Buy Eternal Ltd for the Target Rs. 410 by Motilal Oswal Financial Services Ltd

Still in the investment phase

Elevated spending in marketing and other business delays breakeven

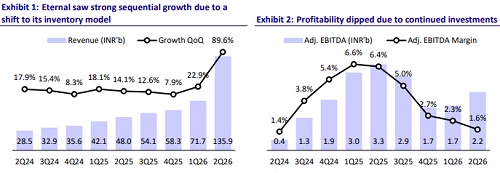

* Eternal reported a 2QFY26 net revenue of INR135b (+90% QoQ/183% YoY). This high growth is mainly on account of shift to inventory ownership in quick commerce (Q-commerce), where revenue now also includes the full monetary value of goods sold as per Ind AS (and not just the marketplace commission).

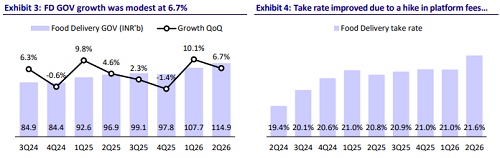

* Food Delivery (FD) NOV came in at INR94.2b, below our estimate of INR97.9b. Blinkit NOV came in at INR116.7b (up 137% YoY) vs. our estimate of INR115.8b. For FD, adjusted EBITDA as a % of NOV margin was up 30bp QoQ to 5.3% vs. our estimate of 5.1%.

* Blinkit reported a contribution margin of 4.6% (3.9% in 1Q). Adj. EBITDA margin was -1.3%, below our expectation of -0.8%. Blinkit aims to achieve 3,000 stores by 4QFY26.

* Our TP of INR410 implies a 17% upside from the current level. The slowdown in FD has also continued in this quarter, and a slower uptick is expected in the near term. We reiterate our BUY rating on the stock, supported by Eternal’s market leadership in both Q-commerce and food delivery and the long-term potential of Blinkit as a generational opportunity in retail, grocery, and e-commerce disruption. However, elevated investments in both Q-commerce and the going-out business are anticipated to constrain profitability in the short term.

Our view: QC expansion to continue

* FD growth remains soft amid multiple headwinds: FD continues to underperform expectations, with no clear inflection yet. Growth remains muted due to a share shift toward Q-commerce and muted discretionary demand. Competitive intensity has also picked up, limiting pricing actions. We expect near-term FD NOV growth to remain constrained to 15-17%.

* Shift to an inventory-led model complete; a medium-term margin tailwind: Blinkit’s transition to an inventory-led model is largely done—around 90% of assortments are now owned inventory. This has improved its gross margin by ~300bp, though contribution margin has risen only ~70bp, as the company reinvested part of the savings into first-mile infrastructure and supply-chain capacity. We expect ~100bp margin uplift over the short term as network utilization improves. About 70% of new dark store additions remain in Tier-1 cities, reinforcing the focus on Tier-1 cities and densification. However, nearterm headwinds to margins from marketing remain.

* Marketing spends to remain elevated as the category expands: Customer acquisition and brand recall investments remain high. Management indicated that ad spends are likely to stay elevated through FY26, skewed toward metro markets. While this delays EBITDA breakeven, it helps sustain MTU momentum as more users adopt Q-commerce for routine purchases.

* Losses remain elevated in other businesses: Losses in the going-out vertical are expected to remain range-bound at ~INR600m per quarter, as per management commentary. No material change in trajectory is expected in the near term. The company continues to prioritize Blinkit’s scale-up and efficiency initiatives over profit milestones across smaller adjacencies.

Valuation and changes to our estimates

* Eternal’s FD business is stable, and Blinkit offers a generational opportunity to participate in the disruption of industries such as retail, grocery, and ecommerce. We reduce our FY26/FY27 estimates, factoring in continued dark store expansion, branding and marketing investments in Q-commerce, as well as lower other income. Eternal should report a PAT margin of 1.2%/2.0% in FY26E/FY27E. Our TP of INR410 implies a 17% upside from the current level. We reiterate our BUY rating on the stock.

FD NOV misses our estimates; QC NOV in line | margin expansion slower than expected

* Eternal reported a 2QFY26 net revenue of INR135b (+90% QoQ/183% YoY). This high growth is mainly fueled by the shift to inventory ownership in quick commerce, where revenue now also includes the full monetary value of goods sold as per Ind AS (and not just the marketplace commission).

* FD NOV came in at INR94.2b, below our estimate of INR97.9b. Blinkit NOV came in at INR116.7b (up 137% YoY) vs. our estimate of INR115.8b.

? For FD, adjusted EBITDA as a % of NOV margin was up 30bp QoQ to 5.3% vs. our estimate of 5.1%.

* Blinkit reported a contribution margin of 4.6% (3.9% in 1Q). Adj. EBITDA margin was -1.3%, below our expectation of -0.8%. Blinkit aims to achieve 3,000 stores by 4QFY26.

* As a result, about 80% of the NOV was on its own inventory in 2QFY26.

* The GST rate cuts have brought down the average GST on Blinkit’s typical basket by ~3%.

* Consol. reported EBITDA came in at INR2,390m; reported EBITDA margin stood at 1.8% vs. 1.6% in 1QFY26.

* PAT was INR650m, down 63% YoY (est. INR3.0b). Adj. revenue surged 172% YoY.

Key highlights from the management commentary

* FD: Eternal continues to target ~20% long-term GOV growth, though near-term trends are softer amid muted discretionary demand. FY26 growth is likely to close around 15%. In FD, the recent increase in platform fees has driven a stronger profit delta; this move followed peers’ pricing actions and aims to sustain margin improvement.

* Blinkit: Strong traction in monthly transacting users (MTUs), with a large share of new customers being added. Customer acquisition costs remain reasonable, and most new cohorts break even at the contribution margin level within a month. Marketing expenses remain elevated and focused on Tier 1 cities, though Tier 2 markets are contributing increasingly. CACs across Tier 1 and 2 are broadly similar.

* NOV growth is likely to be sustained at over 100% for the next couple of years.

* About 70–75% of new dark-store additions are concentrated in the top 10 cities, with smaller cities serviced through shared regional warehouses. Expansion into tail cities is cost-efficient given existing infrastructure.

* Around 80% of NOV now operates under the inventory model, expected to reach 90% in 3QFY26. The balance of 10% remains under a marketplace structure where it benefits both sellers and the platform.

Valuation and view

* Eternal's FD business is stable, and Blinkit offers a generational opportunity to participate in the disruption of industries such as retail, grocery, and ecommerce. We value the QC business using a DCF methodology with a 12% cost of capital and assign a 30x EV/EBITDA multiple to the FD business. Additionally, we ascribe a combined value of ~USD1b to Hyperpure, Going-out, and other residual businesses. We reiterate our BUY rating with a TP of INR410, implying 17% potential upside.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412