Diwali Muhurat Picks : Buy Minda Corp Ltd for Target Rs.690 by Axis Securities Ltd

Investment Rationale

A. Company Growth Plan: Minda Corporation aims to drive multi-year growth through premiumization, new product development, and technology integration. The company aims to achieve Rs 17,500 Cr in revenue, with EBITDA above Rs 2,100 Cr (+12.5%) and a ROCE of 25% over the next four years. This will be achieved through ~Rs 3,550 Cr in incremental revenue from its existing business and ~Rs 1,780 Cr from premium products such as Smart PEPS, PLG systems, EV wiring harnesses, ADAS sensors, and lightweight die-casting components. These initiatives will enhance the product mix and support margin expansion through a higher share of technology-led products.

B. Exports, Capex, and Other JV’s: The company plans Rs 2,000 Cr in capex over five years, including two new greenfield die-casting facilities and one instrument cluster plant. Export revenue is expected to grow at a 37% CAGR from Rs 420 Cr in FY25 to Rs 1,500 Cr by FY30 across key global markets. New product launches across sunroof systems (HCMF JV), EV components (SANCO tie-up), and switches (Toyodenso JV) are expected to add ~Rs 1,450 Cr by FY30, backed by secured orders. Along with other strategic JVs, these initiatives are expected to strengthen Minda’s EV systems portfolio, enhance technological capabilities, and diversify revenue streams.

C. Flash Electronics: Minda’s 49% acquisition of Flash Electronics strengthens its presence in EV powertrain components. Flash Electronics reported FY25 revenue of Rs 1,537 Cr and EBITDA of Rs 223 Cr (14.5%). The company is developing next-generation SESM and IDU technologies that reduce reliance on rare-earth magnets. It is expected to grow at over 20% in the medium term while maintaining EBITDA margins above 14.5%.

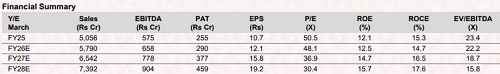

D. Outlook: Minda Corporation is evolving from a conventional auto component manufacturer into a high-value, technology-driven mobility solutions provider. The company is backed by strong financials, sticky OEM relationships, rising profit contribution from Associates (notably Flash Electronics), and well-defined growth levers across both EV and ICE segments, making it a compelling long-term compounding opportunity. The outlook remains positive, supported by robust new order wins, a strong order book, and management’s confidence in outperforming industry growth through both organic and inorganic initiatives. Over FY25–28E, Revenue/EBITDA/PAT is expected to grow at a CAGR of 13%/16%/22%, respectively.

E. Valuation & Recommendation: Given the strong growth trajectory and healthy balance sheet, the stock is valued at a 36x multiple on FY28E EPS. We recommend a BUY rating on the stock with a TP of Rs 690/share, implying an upside potential of 19% from the CMP.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633