Diwali Stock Picks 2025 : Buy V-Mart Retail Ltd For Target Rs.1,069 by Ventura Securities Ltd

Capitalizing on India’s Apparel Revolution – Growth, Expansion, and Profitability Unleashed

Business Model - V-Mart Retail Ltd (V-Mart) operates as a one -stop value fashion retailer. It obtains ~ 79% of its core revenue from its retail apparel segment, 10% from non-apparel and the remaining ~11% from general merchandise.

India's retail apparel market is set for robust expansion, projected to grow from INR 6,846 bn in 2024 to INR 10,682 bn by 2027, at a CAGR of 16.0%. This growth is further fueled by recent reductions in GST rates, income tax cuts, and favorable monsoon conditions, which are collectively driving increased consumer purchasing power and demand for fashion. As one of India's top 10 apparel retailers, V-Mart Retail is well-positioned to capitalize on the structural tailwinds driving growth in Tier 2 to Tier 4 cities.

With the rapidly increasing consumption in these regions, V-Mart plans to expand its retail network from the current 510 stores (4.4 mn sqft) to 660 stores (5.7 mn sqft) by FY28, strategically enhancing its presence in high-growth markets. The company is poised to incur a total Capex exceeding INR 350 cr by FY28, supporting both legacy store revitalization and new store expansion.

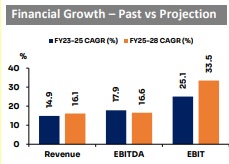

We project revenue growth at a CAGR of 16.1%, from INR 3,254 cr in FY25 to INR 5,094 cr by FY28, largely driven by :

* Expected 14.6% CAGR growth in units sold to 21.1 cr by FY28E,

* Stable ASP of INR 232-241 and,

* Average sales/sqft is projected to increase from INR 7,567 to INR 8,450 by FY28E, driven by efficient space utilization, higher footfall (projected to reach from 73 mn to 117 mn by FY28E), and a volume-driven strategy.

This aligns with V-Mart's focus on increasing sales volumes while maintaining competitive pricing to capture a larger share of the growing apparel market.

In addition to this, we expect EBITDA/net profit to grow at a CAGR of 16.6%/33.7% to INR 609 cr /INR 109 cr over the forecast period. EBITDA margin is expected to rise by 15 bps to 12.0%, supported by a marketing expenses reduction (lower online marketing cost on Limeroad), better employee productivity and process optimization across its retail and supply chain functions. Net margin is projected to rise by 74 bps to 2.1%, and ROE is expected to increase by 442 bps to 10.1%

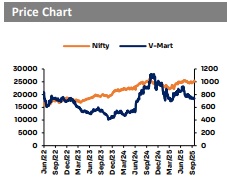

Valuation call – We initiate coverage with a Buy for a DCF-based price target of INR 1,069 (77.6 FY28 P/E), representing an upside of 47.4% from the current CMP of INR 855 over the next 24 months. With V-Mart trading at historical lows, we consider this a low-risk buy, positioning it well for significant upside potential as it capitalizes on the growing apparel market and macroeconomic tailwinds.

SMS subject to Disclosures and Disclaimer goo.gl/8bCMyQ

SEBI Registration No.: INH000001634

.jpg)

.jpg)