Diwali Muhurat Picks : Rainbow Children’s Medicare Ltd for Target Rs.1,625 by Axis Securities Ltd

Investment Rationale

A. Delivering Excellence in Complex Paediatric and Neonatal Care: Rainbow Children’s Medicare is India’s largest multi-speciality paediatric and perinatal hospital chain, built on clinical excellence, early specialisation, and disciplined expansion. The company operates a cluster-based hub-and-spoke model, with Hyderabad (~950 beds), Bengaluru (~500 beds), and Chennai (~300 beds) as key anchors, enabling efficient expansion, strong referral networks, and brand visibility. Nearly one-third of operational beds are ICU-focused, the highest in the sector, allowing Rainbow to manage high-acuity, complex paediatric and neonatal cases, including congenital interventions, emergency surgeries, and high-risk deliveries. It offers an integrated mother-and-child ecosystem, combining obstetrics, perinatal, neonatal, and paediatric super-specialities. This continuum of care drives patient stickiness and positions Rainbow as the go-to referral destination for critical paediatric care.

B. Scalable Growth Driven by Asset-Light Model and Strategic Expansion: Rainbow leverages an asset-light hub-and-spoke model, where large hub hospitals deliver tertiary and quaternary care, and smaller spoke hospitals provide primary and secondary services with lower capex, enabling faster break-even. This model maximises referral synergies, optimises specialist utilisation, and supports rapid, capital-efficient geographic expansion, delivering structurally superior EBITDA margins (~32%) with minimal debt. Rainbow plans a 1.5x increase in total bed capacity over the next three years through greenfield projects and strategic acquisitions, including Gurugram (300-bed hub, 100-bed spoke), Coimbatore (130 beds), Rajahmundry (100 beds), Guwahati (100+50 beds), multiple Bengaluru spokes, and Warangal. The combination of a scalable, low-capex model and targeted expansion makes Rainbow a compelling long-term investment in paediatric and maternity healthcare.

C. Strong Cashflow with Debt-Free Balance Sheet: Rainbow’s asset-light, debt-free model sets it apart from peers, with obligations limited to leases. Over FY26– 28E, the company is expected to generate Rs 1,100–1,200 Cr of FCFF, covering capex for the Gurugram flagship and Tamil Nadu expansions. With Rs 700 Cr cash, recent acquisitions in Guwahati and Warangal, and robust cash generation, Rainbow can self-fund growth and pursue strategic M&A. We expect pre-tax RoCE to improve by 350 bps over the next three years.

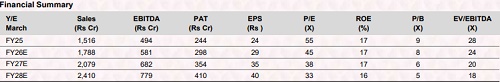

D. Outlook: Rainbow is well-positioned to deliver healthy growth, supported by strong occupancy trends in mature hospitals, improving contributions from new hospitals, and its focused specialisation in paediatrics and maternity care. The company’s hub-and-spoke model provides scalability, while its asset-light expansion strategy ensures efficient capital deployment. Margin expansion is expected as new hospitals mature and operating leverage strengthens. We expect double-digit revenue growth with sustained ~32–33% EBITDA margins over the medium term, backed by disciplined execution and favourable industry tailwinds.

E. Valuation & Recommendation: We value the stock on a DCF basis to arrive at a TP of Rs 1,625/share. We recommend a BUY on the stock with the TP implying an upside of 23% from the CMP.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633