Buy Adani Ports & SEZ Ltd for the Target Rs. 1,770 by Motilal Oswal Financial Services Ltd

Robust performance yet again; logistics and marine emerge as key growth pillars

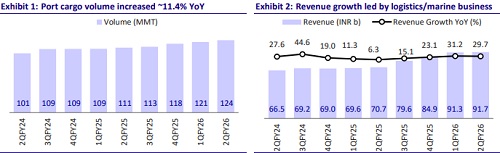

* Adani Ports & SEZ (APSEZ) reported revenue growth of ~30% YoY to INR92b in 2QFY26 (6% above our estimate). Cargo volumes grew 12% YoY to 124mmt, primarily led by containers.

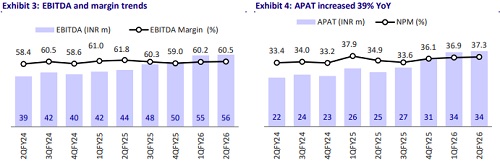

* EBITDA margin came in at 60.5% vs. our estimate of 60.3% (-130bp YoY, +30bp QoQ). EBITDA grew 27% YoY to INR56b (6% above our estimate), while APAT increased ~39% YoY to INR34b (8% above our estimate).

* Its all-India cargo market share increased to 28.1% from 27.4% in 2QFY25. Its container market share stood at 45.9% (vs. 44.4% in 2QFY25).

* In 1HFY26, revenue/EBITDA/APAT grew by 31%/28%/33% YoY. Domestic ports delivered the highest-ever 1H EBITDA margin of 74.2%. The marine segment’s revenue jumped 237% YoY to INR6.4b and EBITDA surged 285% YoY to ~INR3.4b. Logistics 1H revenue stood at INR22b (+92% YoY), driven by the ramp-up in Trucking and International Freight Network services. RoCE improved across business segments, with consolidated RoCE improving to 16% in 1HFY26 from 15% in FY25.

* APSEZ reported steady performance in 2QFY26, supported by strong growth in international port operations. Its logistics business emerged as a key growth driver, with significant improvement in network scale and last-mile connectivity, further complementing port operations. The marine business also saw strong traction, reflecting operational scale-up and integration. Overall, with continued market share gains, capacity additions, and expansion in value-added segments like logistics, APSEZ is well-positioned to grow faster than the broader industry.

* We maintain our estimates for FY26/27 and roll forward our valuation to FY28. Accordingly, we expect APSEZ to post 8% growth in cargo volume over FY25-28. This would drive a CAGR of 14%/15%/18% in revenue/EBITDA/PAT over FY25-28E. We reiterate our BUY rating with a revised TP of INR1,770 (premised on 15x FY28E EV/EBITDA).

Performance led by strong growth in container cargo

* APSEZ handled 123.6 MMT of cargo in 2QFY26, up 11.4% YoY, driven by growth in container volumes. Mundra Port contributed 40%/43% to total volume/domestic volume in 2QFY26 (vs. 45%/47% in 2QFY25), marking diversification across ports.

* Domestic cargo volume increased 8% YoY from 105.4MMT to 113.9MMT, while international cargo volume rose 80% YoY from 5.4MMT to 9.7MMT, driven by operations commencement in Colombo terminals.

* Revenue from domestic ports grew 16% YoY to INR63.5b and EBITDA margins expanded to 73.8% (vs. 72.9% in 2QFY25). Revenue from international ports rose ~35% YoY to INR10.7b and EBITDA grew 125%, led by operations commencement in Colombo Port and margin improvement in Tanzania and Israel.

Logistics and marine businesses gain momentum

* Logistics revenue rose 89% YoY to INR10.6b. The strong growth was supported by higher container volumes, along with ongoing network expansion. It handled 0.18m TEUs of container rail volume (+16% YoY) and ~5 MMT GPWIS volume (- 4% YoY). APSEZ received approval to commence EXIM operations at Virochannagar (Gujarat), Kishangarh (Rajasthan) and Malur (Karnataka) ICDs.

* The marine segment’s revenue jumped 237% YoY to INR6.4b and EBITDA surged 285% YoY to ~INR3.4b, driven by a significant increase in vessel count from 76 (Jun’24) to 127 (Sept’25). Together, these segments contributed significantly to overall revenue growth in 2QFY26.

* As of Sept’25, APSEZ strengthened its integrated logistics network with a total rake count of 132. It operates 12 multi-modal logistics parks (MMLPs) and has expanded its warehousing capacity to 3.1m sq. ft. Agri silo capacity rose to 1.3MMT, with a target of 4MMT.

* In the marine business, APSEZ has significantly increased marine vessels to 127 as of Sept’25 and aims to double its revenue in FY26 from INR11.4b in FY25.

Highlights from the management commentary

* Domestic volume growth is being impacted by muted volume in coal across ports. Additionally, Mundra Port which contributed to ~40% of the total cargo in 2QFY26, its coal volume heavily depends on the imported coal and has seen a coal volume decline of 14% YoY.

* RoCE improved across business segments, with consolidated RoCE improving to 16% in 1HFY26 vs. 15% in FY25.

* APSEZ maintains its ambitious plans to handle ~1b MT cargo by FY30.

* The company continued to deepen its international presence by commencing operations at the Colombo West International Terminal. It also approved the acquisition of NQXT Port in Australia, positioning itself for future growth in global trade corridors.

* The integration of its marine services business (which includes Ocean Sparkle, Astro, and TAHID) has been progressing well, and APSEZ expects its marine business revenue to double from INR11.4b in FY25 (INR11.8b already achieved in 1HFY26).

* Management maintains its guidance to handle 505-515MMT of cargo in FY26, with containers being the primary growth driver, followed by dry cargo and liquid cargo.

Valuation and view

* With strong cash flows, a healthy cash balance of INR130b, and net debt-toEBITDA at 1.8x, APSEZ is well-positioned for further expansion. Capacity enhancements at key ports, ongoing infrastructure projects, and global port acquisitions provide visibility for sustained growth in FY26 and beyond.

* We maintain our estimates for FY26/27 and roll forward our valuation to FY28. Accordingly, we expect APSEZ to report 8% growth in cargo volumes over FY25-28. This would drive a CAGR of 14%/15%/18% in revenue/EBITDA/PAT over FY25-28E. We reiterate our BUY rating with a revised TP of INR1,770 (premised on 15x FY28 EV/EBITDA).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412