Neutral Bombay Stock Exchange Ltd for the Target Rs. 2,800 by Motilal Oswal Financial Services Ltd

Strong revenue growth drives PAT beat

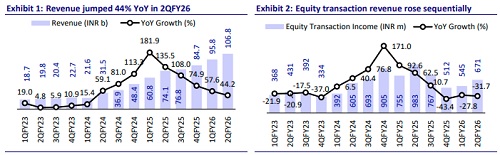

* BSE reported operating revenue of ~INR10.7b (5% beat), up 44% YoY/12% QoQ, mainly driven by 57% YoY growth in transaction charges. For 1HFY26, revenue grew 50% YoY to INR20.3b.

* Opex stood at INR3.8b, up 7% YoY (in line). Regulatory expenses/employee costs/technology costs/other expenses grew 30%/26%/16%/42% YoY, while clearing house expenses declined 42% YoY. EBITDA stood at INR6.9b, up 78% YoY, leading to EBIDTA margins of 64.7% vs. est. of 62.1% and 52.4% in 2QFY25.

* 2Q PAT came in at INR5.6b, up 61% YoY/5% QoQ (10% beat), driven by higher revenue growth. For 1HFY26, PAT grew 78% YoY to INR10.9b.

* In the derivatives trading segment, management aims to drive volume growth by deepening institutional participation, introducing longer-dated contracts, and strengthening data centre infrastructure.

* We raise our earnings estimates by 14%/14%/15% for FY26/FY27/FY28, factoring in higher volume assumptions for the derivatives options segment based on the Oct’25 run rate and stronger-than-expected colocation revenue. We reiterate our Neutral rating on the stock with a TP of INR2,800 (premised on 40x Sep’FY27E EPS).

Transaction charges driven by growth in derivatives and Star MF segments

* Transaction charges jumped 57% YoY to INR7.6b, due to 81%/19% growth in charges from derivatives/Star MF. These were offset by a 32% YoY dip in cash segment charges.

* Treasury income declined 32% YoY to INR428m.

* Revenue from services to corporates grew 16% YoY to INR1.4b, led by 19% YoY growth in listing fees, while book-building fees grew 11% YoY.

* Other operating income at INR932m grew 64% YoY, largely driven by strong expansion in the colocation facility.

* Investment income remained flat YoY at INR711m.

* Cash ADTO declined 23% YoY to INR75.8b, while premium ADTO rose 83% YoY to INR150b in 2Q.

* STAR MF achieved another record quarter, with revenue up 18% YoY. Total transactions increased 24% YoY to ~201m vs. 162m in 2QFY25, with recordhigh transactions of about 71.3m in Oct’25.

* Among subsidiaries, growth in BSE Index Service was driven by higher client adoption and continued product innovation. It has 300+ marquee clients and manages 72 passive investment products tracking 22 of BSE indices, representing a combined AUM of INR2.5t.

* On the ICCL front (Clearing Corporation), revenue stood at INR320m.

* BSE is also working actively with its subsidiaries on creating a platform for trading in the commodities and agriculture segments.

Key takeaways from the management commentary

* Market share continued to expand despite the shift in expiry days, supported by steady efforts to increase institutional participation in longer-tenure derivative contracts.

* BSE will maintain its voluntary monthly contribution of 5% of transaction revenue to the core Settlement Guarantee Fund (SGF) until the corpus reaches 150% of the required level, aiming to stabilize earnings and minimize its impact.

* Colocation revenue rose to INR460m from INR270m in 1QFY26, driven by higher rack utilization and revised throttling charges (Jul’25), with all racks fully allocated and management planning to add 70-90 more by FY26, taking total capacity to around 500 racks across 6KVA and 15KVA configurations.

Valuation and view

* BSE continues to demonstrate broad-based growth across key segments, supported by stable retail activity, a robust IPO pipeline, and structural expansion in STAR MF and index businesses. The exchange’s continued investment in technology, data infrastructure, and product diversification is expected to strengthen its competitive positioning and support long-term earnings visibility.

* We raise our earnings estimates by 14%/14%/15% for FY26/FY27/FY28, factoring in higher volume assumptions for the derivatives options segment based on the Oct’25 run rate and stronger-than-expected colocation revenue. We reiterate our Neutral rating on the stock with a TP of INR2,800 (premised on 40x Sep’FY27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412