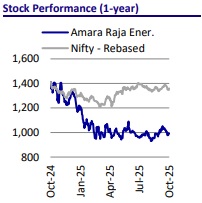

Neutral Amara Raja Ltd for the Target Rs. 1,030 by Motilal Oswal Financial Services Ltd

First gigafactory on track for SOP by 1HCY27

Tubular battery and lead recycling plants to help improve LAB margins

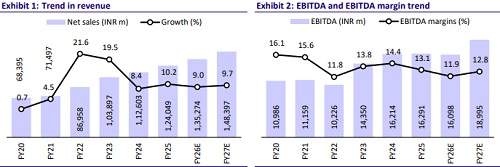

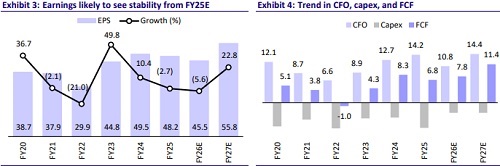

We met with the management team of Amara Raja to get an update on the business. In the lead-acid business, 1) OE demand has picked up after GST rate cuts, while replacement is yet to pick up; 2) lead costs, excl. currency depreciation, remain stable QoQ; 3) the tubular battery plant can drive 300-400bp margin improvement for that segment; 4) the recycling plant can help save costs by 30-40bp; 5) power cost is likely to remain elevated for one more quarter before stabilizing. In the New Energy business, 1) the combined investment for the first gigafactory (2GWh), the R&D plant and the customer qualification plant stands at INR25b (invested INR12b so far and will invest the balance in the next 12 months); 2) based on their progress, Amara would decide on further funding avenues for the entire project cost of about INR60-70b for 16GWh capacity; 3) this business can deliver 10-11% EBITDA margin at a scale of about 10 GWhr; 4) apart from Ather Energy, which has partnered with Amara for its cell requirements, Amara is currently working on few other RFQs. While the market is optimistic about Amara’s li-ion initiative, we are cautious about its potential returns. We maintain a Neutral rating with a TP of INR1,030, based on 18x Jun’27E EPS.

Key highlights from the meetings are as follows:

New Energy business

* In FY25, revenue from pack manufacturing stood at INR5b and revenue from chargers stood at ~INR900m.

* In cell manufacturing, Amara is currently setting up an R&D facility and a customer qualification plant by FY26 end. It already has 200 R&D engineers and aims to deploy 200 more in the division. Amara spends INR800-900m per year on R&D.

* The first gigafactory of 2GWhr NMC chemistry is expected to commence by 1HCY27.

* For the gigafactory, Amara targets to invest INR25b, most of which would be invested by the parent with some leverage, if required. Amara has already infused INR12b in its New Energy subsidiary so far. It intends to infuse the balance over FY26-27.

* Depending on the progress of its projects, Amara would decide on further funding avenues.

* The entire project would see Amara’s capacity scale up to 16GWh. About 30% of this capacity would be dedicated to storage and the balance to automotive. This would entail total capex of about INR60-70b.

* Management has indicated that the current industry size for lithium-ion battery in India is about 10-15Gwh. This battery is primarily required in auto (largely 2Ws), telecom and data centers. This entire requirement is currently imported.

* Demand for this battery is likely to surge to 100-130GWhr by 2030-32, as per industry estimates, assuming 30-40% EV penetration in 2Ws and 15% in 4Ws. Almost 30-40% of this demand would be needed for storage. As per the current estimates, almost 80-90% of this demand is likely to be met with domestic sources.

* Management has indicated that the business can achieve EBITDA breakeven at 4 GWhr capacity and PBT break-even at 8GWhr capacity. Amara targets to reach 8GWh by 2030. It would need to achieve a scale of about 10 GWhr to achieve 10-11% EBITDA margin and 10% RoCE.

* The company is in talks with multiple OEMs and has few RFQs in place. Generally, it takes about three years to go from RFQ to SOP stage. However, apart from Ather Energy, which has partnered with Amara for its cell requirements, Amara does not have any other firm commitments from OEMs, so far.

* Management has indicated that the lithium-ion penetration in telecom currently stands at about 40%. The sector is likely to have full lithium-ion penetration in the next two years. This is also leading to a drag in its LAB business as its current LAB telecom capacity is relatively under-utilized.

* Given the high dependence on imports for raw materials of lithium-ion batteries, the company expects 55-65% of content to continue to be imported despite local cell manufacturing.

* The plan is to localize cell production in India by sourcing cathode and anode materials, as it is not feasible to produce cathode and anode in India unless the company reaches 50GWh capacity.

* However, the PLI scheme requires 60% localization. Amara is not yet eligible for PLI. One understands that the failure to meet volume and value targets under PLI could result in penalties of up to twice the subsidy amount.

* At the current levels and as per prevalent bidding norms, OEMs that have qualified for PLI are expected to get a cost advantage of USD2-3/kwh on cell manufacturing.

Update on lead acid business (LAB)

* OE requirement for batteries has increased after the GST rate cut. However, the same positive momentum is yet to be reflected in the replacement segment.

* The industry has passed on the GST rate cut benefits to consumers.

* The current demand environment has remained stable on QoQ basis.

* Even lead costs are stable QoQ. However, there could be some impact due to INR depreciation toward the latter half of the quarter.

* Amara’s new tubular battery plant has commenced production, and management expects to generate INR10-12b per year from the plant. While trading margin stood at 10%, this is likely to drive margin improvement of 300- 400bp at full capacity.

* On the recycling plant, the battery breaking capacity is expected to come on stream by Dec’25-Jan’26. If Amara is able to recover 2% higher than smelters, it hopes to save 30-40bp in costs.

Understanding the power cost impact on Amara

* There are two aspects to this matter. First, the base rate was raised by Andhra Pradesh Government in 2023 for consumers and it was challenged in the High Court. While consumers did receive a favorable judgement, the AP Government has filed a case in the Supreme Court. As a matter of prudence, Amara has started providing for the higher power tariff over the last few quarters.

* The other impact is due to rules on in-house solar consumption. Amara is used to get a settlement from the AP Government for its entire power plant. The government changed the regulation, saying that whatever power Amara generates from solar should be utilized within 15 minutes, which is inherently not feasible. This has also led to an increase in power costs in the interim.

* Last month, the government reached a temporary settlement with the company. While the elevated costs are likely to persist for one more quarter, Amara hopes to get a resolution on this issue from 3Q onward.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412