Diwali Muhurat Picks : Buy Federal Bank Ltd for Target Rs.240 by Axis Securities Ltd

.jpg)

Investment Rationale

A. Rate Cuts Largely Priced In; Lower NIM Compression in Q2: With the bulk of the repo rate cut impact reflecting in the yields (given pass-on is on a T+1 basis), the quantum of NIM compression in Q2 is expected to be significantly lower at 5-10bps. Resultantly, NIMs will bottom out in Q2, assuming no further rate cuts. The SA rate cut taken in mid-Jun’25 is yet to reflect in the CoF, and should enable the bank to cushion the dent on margins. With TD repricing kicking in from the forthcoming quarters, NIMs are expected to improve gradually over H2. FB has seen a gradual shift in its portfolio mix from EBLR loans declining to 48% vs 52% in Mar’24 and a corresponding increase in the fixed rate portfolio to 33% from 27%. Going ahead, the management sees levers to further decrease the share of EBLR loans, as the growth in the fixed-rate Gold, CV, and Car Financing portfolio gathers pace. Moreover, the gradual shift towards mid-yielding segments (mix improvement of 50-60bps in Q1) along with improving mix of CASA deposits, should also provide support to NIMs

B. Asset Quality Stress Manageable: The management has highlighted that MFI slippages have peaked in May’25 and have been trending downwards MoM over Jun-Jul’25. Similarly, the SMA pool and Collection Efficiency in the MFI book have been on an improving trend, possibly indicating that the worst is now behind. In the Business Banking and CV portfolio, the bank has seen a slight increase in stress; however, it is not alarming. FB continues to tightly monitor these portfolios for any emerging signs of stress. Apart from these portfolios, asset quality continues to remain largely stable. The management has guided for 55bps credit costs for FY26.

C. Growth Recovery Visible from H2 Onwards: The bank has realigned its growth in the retail portfolio and is ready to push for strong growth from H2 onwards. Similarly, the bank will also look to pursue strong growth in the mid-yielding segments. As the macro environment turns favourable, FB will look to accelerate growth in the higher-yielding segments. Given uncertain macros, FB expects to grow at 1.2x of nominal GDP in FY26. However, supported by improving consumption demand and favourable macros, FB will aim at growing the book at 1.2-1.5x nominal GDP on a steady state basis. We expect FB to deliver a healthy ~16% CAGR credit growth over FY25-28E.

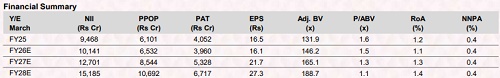

D. Valuation & Recommendation: We value Federal Bank at 1.4x FY27E ABV and the subsidiary at Rs 10/share. We recommend a BUY on the stock with a target price of Rs 240/share, implying an upside of 16% from the CMP.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633