MOSt Market Roundup : Nifty future closed positive with gains of 0.44% at 23249 levels - Motilal Oswal Wealth Management

Market Update

* Equity benchmark Index continued its winning streak for the third consecutive session, supported by buying in blue-chip stocks like Reliance Industries, HDFC Bank, ONGC, Cipla, Bharti Airtel, and Coal, which helped lift the index by nearly 0.5%.

* During the January F&O expiry, traders covered short positions ahead of the Union Budget announcement on Saturday, and strong quarterly results provided a positive boost to the market.

* The Nifty rose 86 points, or 0.4%, to close at 23,249, while the Sensex gained 226 points, or 0.4%, ending at 76,759. Global markets were mixed, as the US Federal Reserve paused its recent rate cuts, signaling a more cautious approach to future moves. Pharma, defense, and realty stocks were key gainers.

* The Nifty Pharma Index saw a rise following the news that the Trump administration rescinded a broad directive to halt federal loans and grants. Laurus Labs surged 8% to close at Rs 588, while Granules India, Cipla, Divi’s Labs, and Aurobindo Pharma saw gains of 2-5%.

* The Nifty Defense Index rose 2% after BEL reported strong quarterly results and news that the Cabinet Committee on Security approved a Rs 10,000 crore project for Pinaka missile ammunition. BEL gained 4%, closing at Rs 278, and Solar Industries, BDL, HAL, and Paras Industries advanced by 2-5%.

Technical Outlook:

* Nifty index opened flattish and witnessed good buying interest in the first hour which was followed by some consolidation. It gave up some gains in the second half but was quickly recovered in the last hour. It managed to cross 23300 zones and closed with gains of around 90 points. It formed a bullish candle on daily frame and has started forming higher highs - higher lows from the last three sessions.

* Now it has to hold above 23200 zones for an up move towards 23400 then 23500 zones whereas supports are placed at 23150 then 23050.

Derivative Outlook:

* Nifty future closed positive with gains of 0.44% at 23249 levels. Positive setup seen in Laurus Lab, KPIT Tech, SRF, IRFC, Berger Paint, BEL, Navin Fluorine, UPL, Bharti Airtel, Dabur and IRB while weakness in Voltas, CAMS, Tata Motors, Paytm, OFSS, Apl Apollo, Policy Bazar, Ambuja Cements, Adani Enterprise, Trent and Can Fin Homes.

* On option front, Maximum Call OI is at 25000 then 24000 strike while Maximum Put OI is at 23000 then 22500 strike. Call writing is seen at 23300 then 23200 strike while Put writing is seen at 23200 then 23000 strike. Option data suggests a broader trading range in between 22900 to 23700 zones while an immediate range between 23000 to 23500 levels.

* Kotak Mahindra Bank - Company’s three senior officials at retail lending team have resigned, CNBC-TV18 reported. Ambuj Chandna, head of consumer banking, is among the three senior officials who have stepped down.

* Max Healthcare – Company approved investing Rs125cr in Jaypee Healthcare and pact to lease 500 bedded hospital at Thane

* Info Edge – Company is scheduling a board meeting on February 5 to mull a stock split along with Q3FY25 results

* Ajmer Realty –Company) has acquired a land parcel in Mumbai, India, for Rs51cr through a bidding process with KJ Somaiya Trust. The company plans to launch an ultra-luxury residential project on the site. The project is expected to yield a carpet area of 44,000 square feet with an estimated gross development value of Rs175cr billion rupeesLTI Mindtree - FLS Mining Partners with LTIMindtree for Strategic Transformation of Application Maintenance Services.

* BEL - Q3 Results -- Net Profit Rs1316cr (up 47.3% YoY) , Revenue Rs5756.2cr (up 39.2% YoY), Ebitda Rs1653.3cr (up 57.5% YoY) and Ebitda Margin 28.7% vs 25.4% YoY

* Aditya Vision reported weak Q3 results - Net profit up 9.2% (YoY) to Rs 24.2 crore, Revenue up 23% (YoY) to Rs 508 crore, Ebitda up 7.1% (YoY) to Rs 46.6 crore and Ebitda Margin at 9.2% versus 10.5%.

* Dr. Lal Path Labs Q3 FY25 - Net Profit Rs98.1cr (up 19.3% YoY), Revenue Rs596.7cr (up 10.7% YoY) Ebitda Rs154cr (up 9.5% YoY), Ebitda Margin 25.8% vs 26.1% YoY

* Strides Pharma Q3 FY25 reported impressive Ebitda and Ebitda margin. Net Profit Rs90cr (% YoY) Revenue Rs1153.7cr (up 14.7% YoY), Ebitda Rs210cr (up 48% YoY) and Ebitda Margin 18.2% vs 14.1% YoY

* Bajaj Finserv Q3 FY25 - Net Profit Rs2231cr (up 3.4% YoY), Revenue Rs32042cr (up 10 % YoY) and Gross written premium was up 5% at Rs 12,987 crore versus Rs 12,415.

* Heidelberg Cement India Q3 FY25 – weak results - Net Profit Rs5.2cr (down 83.5% YoY), Revenue Rs542.8cr (down 10.6% YoY), Ebitda Rs33.3cr (down 49.1% YoY) and Ebitda Margin 6.1% vs 10.8% YoY

Global Market Update

* European Market - European shares and US stock futures gained as traders awaited earnings from Apple Inc. and a likely interest-rate cut from the European Central Bank. Germany, France and UK Index gained 0.2%.

* Asian Market – Asian equities were mixed in another holiday-thinned trading day Thursday, with investors digesting broadly positive tech earnings that came days after the upheaval caused by China's DeepSeek explosion onto the global AI scene. With most markets closed for the Lunar New Year break, there was little major reaction to the Federal Reserve's widely expected pause in interest rate cuts and indications that no more were in the pipeline.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html SEBI Registration number is INH0000004

More News

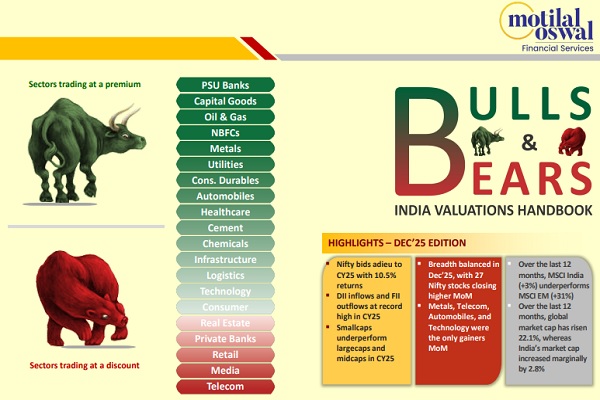

Bulls and Bears : Nifty bids adieu to CY25 with 10.5% returns; DII inflows and FII outflows ...