Diwali Muhurat Picks : Buy Chalet Hotels Ltd for Target Rs.1,120 by Axis Securities Ltd

Investment Rationale

A. Diversified Portfolio: Chalet Hotels Limited operates a diversified portfolio across hospitality, commercial, and residential segments, with its core strength in hospitality. It has 11 hotels with over 3,350 keys as of Q1FY26, managed under long-term partnerships with Marriott International and Accor Hotels, including brands like JW Marriott, Westin, Four Points, Courtyard, Lakeside Chalet, and Novotel. The commercial portfolio spans 2.4 Mn sq. ft., providing steady rental income and healthy cash flows, while the residential segment comprises two premium towers in Koramangala with 321 units, of which only 13 remain unsold. Chalet’s integrated asset model ensures diversified revenue streams, operational resilience, and sustainable growth.

B. Aligned Pipeline with Demand Drivers: Chalet Hotels has an aggressive expansion pipeline, planning to add ~1,200 rooms and 0.9 Mn sq. ft. leasable area over the next three years. Key projects include The Dukes Retreat (Khandala) expansion, Taj at Delhi International Airport (~385–390 keys, H1FY27), Varca, South Goa (~190 rooms, FY28), and CIGNUS Powai Tower II (0.9 Mn sq. ft., Q4FY27), along with new hotels in Navi Mumbai. The company is well-positioned to benefit from favourable demand-supply dynamics. Its hotels, located near commercial districts and airports, command ARR premiums while maintaining high occupancy (75–80% post-pandemic). With a focus on business travellers, seasonal fluctuations remain moderate. Limited supply additions in Tier-1 cities have helped Chalet’s properties, especially in MMR, deliver ARR growth of 8–10%, supported by Pan-India demand growth of 11.6% (2022–27) outpacing supply growth of 9%, with strong expansion in the Luxury (5.3%) and Upper-upscale (7.2%) segments.

C. Capex with Focused Debt Level: Chalet Hotels Limited has planned a Rs 2,000 Cr capex for its announced projects by FY27, largely funded through internal accruals. The management targets to maintain a prudent leverage profile of around 3.5x EBITDA. As of Q1FY26, net debt stood at Rs 2,000 Cr, with the average cost of finance declining 40 bps QoQ to 8%, while the company maintained a healthy liquidity buffer of Rs 320 Cr, supporting its aggressive expansion and operational needs.

D. Outlook: Chalet Hotels is well-positioned for sustainable growth, supported by its diversified portfolio and healthy cash flows from commercial assets. The company expects to generate ~Rs 300 Cr from the sale of remaining residential units, which will be deployed towards hospitality and commercial expansion, including the Taj at Delhi Airport, enhancing returns. With strong brand partnerships, strategic locations, and favourable industry tailwinds, Chalet is expected to deliver robust occupancy, ARR growth, and long-term value creation.

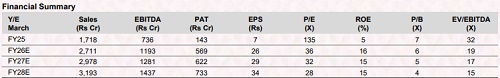

E. Valuation & Recommendation: We value the stock at 21x H1FY27E EV/EBITDA. We recommend a BUY rating on the stock with a TP of Rs 1,120/share, implying an upside potential of 19% from the CMP

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

.jpg)