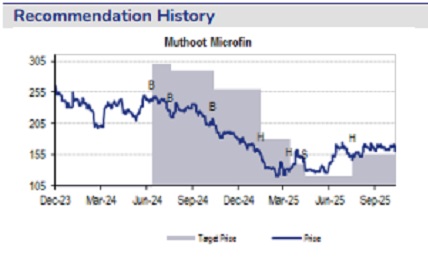

Buy Muthoot Microfin Ltd For Target Rs. 190 By JM Financial Services

Momentum picking up; upgrade to BUY

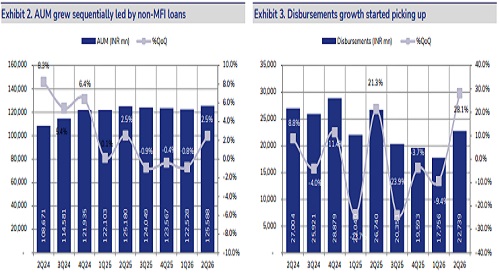

In 2QFY26, Muthoot Microfin (MML) reported a steady improvement with a PAT of INR 305mn (+41% JMFe) mainly led by lower than expected credit costs of 3.6%. NII de-grew -14% YoY, +5% QoQ on account of lower AUM growth while reported NIMs was up +40bps QoQ. Opex grew +15%/+flat YoY/QoQ) which led to a PPoP of INR 1.5bn (-37%/+14% YoY/QoQ, -18% JMFe). Disbursements grew (-15%/+28% YoY/QoQ), leading to moderate AUM growth of (+0.3%/+2.5% YoY/QoQ). The asset quality outcome during the quarter was favourable as GS3/NS3 improved 24bps/16bps QoQ to 4.6%/1.4% while collection efficiencies (CE) improved sequentially. We expect credit costs to continue trending downward while management guidance remains conservative at 4-6% for FY26E. The launch of new products viz. GL, microLAP and individual is expected to contribute growth going forward while CoFs benefit led by rating upgrade will also lead to NIM expansion. We revised our credit cost estimates downward by -90bps (from 4.2% to 3.3%) while slight increase in opex leads to +2% FY26E EPS revision. Given the steady improvement in CEs and revival in growth led by non-MFI products, we expect MML to report RoA of 2.1%/3.6% for FY26E/FY27E and we upgrade the stock to BUY with a revised TP of INR 190 valuing at 1.0x FY27E BVPS (vs. earlier 0.8x FY27E BVPS).

* Asset quality improves: GS3/NS3 improved 24bps/16bps QoQ to 4.6%/1.4%. Collection efficiency demonstrated an upward trend, improving to 93.3% from 93% in 1Q while x-bucket collection efficiency improved to 99.8% (vs. 99% in 1Q). Credit costs (calc) declined significantly to 3.6% (vs. 4.1% QoQ), which was below management’s guidance (4-6% for FY26). Stage-3 PCR moved up 190bps to 70.4%. Additionally, MML exposure to MML+4 and above loans reduced ~150bps QoQ to 3.2%. The total exposure to customers exceeding INR 200k indebtedness also declined to 0.8% from 1% QoQ. With continued improvement in collections, we anticipate credit costs to moderate. Thus we reduced our credit cost estimates by -90bps to 3.3% for FY26E. We expect credit cost to normalize to 2.4% in FY27E.

* Flattish AUM growth, diversification into new products to drive growth: Disbursements grew +28% QoQ, -15% YoY, while AUM grew +2 YoY/flat QoQ. Management remains optimistic on recovery in growth, driven by the launch of three new products: (1) micro LAP loans with ticket sizes ranging from INR 0.1-1mn, (2) gold loans through 60-40 co-lending partnership with its parent company - Muthoot Fincorp, and (3) individual loans targeting micro MSME financing. With this, management remains confident in achieving the FY26 growth guidance of 5-10%. We estimate AUM growth of +11%/+16% for FY26E/FY27E.

* PAT beat led by lower credit cost: MML reported a PAT of INR 305mn (+41% JMFe) mainly led by lower than expected credit costs of 3.6%. NII de-grew -14% YoY, +5% QoQ led by lower AUM growth. NIMs moved up +40bps QoQ as yields moved up 41bps QoQ and CoFs declined - 20bps QoQ. Opex grew +15%/flat YoY/QoQ) which led to a PPoP of INR 1.5bn (-37%/+14% YoY/QoQ, -18% JMFe). Management noted that the current elevated opex ratio of 7.0% is expected to moderate going forward as AUM picks up and recent investments in technology begin to yield operating leverage.

* Valuation and view: Given the steady improvement in CEs and revival in growth led by non-MFI products, we expect MML to deliver RoA of 2.1%/3.6% for FY26E/FY27E. We upgrade the stock to BUY with a revised TP of INR 190 valuing at 1.0x FY27E BVPS (earlier 0.8x FY27E BVPS).

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361