Diwali Stock Picks 2025 : One 97 Communications Ltd For Target Rs.2,074 by Ventura Securities Ltd

At the forefront of technology, set to enter its next growth phase

Business Model - One97 Communications Ltd (Paytm) is India's leading digital payment ecosystem for consumers and merchants. As of Jun 30, 2025, the company had 74 mn+ monthly transacting users (MTUs) and 13 mn+ device subscription merchants to whom it offers payment services, financial services, and commerce & cloud services.

Since our initiating_coverage on Paytm in Aug 2024, the company has significantly improved its business position, achieving profitability and strong revenue growth through operational and strategic shifts. Paytm’s merchant base grew from 40.7 mn in Q1FY25 to 45 mn in Q1FY26, sustaining Paytm’s leadership in the industry, while payment GMV climbed from INR 4,210 bn to INR 5,341 bn over the same period. Additionally, device penetration in merchant base surged from 10.9 mn to 13 mn, presents a strong ecosystem for recurring revenue stream. Paytm’s extensive merchant network, ranging from small MSMEs to large enterprises, benefits from value-added services like credit, payment devices, and business management tools. Paytm's UPI market share improved from 7% in Q1FY25 to 7.3% in Q1FY26, with its UPI P2M market share rising from 20.4% to 20.9% (assuming 80% of Paytm GMV comes through UPI platforms).

Additionally, Paytm relaunched ‘Paytm Postpaid’ – “Spend Now, Pay Next Month", an innovative product in partnership with Suryoday Small Finance Bank, powered by NPCI. The product is on Paytm app and can be available on merchant UPI network. There is ongoing innovation in merchant payment solutions, aiming to capture high-margin opportunities in financial services and further leverage AI across its ecosystem. As Paytm continues to navigate the evolving fintech landscape, its ability to leverage technology, and maintain strong relationships with device merchants will be crucial to its sustained growth. With UPI emerging as the favoured digital payments medium and Paytm originated soundbox (+POS) becoming an essential toolkit for payments, Paytm is well placed to benefit from the industry tailwind. As Paytm continues to navigate the evolving fintech landscape, its ability to adapt to regulatory changes, leverage technology, and maintain strong relationships with merchants and MTUs will be crucial to its sustained growth in other verticals – Financial Services and Cloud & marketing Services.

We anticipate Paytm's MTUs & subscription paying device merchant base could increase from 74 mn & 13 mn in Q1FY26 to 95 mn & 22 mn respectively by FY28E, while payment GMV could improve from INR 18.7 trillion in FY25 to INR 33.9 trillion by FY28E. Over FY25-28E, Paytm’s revenue & contribution profit is projected to grow at a CAGR of 27.3% & 30.8%, to reach INR 14,200 cr & INR 8,208 cr respectively, while contribution margin is expected to improve from 53.2% to 57.8% over the same period. Paytm turned post-ESOP EBITDA positive in Q1FY26, a trend we expect to sustain. By FY28E, we project a post-ESOP EBITDA of INR 2,164 cr (15.2% margin) and net profit of INR 2,138 cr (15.1% margin), a sharp turnaround from FY25 losses of INR 1,543 cr & INR 659 cr, respectively. This improvement is underpinned by AI-driven operating leverage and a disciplined cost structure.

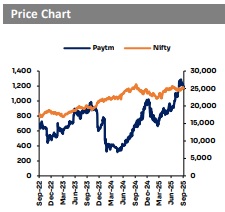

Valuation call – At the CMP of INR 1,237, Paytm is trading at FY28 P/E of 36.9X. We recommend BUY with a DCF based price target of INR 2,074 (61.8X FY28P/E), representing an upside of 61.8%.

SMS subject to Disclosures and Disclaimer goo.gl/8bCMyQ

SEBI Registration No.: INH000001634

.jpg)

.jpg)

.jpg)