Diwali Muhurat Picks : Buy DOMS Industries Ltd for Target Rs.3,110 by Axis Securities Ltd

Investment Rationale

A. GST 2.0 Reforms: The recent GST cut on stationery items—from 5%/12% to nil/5%—is a clear positive for DOMS, enhancing affordability and driving consumption across rural and urban markets. Backed by its strong brand equity, extensive distribution reach, and premiumisation focus, the company is well placed to capture incremental demand and gain share from the unorganised segment. The move is also expected to support formalisation and sustain volume-led growth with margin stability. However, the transition to the new GST framework has caused short-term trade disruptions as distributors realigned inventories to the revised tax structure.

B. Expanding Portfolio; Strengthening Category Presence: DOMS continues to broaden its portfolio across core and high-growth segments such as Hobby & Craft, Baby Hygiene, and Back-to-School, witnessing healthy consumer traction. The Super Treads acquisition has bolstered its presence in Eastern India and enhanced paper stationery capacity. Meanwhile, its 44-acre greenfield project is progressing on schedule, with the first factory building expected by Q3FY26 and commercial operations by Q4FY26, supported by ongoing brownfield expansions to cater to rising demand.

C. Capacity Expansion on Track: DOMS’ 44-acre greenfield project is on schedule, with the first plant by Q3FY26 and production from Q4FY26. FY26 capex is guided at Rs 210–225 Cr, mainly for the new facility. Ramp-up from FY27 is expected to deliver 2–3x asset turns, supporting an 18–20% growth trajectory.

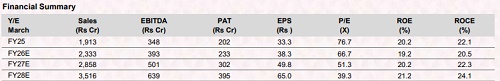

D. Outlook: DOMS’ growth is supported by its 44-acre greenfield facility, expansion into pens, bags, toys, and diapers, and a distribution push toward 3– 3.5 Lc outlets. The FILA partnership adds global reach and R&D strength. These initiatives underpin our FY25–28E Revenue/EBITDA/PAT CAGR of 23%/22%/25%.

E. Valuation & Recommendation: We value the company at 58x Mar’28E EPS. We recommend a BUY on the stock with a TP of Rs 3,110/share, implying an upside of 22% from the CMP.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

.jpg)