Sell India Cements Ltd for the Target Rs.280 by Motilal Oswal Financial Services Ltd

Improved cost control drives EBITDA beat.

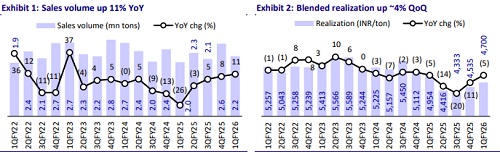

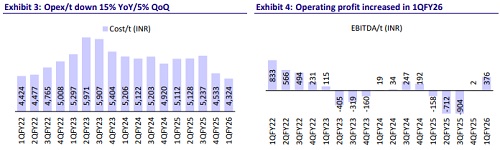

* India Cements (ICEM) reported EBITDA of INR819m (21% beat) in 1QFY26 vs. operating loss of INR310m in 1QFY25. The improvement in operating performance was led by cost control measures, as opex/t was down ~15% YoY in 1QFY26. Sales volume grew ~11% YoY to 2.2mt (~6% below our estimate). The company reported net loss of INR138m (estimated loss of INR276m) vs. a loss of INR1.6b in 1QFY25.

* Following its acquisition by UTCEM, the company has initiated a capex plan aimed at enhancing efficiency and production. This plan includes the installation of WHRS, pre-heater modification, cooler upgrades, and alternative fuel technologies. The capex will be funded through a mix of internal accruals and debt, with the goal of keeping net debt below INR500m upon completion. The company aims to achieve EBITDA/t of INR1,000 by FY28 vs. INR376 in 1QFY26. ICEM will continue to operate as a separate entity for now and revisit the decision in FY27-28.

* We broadly maintain our EBITDA estimates for FY26/FY27. We also introduce FY28 estimates in this note. We value ICEM at an EV/t of USD80 to arrive at our TP of INR280. Reiterate Sell.

Realization up ~4% QoQ; EBITDA/t at INR376 (est. INR292)

* ICEM’s revenue increased ~5% YoY to INR10.2b in 1QFY26 (~13% miss). Sales volume increased ~11% YoY (down ~17% QoQ; -6% vs. est.) to 2.2mt. It reported a net loss of INR138m vs. a net loss of INR1.6b in 1QFY24.

* Blended realization/t increased ~4% YoY to INR4,700. Variable cost/other expenses/freight cost per ton declined 7%/1%/5% QoQ. Employee cost declined 8% QoQ. Opex/t declined ~5% QoQ to INR4,324 (~9% below our estimate). EBITDA/t stood at INR376 vs. our estimate of INR292.

* Depreciation increased ~34% YoY, while finance costs declined ~60% YoY. Other income increased ~38% YoY. Average interest rate declined 110bp QoQ to 6.83%. ETR stood at ~15%.

Highlights from UTCEM’s management commentary

* The company’s capacity utilization stood at ~61% in 1QFY26 vs. 73% in 4QFY25. The trade/non-trade mix stood at ~55%/45%. Direct sales stood at ~66%.

* The company is targeting to increase its WHRS capacity to 30MW by FY27 vs. 9MW currently, and other renewable power capacity to 221MW by FY27 vs. 20MW currently. It targets to scale up its green power share to 86% by FY27 from 5% currently. It expects efficiency gains from planned capex over the next two years to start reflecting from 4QFY27.

Valuation and view

* Following its acquisition by UTCEM in 4QFY25, ICEM has implemented significant cost control measures, reducing opex/t by INR918/t over the past two quarters through savings across key cost heads. The company is investing in enhancing productivity and energy efficiency, increasing green power share, and digitization initiatives. These efforts are expected to start yielding results from 4QFY27.

* We estimate the company’s revenue CAGR at ~10% over FY25-28, led by a volume/realization CAGR of ~8%/2%. We expect the company to achieve EBITDA/t of INR350/525/760 in FY26/27/FY28. We value ICEM at an EV/t of USD80 and arrive at our TP of INR280. Reiterate Sell.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412