Buy Kaynes Technologies Ltd for the Target Rs. 7,300 by Motilal Oswal Financial Services Ltd

Strong order book aids growth visibility

Operating performance in line; earnings miss due to higher depreciation

* Kaynes Technologies (KAYNES) reported a robust 4Q performance, with revenue growth of 55% YoY, led by strong bookings in the industrials (up 61% YoY, including EV), automotive (up 51% YoY) and IoT, IT & consumers (up 3x YoY) segments. EBITDA margin expanded 210bp YoY during the quarter, led by the gross margin expansion of 720bp (higher mix of ODM business 32% vs. almost nil in 4QFY24).

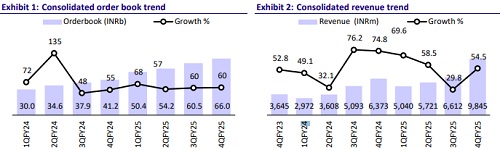

* Order inflows remained strong at INR15.3b in 4Q, boosting the order book by 60% YoY/9% QoQ to ~INR66b, anchored by high-margin sectors like Aerospace, Industrials, and Automotive. With improved execution visibility, a favorable order mix, and continued investments in high-tech verticals, KAYNES appears well-positioned to sustain growth and profitability going ahead.

* We maintain our FY26/FY27 earnings estimates and reiterate our BUY rating on the stock with a TP of INR7,300 (premised on 55x FY27E EPS).

Robust revenue performance with improved margins

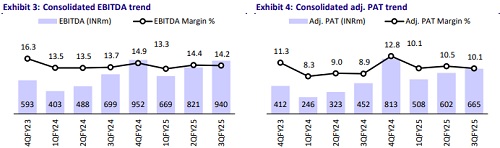

* Consol. revenue grew 55% YoY to INR9.8b (est. INR10.6b) in 4QFY25, while EBITDA rose 76% YoY to INR1.7b (est. in line).

* EBITDA margin expanded 210bp YoY to 17.1% (est. 16.2%), led by a corresponding expansion in gross margin (up 720bp YoY) due to a favorable business mix and accounting change for some consumables transferred to other expenses (up 540bp YoY). Adjusted PAT grew 43% YoY to INR1.2b (est. of INR1.3b).

* In FY25, revenue/EBITDA/adj. PAT grew 51%/62%/60% YoY to INR27.2b/INR4.1b/INR2.9b.

* Net working capital days improved to 93 in FY25 from 111 in FY24. Net debt increased to ~INR6.8b as of FY25 from INR2.2b as of FY24.

Highlights from the management commentary

* Guidance: Management guided for YoY revenue growth of over 60% (including the Canada acquisition) in FY26. Core EMS margins are expected to improve by 50bp (to 15.5-16%). ODM contributions from the industrials, railways, and IT/IoT segments (aided by growing demand from CDAC) are also expected to rise.

* August Electronics: The Canada-based entity is expected to clock revenue growth of 15-20% independently and over 20% with KAYNES’ integration. The acquisition strengthens KAYNES’ North American footprint, brings in high-margin customers, and offers a strategic China+1 sourcing alternative for global clients. August Electronics operates at higher EBITDA margins than KAYNES’ consolidated levels, aiding profitability.

* Capex: FY26 capex will be focused on semiconductor and HDI PCB projects, with maintenance-only investments in Core EMS. Construction of the OSAT (at Sanand, Gujarat) and HDI PCB (at Chennai) facilities is on track for completion, with revenue visibility from 4QFY26. The INR34b OSAT and INR14b HDI PCB capex will be majorly incurred in FY26/FY27

Valuation and view

* KAYNES ended FY25 on a strong footing with an all-round performance. With a strong order book (INR66b), the company is likely to sustain its strong revenue growth momentum going forward. Further, increased traction in some of its high-margin verticals will lead to margin expansion for the company.

* We estimate a CAGR of 57%/61%/70% in revenue/EBITDA/adj. PAT over FY25- FY27. Reiterate BUY with a TP of INR7,300 (premised on 55x FY27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412