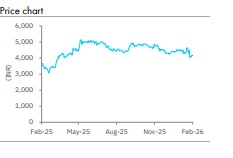

Accumalate Hindustan Aeronautics Ltd for the Target Rs.4,700 by Elara Capitals

Hindustan Aeronautics (HNAL IN) posted healthy revenue growth, in line with our estimates , led by a likely 25% YoY increase in manufacturing revenue . Adjusted EBITDA margin expanded by 480bp , led by operating leverage and steady growth in ROH . Despite not being in AMCA, HNAL has a large orderbook with robust revenue visibility and ongoing projects providing order visibility. We retain Accumulate with a higher TP of INR 4,700 on 3 0x Dece mber FY27E P/E as we roll forward , and while factoring in lower Tejas jets delivered in FY26 . Rising share of indigenization, strong orderbook, long -term inflow visibility and unexplored exports opportunity in the aircraft and helicopter industry make HNAL a strong compounder in India’s defence industry.

In-line Q3 revenue, led by higher manufacturing: Revenue rose 11% YoY to INR 77bn in Q3FY26, as estimated, with guidance of 8 -10% sales growth in FY26, followed by double -digit growth thereafter. Sales growth may be driven by 25% YoY growth in manufacturing , led by execution of AL -31FP engines & helicopters, and 10% YoY growth in ROH .

HNAL, beyond AMCA, still a prime player: Unlike in fighter aircraft where Aeronautical Design Agency (ADA) design s fighter jets in India, HNAL designs and develops military helicopter s independently . The company has an order pipeline of INR 3tn in aircraft and helicopters (wherein HNAL is a sole beneficiary ). These ongoing and developmental programs in aircraft are Tejas Mk II (prototype in Q2FY27), Su -30 upgrade, Dornier 228 , TEDBF, CATS Warrior UCAV & helicopters , such as Utility Helicopter Maritime (UHM; AoN approved INR 320bn), India Multi -Role Helicopter (replaces Mi -17; to develop engine with Safran, France), LUH, LCH Prachand , along with new initiatives , such as MRO for Airbus, foray into civil helicopter (certification by Q3FY27) and commercial aircraft (SJ -100, a development project with Russia). Further, there is a huge export s opportunity in the aircraft and helicopter segment globally, which is tough to time as thes e are G2G transactions .

Margins surge on operating leverage: Adjusted EBITDA surged 33% YoY to INR 22.4bn with margin expanding 480bp YoY to 29% , led by operating leverage and continued growth in ROH. We expect this trend of margin improvement to continue in Q4 , with FY26 likely to see margin of 29%, which would taper off thereafter as manufacturing share rises.

Retain Accumulate with a higher TP of INR 4,700: We raise our FY26E EPS by 7% on consistent margin improvement over 9MFY26, and FY27 E & FY28 E EPS by 1% and 2% , respectively , on higher Other income . We retain Accumulate with a higher TP of INR 4,700 from INR 4,480 on 3 0x (unchanged) December 2027E P/E as we roll forward by a quarter , and while factoring in the delay in LCA Tejas delivery . HNAL is well positioned to be a strong compounder in the defence industry with robust orderbook and long -term inflow visibility, led by a rising share of indigenization and unexplored exports opportu nity in the aircraft & helicopter industry . We expect an earnings CAGR of 7% in FY25 -28E with a 2 3% ROE during FY25 -28E. Key risks include delay in receipt of engines and a slowdown in execution .

Please refer disclaimer at Report

SEBI Registration number is INH000000933

.jpg)