Diwali Muhurat Picks : Buy JSW Energy Ltd for Target Rs.625 by Axis Securities Ltd

Investment Rationale

A. Capacity Expansion Pipeline: The company currently has an installed power generation capacity of 13.2 GW, and it has a total locked-in generation capacity of 30.5 GW, comprising 13.2 GW operational, 12.5 GW under-construction across thermal and renewable, 150 MW under acquisition hydro, and has a pipeline of 4.6 GW. The company also has 29.4 GWh of locked-in energy storage capacity through hydro pumped storage projects of 26.4 GWh and a battery energy storage system of 3.0 GWh. The Company aims to reach 30 GW of generation capacity and 40 GWh of energy storage capacity by FY 2030 and achieve Carbon Neutrality by 2050. According to Strategy 3.0, it aims to achieve a FY30 run rate EBITDA of 2.7-3.0x of FY25 proforma EBITDA, and it will spend a total capex of Rs 1,30,000 Cr over FY26-FY30 by keeping its Net Debt/EBITDA near ~5.0x in FY30.

B. Focus on Renewable Energy: In Q2FY26, the company added cumulative RE capacity of 443MW. The share of renewables in the overall capacity stands at 57% (48% in FY25), consisting of wind capacity at 3,709 MW, solar capacity at 2,213 MW, and hydro capacity at 1,631 MW. The company targets to enhance renewable capacity to 2/3 rd of its total installed capacity by 2030 and is well on track to achieve the same. Its total underconstruction RE portfolio currently is ~11 GW, and the pipeline portfolio is 2.8 GW.

C. Early Mover Advantage in Energy Storage – Capitalizing on the New Age Businesses: The company is set to benefit from the growing energy storage space. It has a locked-in capacity of 29.4 GWh, of which 3.0 GWh is for battery energy storage systems (BESS) and 26.4 GWh is for hydropumped storage projects (PSP). Under its Strategy 3.0, the company has a target to set up an energy storage capacity of 40 GWh/5 GW by 2030. The company has signed a Pumped Hydro Energy Storage Facility Agreement (PHESFA) with state DISCOMS to the tune of 24 GWh. The company is in the advanced stage of completing the trial runs of its 3,800 TPA green hydrogen project in Vijayanagar. It expects the plant to be commissioned soon.

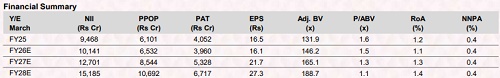

D. Valuation & Recommendation: The stock is trading at 14x 12-month forward consensus EV/EBITDA against the industry average of 12x. We recommend a BUY rating on the stock with a TP at Rs 625/share, implying an upside potential of 15% from the CMP.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633