Buy Zen Technologies Ltd for the Target Rs. 2,150 by Choice Institutional Equities

Short-term dip; revival expected in H2

ZEN delivered a steady Q2FY26 performance with margin holding firm despite a softer topline, reflecting strong cost-efficiency and operating discipline. The order inflow was slower due to the government’s near-term focus on emergency procurement after Operation Sindoor. Yet, the management reiterated confidence that delayed simulator and anti-drone orders, worth around INR 650 Cr., will materialise in H2FY26. The company remains fundamentally sound, supported by a debt-free balance sheet, robust EBITDA margin and a strong over INR 1,100 Cr net cash position.

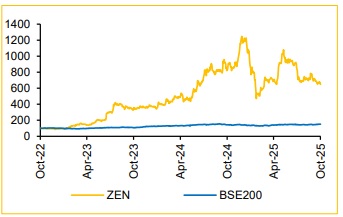

We believe the recent stock correction largely prices in short-term execution delays rather than any structural weakness. ZEN’s INR-6,000 Cr cumulative execution guidance by FY28 remained intact. Owing to the rising domestic and global demand for anti-drone and simulator systems, we expect a sharp rebound in order inflows in the coming quarters. ZEN is also in business negotiations with several friendly nations, which result in export opportunities.

Stable quarter with margin intact; PAT ahead of estimate

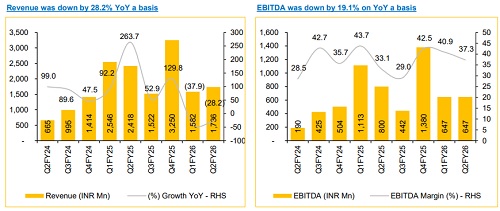

* Revenue for Q2FY26 down by 28.2% YoY & up by 9.7% QoQ at INR 1,736 Mn (vs CIE est. INR 1,740 Mn)

* EBIDTA for Q2FY26 down by 19.1% YoY and up by 0.1% QoQ at INR 647 Mn (vs CIE est. INR 655 Mn). EBITDA margin stood at 37.3%, improved by 422bps YoY (vs CIE est. of 37.6%)

* PAT for Q2FY26 down by 2.4% YoY and up 16.6% QoQ at INR 619 Mn (vs CIE est. INR 550 Mn). PAT margin improved by 943bps YoY, reaching 35.7% (vs CIE est. 31.6%)

View & Valuation:

We maintain a positive outlook on ZEN, supported by its strong IP-led capabilities and rising global demand for counter-drone and simulation systems. Reiterating our BUY rating with a target price of INR 2,150, we value the stock at 35x FY27–28E average EPS. We expect a meaningful acceleration in order inflows and execution through FY27–28E, driving earnings and valuation re-rating.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131