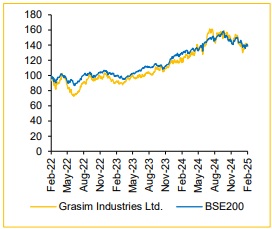

Buy Grasim Industries Ltd For the Target Rs. 2,910 by Choice Broking Ltd

Revenue in line with expectations; Elevated Q3 costs impacted EBITDA, but expenses started normalizing signal margin recovery in the near term

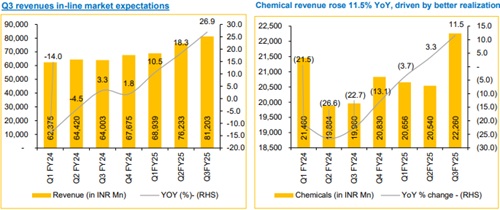

* Q3FY25 revenues came at INR81,203 Mn, (vs Consensus est. INR80,120 Mn), up 26.9% YoY and up 6.5% QoQ.

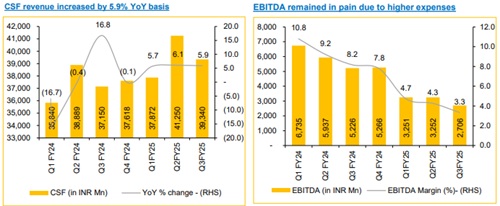

* EBITDA for Q3FY25 was reported at INR2,706 Mn, (vs Consensus est. INR3,956 Mn) down 48.2% YoY and down 16.8% QoQ, impacted due to higher operating expenses. EBITDA Margin for the quarter was 3.3% (vs Consensus est. 4.9%), down 483bps YoY and down 93bps QoQ.

* Company reported a loss of INR1,686 Mn in Q3FY25, (vs Consensus est. of loss of INR1,308 Mn) vs INR2,364 Mn profit in Q3FY24. EPS for Q3FY25 came at INR(2.5).

Paint venture nears completion:

90% capex done, set to drive longterm growth: Birla Opus is ramping up fast. Commercial production kicked off at Chamarajanagar in Nov '24, with Mahad set to go live this quarter. Kharagpur trial run is lined up for Q1FY26. The product portfolio has expanded to 170+ products and 1,000+ SKUs, now flowing through 131 depots, reaching 5,500+ towns. With momentum building, the Paints business is on track and we estimate ~INR90 Bn in revenue by FY27, which accounts for 24.4% of revenue

Chemical business is expected to grow at a CAGR of 9.0% over FY24-27, supported by capacity expansion and positive momentum in realizations:

GRASIM is scaling up big in chemicals. Specialty chemicals capacity doubled to 246ktpa in FY24, while caustic soda is set to expand to 1.5mtpa by FY26E (from 1.4mtpa). The company is also boosting chlorine derivatives, adding an ECH plant (50ktpa) and CPVC resin (Phase I: 50ktpa) at Vilayat, taking chlorine integration to 70% postexpansion. Chemical business realizations are improving, and we expect prices to hit ~INR81/kg by FY27. With strong expansion plans, we expect GRASIM’s Chemical business on track to hit ~INR103bn revenue by FY27, growing at a 9% CAGR.

View & Valuation:

We revise our FY26/27 EPS estimates by 12.9%/14.2% and upgrade our rating to ‘BUY’ with a revised TP of INR2,910, valuing on SOTP with a holding company discount of 35% and EV/EBITDA multiple of 8x on CSF, 9x on Chemical, and 12x on Renewable business on FY27 EV/EBITDA. However, we haven’t assigned any multiple to GRASIM Paints business because EBITDA will remain negative for the next ~2-3 years.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131