Diwali Muhurat Picks : Buy Kotak Mahindra Bank Ltd for Target Rs.2,500 by Axis Securities Ltd

Investment Rationale

A. Growth Momentum to be Healthy; Calibrated Improvement in Unsecured Mix: KMB remains committed to growing advances at 1.5-2x of nominal GDP growth. With Asset quality challenges in the unsecured portfolio now behind, the bank will look to resume growth in the PL, CC, and MFI segments. While the MFI portfolio contribution to the portfolio will remain capped at 3-4%, KMB believes PL and CC remain key growth drivers, as the bank looks to scale up the unsecured book to ~15% of the total portfolio. Another focus area for the bank would be the mid-market segment, wherein KMB will look to accelerate growth. In its Q2 provisional update, the bank has posted a healthy 16/4% YoY/QoQ, and we expect healthy credit growth delivery to continue. Resultantly, we expect KMB to deliver a healthy ~17% CAGR credit growth over FY25-28E.

B. Credit Costs to Taper Gradually: The stress in the unsecured segments, particularly MFI, has peaked and should subside over H2FY26. However, the bank is witnessing emerging stress in the retail CV segment, owing to which the bank has tightened its underwriting policies. The management expects the stress in the retail CV segment to subside over the next couple of quarters. In the business banking and SME portfolio, KMB is currently not witnessing any signs of stress emerging. With the slippages in the unsecured portfolio having peaked out and the incremental stress formation across most segments (ex-Retail CV) remaining benign, KMB expects credit costs to taper sequentially. We pencil in credit costs of 80 bps (+/-5bps) over FY26-28E.

C. Outperformance on NIMs vs Peers: KMB’s sharp margin compression visible in Q1 was primarily owing to repo rate changes and slower growth in the higher-yielding segments. With the 50bps repo rate cut in Jun’25 is yet to reflect on the yields, margins will continue to remain under pressure in Q2. However, the SA rate action (reduction of ~75 bps) should reflect in Q2, partially supporting NIMs. Thus, we expect the quantum of compression to be considerably lower QoQ. From Q3 onwards, KMB's margins should find support from the (1) Impact of CRR cut, (2) Improving growth in the unsecured segments and an improving mix in the overall portfolio, and (3) Downward repricing of deposits, especially TDs. We expect FY26 margins to remain lower at ~4.7%, before improving to ~4.9-5% over FY27-28E, driven by aforementioned factors.

D. Focus on Deposit Granularity: KMB continues to focus on SA Accounts, Activ Money and Retail TDs to drive deposit growth, while aiming at containing CoF. The Kotak811 channel will remain a key enabler to drive healthy liability franchise growth. In the CA accounts, the bank saw improved traction in the NTB in the self-employed segment. KMB's focus on LAP, SME, and business banking verticals should enable healthy CA deposit accretion. We expect deposit growth will mirror credit growth, enabling the bank to maintain a steady LDR between 85-86%.

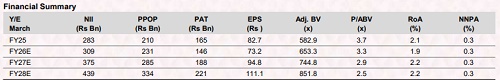

E. Valuation & Recommendation: We value the bank’s core book at 2.5x FY27E ABV and assign a value of Rs 635 to the subsidiaries. We recommend a BUY on the stock with a target price of Rs 2,500/share, implying an upside of 17% from the CMP.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

.jpg)