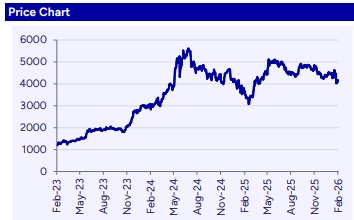

Buy Hindustan Aeronautics Ltd for the Target Rs.5,338 by PL Capital

Quick Pointers:

* During the quarter, HAL received 5th GE-F404 engine and has 5 aircrafts ready for delivery.

* Management has acknowledged a one-time impact from the new labor codes but has not disclosed the amount.

Hindustan Aeronautics (HAL) delivered a 10.7% YoY revenue growth, while EBITDA margin remained flat at 24.3%. HAL continues to demonstrate strong execution and growth visibility, having received fifth GE-F404 engines during the quarter, with five LCA MkA1 aircrafts ready for delivery and an additional nine aircrafts already built and awaiting engine supplies for delivery. While rumours suggest HAL’s exclusion from the AMCA prototype phase, management remains confident of participating in the production phase, expected post-2035. We believe that even in the event of exclusion from the prototype stage, the impact on HAL’s mid-to-long-term earnings is negligible, as AMCA production lies well beyond the current horizon. Meanwhile, a robust confirmed order book provides strong revenue visibility up to 2032, supported by a healthy production pipeline and multiple strategic programmes including IMRH, LCA Mk2 and CATS which are expected to enter production post-2032, reinforcing HAL’s long-term growth and technological capabilities. The stock is currently trading at a P/E of 30.1x/27.3x on FY27/28E earnings. We roll forward to Mar’28E and maintain ‘Buy’ rating valuing the stock at a PE of 35x Mar’28E (38x Sep’27E earlier) arriving at a TP of Rs5,338 (Rs5,507 earlier).

HAL’s execution on the deliveries of Tejas Mk1A aircrafts will be a key monitorable in the coming quarters, however its long-term play on the growing strength & modernization of India’s air defense given 1) it is the primary supplier of India’s military aircraft, 2) long-term sustainable demand opportunity owing to government’s push on indigenous procurement of defense aircraft, 3) a robust order book with a 2-year pipeline of Rs1.0trn+, 4) leap in HAL’s technological capabilities due to development of advanced platforms (Tejas, AMCA, GE-414 & IMRH engines, etc.), and 5) improvement in profitability via scale & operating leverage.

Higher provisions weighed on profitability: Consolidated revenue increased by 10.7% YoY to Rs77.0bn (PLe: Rs76.2bn). EBITDA increased by 11.2% YoY to Rs18.7bn (PLe: Rs17.9bn) while EBITDA margin expanded by 12bps YoY to 24.3% driven by gross margin expansion partially offset by higher employee costs (+28.5% YoY to Rs16.7bn) which may include one-time impact of new labour codes. PBT increased by 21.5% YoY to Rs24.7bn (PLe: Rs21.4bn) aided by significantly higher other income (+44.7% YoY to Rs9.1bn). PAT increased by 29.6% YoY to Rs18.7bn (PLe: Rs16.0bn; consensus Rs16.5bn) aided by lower effective tax rate (25.1% vs 29.6% in Q3FY25).

9MFY26 Performance: Revenue increased by 10.8% YoY to Rs191.5bn. EBITDA increased by 9.2% YoY to Rs47.1bn while EBITDA margin contracted by 35bps YoY to 24.6%. Adj. PAT increased by 16.3% YoY to Rs49.2bn aided by higher other income (+48.1% YoY to Rs25.5bn).

Above views are of the author and not of the website kindly read disclaimer.

.jpg)

2.jpg)