Bulls and Bears : Nifty bids adieu to CY25 with 10.5% returns; DII inflows and FII outflows at record high by Motilal Oswal Financial Services Ltd

Nifty bids adieu to CY25 with 10.5% returns; DII inflows and FII outflows at record high

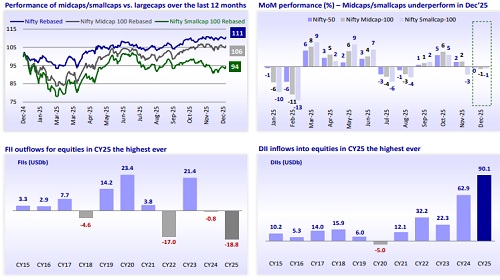

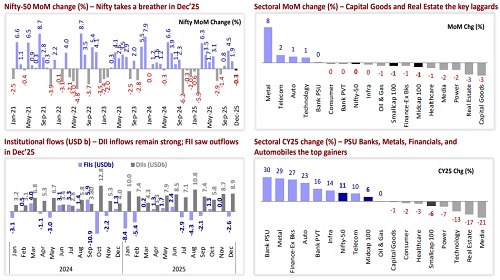

* Nifty hits record high, bids adieu to CY25 with 10.5% returns: CY25 concluded with yet another year of positive returns for the Indian markets, marking the tenth consecutive year of positive returns. The Nifty touched a fresh high of 26,326 before ending CY25 at 26,130, up 10.5% YoY. The Nifty ended its three-month winning streak in Dec’25. The Nifty touched a fresh high of 26,326 before closing down 0.3% MoM at 26,130 in Dec’25. Notably, the index was volatile and swung around 633 points before closing 73 points lower. During the last 12 months, smallcaps declined 6%, underperforming largecaps and midcaps, which rose 11% and 6%, respectively. In the last five years, midcaps (CAGR: 23.7%) have significantly outperformed largecaps (CAGR: 13.3%) by 103%, while smallcaps (CAGR: 20.1%) have markedly outperformed largecaps by 63%.

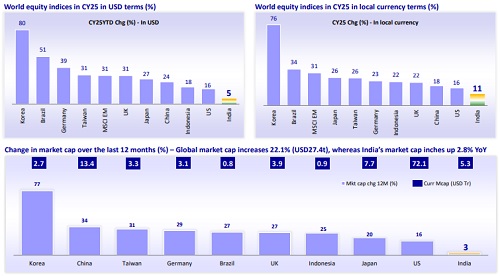

* DII inflows and FII outflows at a record high in CY25: DII flows into equities were the highest ever at USD90.1b in CY25 vs. inflows of USD62.9b in CY24. With just one year of outflows since CY15, DIIs have invested USD255.8b cumulatively over the last 10 years (CY16-CY25). Conversely, FIIs witnessed the highest ever equity outflows of USD18.8b in CY25 vs. outflows of USD0.8b in CY24. During the last 10 years, FIIs have invested USD32.3b cumulatively in the Indian market, with four years of outflows.

* Breath favorable in CY25: Among the sectors, the top gainers were PSU Banks (+30%), Metals (+29%), Financials (+27%), Automobiles (+23%), and Private Banks (+16%). The breadth was favorable in CY25, with 33 Nifty stocks closing higher. Shriram Finance (+72%), Maruti Suzuki (+54%), Eicher Motors (+52%), Hindalco (+47%), and SBI Life Insurance (+46%) have been the top performers, while Trent (-40%), TCS (-22%), Tata Motors PV (-18%), HCL Tech (- 15%), and Power Grid (-14%) have been the key laggards.

* India underperforms key global markets in Dec’25: Among the key global markets, Korea (+7%), Taiwan (+5%), Germany (+3%), MSCI EM (+3%), the UK (+2%), China (+2%), Indonesia (+2%), Brazil (+1%), and Japan (+0.2%) ended higher in local currency terms on a MoM basis in Dec’25. However, India (- 0.3%) and the US (-0.1%) ended lower MoM. During the last 12 months in USD terms, the MSCI India Index (+3%) underperformed the MSCI EM Index (+31%). In the last 10 years, the MSCI India Index notably outperformed the MSCI EM Index by 53%. In P/E terms, the MSCI India Index is trading at a 47% premium to the MSCI EM Index, below its historical average premium of 78%.

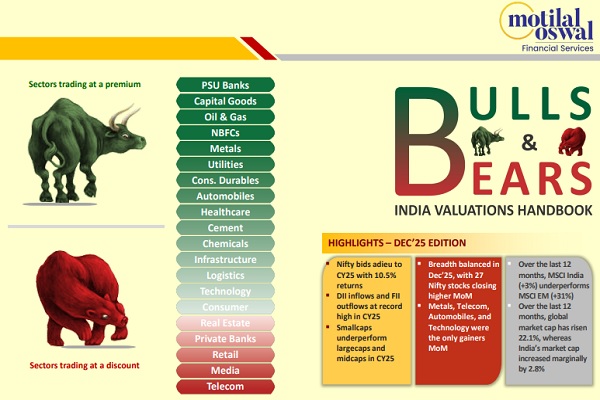

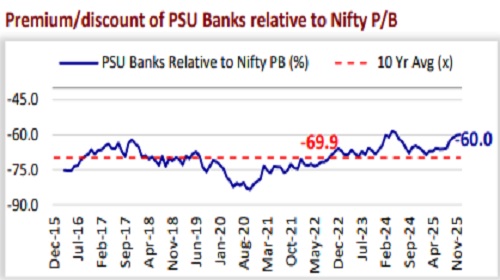

* Valuations – two-thirds of the sectors trade at a premium to their historical averages: The Nifty now trades at a 12-month forward P/E of 21.2x, near its LPA of 20.8x (2% premium). Conversely, the P/B ratio at 3.2x represents an 11% premium to its historical average of 2.9x. The market capitalization-toGDP ratio now stands at 133% of FY26E GDP (9% YoY), at its year-end high and well above its long-term average of 87%. Consumer, Technology, Real Estate, and Logistics now trade near their long-period average (LPA) valuations, while Capital Goods, PSU Banks, NBFCs, Oil & Gas, Metals, and Utilities trade at a premium to their LPA. Private Banks and Retail trade at a discount to their LPA.

* The year ahead: We have a positive outlook on Indian equities and believe that Indian markets are well poised to retrace the underperformance of CY25, supported by better earnings prospects, supportive domestic macros, and an improved geopolitical situation. Valuations are reasonable, with Nifty trading at 21.2x, near its LPA of 20.8x, and any evidence of earnings growth pickup should help valuations expand. The prevalent concerns of lower nominal GDP materially affecting corporate profit growth appear overblown to us, as corporate earnings are influenced by multiple factors beyond broad economic growth, which possesses limited explanatory power for corporate earnings growth. In our model portfolio we raise Indian IT services to mildly overweight by trimming our position in consumer discretionary and healthcare names. Our preferred sectors are Diversified Financials, IT Services, Automobiles, Telecom, and Capital Goods, whereas our key underweights are Energy, Metals, and Utilities.

* Top ideas: Largecaps – Bharti Airtel, ICICI Bank, SBI, L&T, M&M, Infosys, Titan Company, Bharat Electronics, Interglobe Aviation, Tata Steel, TVS Motor, Tech Mahindra, Max Healthcare, and Indian Hotels. Midcaps and Smallcaps – Swiggy, Dixon Technologies, Suzlon Energy, Jindal Stainless, Coforge, Angel One, Radico Khaitan, Delhivery, V-Mart Retail, and VIP Industries.

India underperforms key global markets in CY25

Smallcaps underperform; DII inflows in CY25 the highest ever

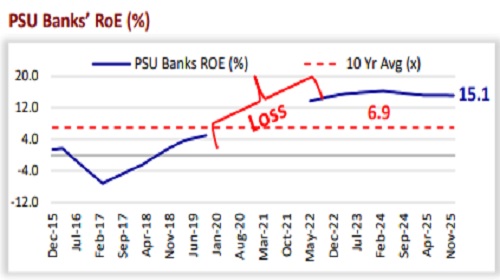

PSU Banks: Resetting to a new normal in profitability

* PSBs have reversed a decade-long trend of market share erosion, regaining ~40bp in FY25 to ~58%. This was supported by healthy credit growth, backed by robust asset quality, strong capital buffers, and ample liquidity that allowed them to sustain steady credit flow, while private peers faced CD ratio constraints. In FY25, PSBs outpaced private banks in loan growth for the first time in 15 years (12% vs. 10%), driven by momentum in retail and MSME segments and relative insulation from stress in unsecured loans.

* NIMs for the PSBs are expected to be stable in 3QFY26, while some mild improvement is likely in 4QFY26 as a large part of repo repricing has been largely done. PSBs are cautiously rebalancing their asset mix toward higheryielding RAM loans. With a low CD ratio, rising fee income, and prudent use of loan syndication and sell-downs, PSBs are well-positioned to report sustainable NIMs while sustaining healthy credit growth and profitability.

* PSBs have undergone a remarkable balance sheet transformation, moving from double-digit NPAs to best-in-class asset quality. PCR has risen sharply from 45% in FY18 to ~79% in FY25, while the GNPA ratio has declined from 14.6% to 2.8%, bringing the net NPA ratio down to 0.5%, comparable with private banks. Slippages have dropped from ~7.9% in FY18 to ~0.7% in FY25 and are expected to stay below 1% through FY27-28E, highlighting the resilience of PSBs’ asset quality vs. private peers (~1.8-1.9% slippages). Credit costs have improved significantly but are expected to rise gradually due to slower recoveries and ECL transition, though the healthy PCR provides a cushion.

* PSBs trade at 1.3x P/B, 47% above their 10-year average of 0.9x. PSU banks have maintained healthy profitability, thanks to sustained improvements in both asset quality and benign credit cost. PSBs have seen a strong re-rating over the past five years, shedding their legacy image of lenders with poorer underwriting capabilities to become competitive players delivering consistent value to stakeholders. Despite a healthy RoE of ~18% and a sustainable RoA of 1%+, most covered PSBs trade at reasonable valuations of 0.9-1.3x P/B. Structural improvements in asset quality, capital strength, digital adoption, and operating efficiency offer visibility on sustaining this RoA.

Nifty takes a breather in Dec’25 and bids adieu to CY25 with 10.5% returns

* The Nifty ended its three-month winning streak in Dec’25. The Nifty touched a fresh high of 26,326 before closing down 0.3% MoM at 26,130 in Dec’25. Notably, the index was volatile and swung around 633 points before closing 73 points lower. The Nifty was up 10.5% in CY25, clocking the tenth consecutive year of positive returns!.

* All major sectors ended lower – Metals (+8%), Telecom (+2%), Automobiles (+1%), and Technology (+1%) were the only gainers. Conversely, Capital Goods (-3%), Real Estate (-3%), Power (-2%), Media (-2%), and Healthcare (-1%) were the top laggards MoM.

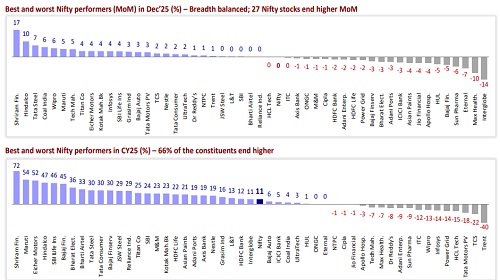

Breadth balanced in Dec’25, with 27 Nifty stocks closing higher MoM

* Best and worst Nifty performers in Dec’25: Shriram Finance (+17%), Hindalco (+10%), Tata Steel (+7%), Coal India (+6%), and Wipro (+6%) were the top performers, while Interglobe (-14%), Max Healthcare (-10%), Eternal (-7%), Sun Pharma (-6%), and Bajaj Finance (-5%) were the key laggards.

* Best and worst Nifty performers in CY25: Shriram Finance (+72%), Maruti Suzuki (+54%), Eicher Motors (+52%), Hindalco (+47%), and SBI Life Insurance (+46%) have been the top performers, while Trent (-40%), TCS (-22%), Tata Motors PV (-18%), HCL Tech (-15%), and Power Grid (-14%) have been the key laggards.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

Nifty immediate support is at 25000 then 24850 zones while resistance at 25200 then 25400 zo...