Diwali Muhurat Picks : Buy Coforge Ltd for Target Rs.1,980 by Axis Securities Ltd

Investment Rationale

A. Strong Presence in Niche Segments Across Geographies: In BFS, Coforge operates across Wealth/Asset Management and Risk/Compliance segments. In the Insurance domain, it is active in Life, Non-Life, and Commercial/Speciality lines. Within the Travel & Hospitality sector, the company services Airlines, Travel Tech, Airports, Surface Transport, and Hospitality. In Q1FY26, 50% of revenue came from America, followed by 38.7% from EMEA, while other geographies contributed 11.4%. The top 5 clients reported growth of 25.1% QoQ and 50.8% YoY, contributing 20.8% to revenue. The top 10 clients grew 15.7% QoQ and 36.8% YoY, contributing 29.4% to overall revenue.

B. Key Acquisitions to Enhance Operational Capabilities: Intending to expand its service and product offerings and gain access to a wider customer base and geographies, Coforge has pursued a series of strategic acquisitions in recent years. The acquisitions of Incessant, Ruletek, and Wishworks have significantly strengthened its digital capabilities. In FY25, Coforge announced a strategic merger with Cigniti Technologies. This merger is expected to enhance end-to-end IT delivery by integrating world-class QA/testing capabilities, thereby positioning the combined entity as a full-service digital transformation provider. The acquisition of Cigniti is anticipated to drive long-term revenue growth in the range of 10–12%.

C. Strategic Capex, Deal Wins, and AI Pivot Provide Revenue Visibility: In Q1FY26, Capex was $65 Mn, with $58 Mn allocated to an AI data centre project. Over the last two quarters, ~$85 Mn was invested in this data centre, with $62 Mn received as a client advance and $23 Mn funded by a term loan. The Capex is expected to taper down to original levels (2-3% of revenue) in FY26. In terms of deals, the company signed five large deals during the quarter. The executable order book for the next 12 months stood at $1.6 Bn, up 47% YoY, which indicates strong revenue visibility. Coforge aims to close at least 20 large deals in FY26. Therefore, management remains committed to setting new performance and capability benchmarks through such initiatives.

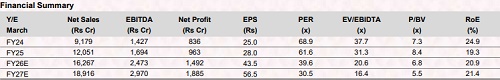

D. Outlook & Valuation: Coforge is well-positioned for growth, given its multiple long-term contracts with leading global brands. The company maintains a positive outlook, expecting recent deal wins to drive revenue growth. The management remains committed to setting new benchmarks in the evolving industry landscape. We believe that the company remains on track to meet its long-term guidance and expect a CAGR of 25%/39%/40% for Revenue/EBIT/PAT over FY25–27E. The stock is currently trading at 40x and 31x FY26E/FY27E EPS.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

.jpg)