.

* Eris has a strong pipeline opportunity in Gliclazide + combinations and Empagliflozin + combinations in 4QFY25.

Working on niche products to drive growth over medium term

* In 9MFY25, total domestic formulation revenue grew 35% YoY to INR19b, driven by new product launches and price increases. Further, the integration of the acquired portfolio is also driving growth.

* Including the Biologic 1 acquisition, organic domestic formulation business grew 9% YoY to INR15b with EBITDA margin of 40%, while revenue from Biologic 2 business stood at INR3b in 9MFY25.

* ERIS plans to launch multiple new products with several first-to-market in FY26.

* We expect ERIS to outperform the industry over the medium term, as it has established its presence in the cardiac/antidiabetic segments. Additionally, the new product pipeline and patent expiries in its focus therapies provide growth visibility. We expect ERIS to post a CAGR of 9.6% in overall sales over FY25-27.

Valuation and view

* We reduce our FY25 EPS estimate by 4% (factoring lower sales from biologics business) and largely maintain our estimates for FY26/FY27. We value ERIS at 25x 12M forward earnings to arrive at a TP of INR1,270.

* ERIS is building the GLP1 franchise by ensuring the sourcing of API for synthetic peptide and subsequently conducting clinical trials/enhancing manufacturing capacity for recombinant semaglutide. It continues to launch combination products in SGLT2 space. Considering this and a reduction in financial leverage, we estimate a CAGR of 16%/42% in EBITDA/earnings over FY25-27. However, the current valuation leaves limited upside. Maintain Neutral.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)