Diwali Stock Picks 2025 : Buy Capri Global Capital Ltd For Target Rs.274 by Ventura Securities Ltd

Business Model - Diversified secured retail lending through gold loans, MSME, housing finance, and construction finance. The company also generates fee income through insurance distribution and car loan origination.

Capri Global Capital Ltd. (CGCL) is a resilient, growth-focused lender with a diversified and secured loan portfolio, anchored by high-yield segments like gold loans (37% of AUM with yield of ~21% ), MSME (22% of AUM with yield of ~17%), housing finance (22% of AUM with yield of ~13%), and construction finance (18% of AUM with yield of ~17.3%). With gold loans yielding 21%, CGCL has seen strong profitability and asset quality, maintaining NPAs below 2%.

CGCL has made significant strides in cost-to-income improvement and branch-level productivity. Branch productivity has surged, with Gold AUM per branch increasing from INR 2 Cr in FY23 to INR 10 Cr in FY25, and overall, AUM per branch growing from INR 14 Cr to INR 21 Cr. These improvements reflect enhanced operational efficiency and a more scalable, profitable business model.

CGCL also generates asset light complementary income streams from its car loan origination and insurance distribution businesses, diversifying revenue. Its tech-driven approach, including AI-powered underwriting and digital loan journeys, optimizes efficiency and cost. With a favorable borrowing structure (~90% floating rates), CGCL is positioned to benefit from declining interest rates, further boosting margins and longterm growth prospects.

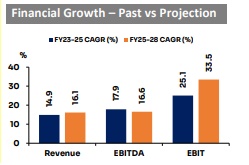

We expect CGCL to achieve strong growth from FY25 to FY28, with AUM growing at a 29% CAGR, reaching INR 48,975 Cr by FY28. Gold loans will remain the dominant segment, contributing 40% of AUM, while MSME, housing, and construction finance will make up 21%, 21%, and 17%, respectively. Co-lending AUM is expected to reach INR 9,661 Cr, maintaining a 20% share of total AUM. On the liability side, we expect bank borrowings to constitute 75% of total borrowings by FY28, with SIDBI/NABARD refinance growing to INR 5,408 Cr. With expected credit rating improvement and 90% of borrowings on floating rates, CGCL stands to benefit from lower interest rates, which will help improve NIM by ~60 bps to 9% by FY28. GNPA and NNPA is expected to stabilze to 1.5% and 0.9% respectively, by FY28. RoA is projected to improve by ~100bps to 3.7%, and RoE is expected to reach 16.9%(+520bps) by FY28. The successful INR 2,000 Cr QIP in Q1FY26 has further bolstered CGCL’s equity base, supporting continued growth.

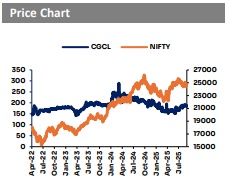

Valuation call - We initiate coverage with a BUY rating and a price target of INR 274 (2.8X FY28E P/ABV), representing an upside of 44.2% of the CMP of INR 190 over the next 24 months. Key Risk: As CGCL runs a fully floating book, it bears the risk of interest rates increasing, which will lead to a decrease in NIM. Increase in delinquencies will increase credit costs and compress profit margin.

SMS subject to Disclosures and Disclaimer goo.gl/8bCMyQ

SEBI Registration No.: INH000001634

.jpg)

.jpg)