Diwali Stock Picks 2025 : Buy Hindustan Construction Co Ltd For Target Rs.64 by Ventura Securities Ltd

Business Model - Hindustan Construction Company (HCC) operates on an EPC-led business model, executing large and complex infrastructure projects across transport, water, power, and urban development, with niche expertise in hydropower, tunneling, and nuclear construction. It has an order book of INR 11,188 cr and generates steady cash flows from its core EPC operations.

India’s FY26 infrastructure capex allocation of INR 11.2 trillion (+10.2% YoY) across railways, roads, defence, energy, and urban development provides a strong multi-year growth runway for EPC companies. With over a century of execution experience and proven technical expertise in hydro, tunneling, nuclear, metro, and transport projects, HCC stands well-positioned to benefit from this sectoral tailwind.

In FY25, HCC posted consolidated revenue of INR 5,603 cr and net profit of INR 113 cr. While the topline was softer, margins showed meaningful turnaround — EBITDA margin improved to 14.2% vs9.6% in FY24, driven by cost discipline, sharper project selection and operational improvements. The company’s order book of INR 11,852 cr as of March 2025 reflects healthy diversification with 53% in transportation, 29% in hydro, 14% in water and 4% in nuclear. Additionally, HCC holds L1 positions worth ~INR 6,000 cr, with bids of ~INR 40,000 cr under evaluation, pointing to a strong execution pipeline in FY26 and beyond.

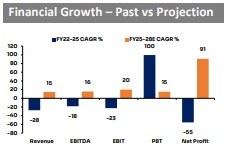

Looking ahead, we expect HCC’s consolidated revenues to grow at a CAGR of 14.6% over FY25–28E to INR 8,437 cr, supported by execution of its robust backlog and new project wins. EBITDA is projected to grow at 15.7% CAGR to INR 1,229 cr, with margins expanding by 40bps from 14.2% to 14.6%, driven by selective project execution and higher-value contracts. Net profit is projected to reach INR 782 cr, with margins expanding by 730 basis points from 2% to 9.3% margins aided by debt reduction and migration to the new tax regime. Return ratios are set to strengthen meaningfully, with ROE/ROIC projected at 21.6%/25.4% with margins expanding by 920/850 basis points by FY28E.

Balance sheet repair is central to the HCC story. The company has outlined debt reduction of ~INR 900 cr in FY26 through internal accruals, awards, and a rights issue of ~INR 900 cr. Supported by asset monetization and claim recoveries, net debt/EBITDA is projected to decline from 3.1x in FY25 to just 0.5x by FY28E — a material improvement that underpins sustainable growth. HCC’s margin-focused execution, robust order pipeline, and clear deleveraging path positions it as a beneficiary of India’s infrastructure investment cycle, offering investors a compelling turnaround and growth story.

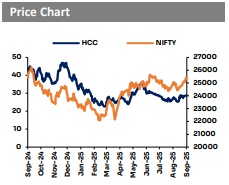

Valuation call – At the CMP of INR 28.9, the stock is trading at FY28 EV/EBITDA of 12.2X. We recommend BUY with price target of INR 64, representing an upside of 120.2% over the next 24 months. Key Risks – Low Promoter’s Holding

Disclosure: -

* In the Profit and Loss - Exceptional item incorporates Steiner AG receivables of INR 1,100 cr and Awards Receivables of INR 2,000 cr; valuation has been computed factoring the prospective ~INR 900 cr rights issue.

* Claims Receivables amounting to INR 7,000 cr have not been considered in the model as they remain subject to tribunal outcome with no defined timeline.

SMS subject to Disclosures and Disclaimer goo.gl/8bCMyQ

SEBI Registration No.: INH000001634

.jpg)

.jpg)