Neutral TCI Express Ltd for the Target Rs. 720 by Motilal Oswal Financial Services Ltd

Steady 2Q; volume and margins likely to recover as demand from the SME segment improves

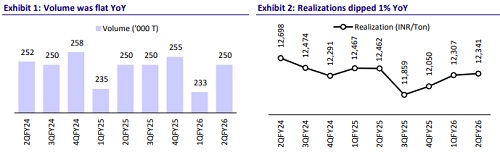

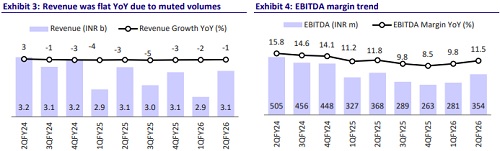

* TCI Express (TCIE)’s 2QFY26 revenue was flat YoY at INR3.08b (+8% QoQ), in line with our estimate. Volume growth was flat YoY, hit by the GST rate cut.

* EBITDA stood at INR354m (-4% YoY/+26% QoQ), 6% above our estimate. EBITDA margin came in at 11.5% in 2QFY26 vs. our estimate of 10.6%.

* APAT stood flat YoY at INR252m (+29% QoQ) vs. our estimate of INR237m.

* During 1HFY26, its revenue/EBITDA/APAT dipped 2%/9%/6% YoY.

* Management expects the volume growth to improve hereon, supported by the improvement in demand from the SME segment. TCIE projects 8% tonnage and 10% revenue growth in FY26. EBITDA margin could expand hereon through cost optimization, automation benefits, and price increases. It targets more than a 12% EBITDA margin in the next two quarters.

* In 2QFY26, the volume growth was flat YoY as demand paused with the announcement of the GST rate cut. Volume growth could have otherwise been higher by 2-3% in this quarter. The company has been witnessing healthy volumes in the months of Oct and Nov’25, aided by spillover from the festive season and improvement in demand from the SME segment.

* We retain our estimates for FY26 and FY27 and roll forward our valuation to FY28. Hence, we expect TCIE to clock an 8%/9%/16% volume/revenue/EBITDA CAGR over FY25-28. We reiterate our Neutral rating with a TP of INR720 (based on 20x FY28 EPS).

Key highlights from the management commentary

* TCIE’s 2QFY26 volume stood at 0.25m tons (flat YoY). Capacity utilization during 2QFY26 remained steady at 83%.

* The GST rate cut-related demand pause impacted volume growth by ~2–3% during the quarter. However, strong festive-season demand across categories supported volumes. Moreover, the company is witnessing healthy volumes in October and November, aided by festive spillover and improving demand from the SME segment.

* TCIE shifted its Mumbai sorting center to a new sorting center, enhancing processing capacity by 3 times and enabling faster, cost-efficient operations. Further, 10 new branches under Surface Express and 25 under Rail were added.

* Tonnage growth in FY26 is expected at 8%. Revenue growth is projected at 10%, supported by price hikes, network expansion, and growing multimodal contribution.

* EBITDA margin is expected to improve through cost optimization, higher automation benefits, and price increases, targeting more than 12% EBITDA margin over the next two quarters.

Valuation and view

* TCIE’s 2QFY26 was broadly in line. We believe the volume growth is set to improve ahead with demand improving from the SME segment and GST rate cut benefits flowing through.

* We maintain our estimates for FY26 and FY27 and roll forward our valuation to FY28. Accordingly, we expect TCIE to clock an 8%/9%/16% volume/revenue/ EBITDA CAGR over FY25-28. We reiterate our Neutral rating with a TP of INR720 (based on 20x FY28 EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412