Buy Sun Pharma Ltd for the Target Rs. 1,960 by Motilal Oswal Financial Services Ltd

Superior show in innovative/branded portfolios

US generics sales weaken

* Sun Pharma (SUNP) delivered in-line revenue/EBITDA in 2QFY26. Earnings came in below our estimates largely due to lower other income.

* The growth momentum remained intact in global innovative medicines, driven by its increasing reach and enhanced traction in the existing markets. Interestingly, sales of innovative medicines surpassed generics in the US for the first time in 2QFY26. This implies that innovative medicines sales would be at least USD250m in the US in 2QFY26.

* Emerging markets and ROW segment saw robust growth, led by improved traction in innovative medicines and generic products.

* SUNP remains in good stead in domestic formulation (DF) market to not only hold leading position but also to gain market share gradually.

* We reduce our earnings estimates by 4%/6%/3% for FY26/FY27/FY28, factoring in marketing spends on global innovative medicines and a higher tax rate. These factors are partly offset by lower R&D spends on global innovative medicines under development.

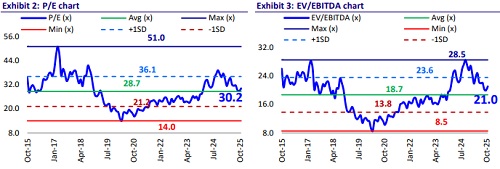

* We value SUNP at 32x 12M forward earnings to arrive at a TP of INR1,960. SUNP continues to strengthen its branded franchise across focus markets in developed and emerging regions. Product launches and increased penetration should help SUNP sustain superior growth compared to largecap peers in Indian pharma space. Maintain BUY.

Higher opex decelerates EBITDA growth after eight quarters

* Sales grew 8.6% YoY to INR144b (vs. our est: INR140.5b).

* DF sales grew 11% YoY to INR47.3b (33% of sales). ROW sales grew 22.7% YoY to INR20.4b (14% of sales). EM sales grew 15.7% YoY to INR28.3b (19% of sales). US sales were stable at INR43.2b (USD496m in CC terms and down 4% YoY; 30% of sales).

* Gross margin contracted 40bp YoY to 79.3%.

* EBITDA margin contracted 60bp to 28% (vs our est: 28.3%).

* EBITDA grew at 6% YoY to INR40.2b (vs. our est: INR39.7).

* Adj PAT was INR27.9b (our est: INR30.2b), down 3.8% YoY.

* For 1HFY26, revenue/EBITDA/PAT grew 9%/10%/2% YoY.

Highlights from the management commentary

* Ilumya has now been commercialized in all target geographies and is available in 35 markets globally.

* Innovative R&D accounted for 38% of total R&D spending, representing ~10% of global innovative medicine sales for the quarter.

* SUNP remains on track to launch Unloxcyt in 2HFY26 and plans to file Illumya for psoriatic arthritis in 2HFY26.

* Growth in innovative medicines was driven by Ilumya/Odomzo, though this was partially offset by lower generic sales due to intensified competition and reduced g-Revlimid volumes.

* Sales of g-Revlimid were lower YoY/stable QoQ and could decline going forward.

* R&D spends are expected at the lower end of 6-8% guidance for the year.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)