Buy Hindustan Aeronautics Ltd for the Target Rs.5,500 by Motilal Oswal Financial Services Ltd

In-line quarter

Hindustan Aeronautics’ (HAL) 3QFY26 revenue/PAT came in line with our estimates. With an estimated order book of ~INR2.3t to date, we expect this order book to propel manufacturing revenue from the current levels. With receipt of 5 engines from GE for Tejas Mk1A, HAL is ready to deliver these five aircraft during the year and is awaiting more engine deliveries to further scale up deliveries of Tejas Mk1A. HAL has not yet received any details regarding its participation in the AMCA project, where media reports suggested private sector participation. We cut our estimates by 4%/5%/5% for FY26/27/28 to bake in a slightly lower number of Tejas Mk1A deliveries and arrive at a revised TP of INR5,500 based on the average of DCF and 30x Mar’28E earnings. We maintain BUY on HAL. Tejas aircraft deliveries and execution of the manufacturing order book will be key drivers for the stock going forward.

In-line revenue and PAT

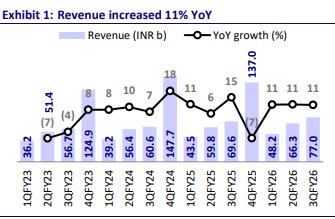

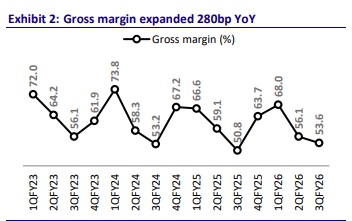

Revenue increased 11% YoY to INR77b, broadly in line with our estimate of INR79b. Gross margin expanded 280bp YoY to 53.6% vs. our estimate of 55%. Absolute EBITDA increased 11% YoY to INR19b, slightly below our estimate of INR20b, while margins were broadly flat YoY at 24.3% (+10bp YoY). Aided by higher other income and a lower tax rate, HAL’s PAT increased 30% YoY to INR18.7b, in line with our estimate. For 9MFY26, revenue/EBIDAT/PAT increased 11%/9%/12% YoY to INR191b/47b/49b, while EBITDA margin contracted 40bp YoY to 24.6%. Employee expenses were higher than expected due to changes in gratuity ceilings by IDA. This has resulted in an increase in employee benefit expenses by INR3.3b for 9MFY26. Excluding that, adj. PAT for 9MFY26 increased 20% YoY to ~INR52.5b (7% ahead of estimate).

Update on the Tejas Mk1A project

HAL has received five F404 engines from GE to date and has successfully integrated them, enabling five LCA Mk1A aircraft to be readied for delivery. The company has identified and resolved all major design and development issues and is in active discussions with the Indian Air Force to commence deliveries at the earliest. An additional nine aircraft have already been built and flown, with their deliveries contingent upon further engine supplies from GE. GE has committed to delivering 24 engines in FY27, which is expected to significantly accelerate Tejas deliveries going forward.

Recent order wins

* Dornier Aircraft: The MoD, at the DAC meeting, signed an INR23b contract with HAL for the acquisition of eight Dornier-228 aircraft for the Indian Coast Guard, supporting domestic manufacturing, MSMEs, and long-term MRO and lifecycle support opportunities.

* Dhruv NG: In Jan’26, HAL signed a contract worth over INR18b with Pawan Hans for the supply of 10 indigenously developed Dhruv-NG helicopters, including spares and accessories, with execution scheduled by CY27 and civil certification expected within two to three months following its maiden flight on 30th Dec’25.

Recently announced DAC approvals

The DAC, in its meeting held today (12th Feb’25), accorded AoNs worth INR3.6t. This included an order for Air-Ship Based High-Altitude Pseudo Satellite (AS-HAPS). In Feb’22, the MoD had signed a deal with HAL for the development of the first prototype of the High-Altitude Pseudo Satellite (HAPS), a part of HAL’s Combat Air Teaming System (CATS) program that is a combination of manned and unmanned systems. Given HAL’s existing development mandate and prior contractual engagement in the HAPS domain, the latest AoN meaningfully strengthens its medium-term order visibility.

Steps towards increasing exports over the long term

HAL has invited consultancy firms through an Expression of Interest (EoI) to help build a structured export strategy for its aircraft and helicopter portfolio. This indicates HAL's strategic focus on expanding beyond domestic defense orders and developing overseas markets in regions such as Africa, Southeast Asia, and Latin America. The consultants are expected to identify potential customers, study local procurement systems, and help create long-term sales pipelines and partnerships. Over time, this initiative can help HAL diversify its revenue base, reduce dependence on Indian defense spending, and build a more stable, export-led growth model.

Other key developments for HAL

* On 6 Dec’25, the second mass-produced HTT-40 trainer aircraft made its first successful test flight from HAL’s new factory in Nashik.

* DRDO completed a high-speed rocket-sled test of a fighter aircraft’s emergency ejection system at 800 km/h in collaboration with the ADA and HAL.

* HAL has received four competitive bids from major industrial players to establish a 20,000-ton isothermal forging press facility, a strategic step toward building heavy forging capability for advanced aero-engine and defense components domestically and reducing reliance on imports.

* HAL has confirmed that its CATS Warrior combat drone program is progressing well and is expected to be ready in CY26 and plans to fly in CY27, strengthening India’s indigenous unmanned combat capabilities.

Financial outlook

We cut our estimates 4%/5%/5% for FY26/27/28 to factor in a slightly lower number of Tejas Mk1A deliveries and expect the overall revenue to grow at a CAGR of 22% over FY25-28, primarily driven by a scale-up in manufacturing revenue. We expect EBITDA margin to remain strong at 29.1%/28.0%/26.8% for FY26/FY27/FY28, fueled by indigenization efforts taken by the company as well as lower provisions. With this, we expect PAT to register a 15% CAGR over FY25-28. With improving revenue and stable margins, we expect RoE/RoCE to remain comfortable, reaching 21.6%/22.1% by FY28

Valuation and view

HAL is currently trading at 30.5x/27.3x/22.1x P/E on FY26E/FY27E/FY28E EPS. We reiterate our BUY rating on the stock with a revised TP of INR5,500 based on the average of DCF and 30x Mar’28E earnings.

Key risks and concerns

Key risks would include 1) slower-than-expected finalization of large platform orders, 2) further delays in deliveries of key components such as engines for Tejas Mk1A, 3) delays in payments from MoD, and 4) increased involvement of the private sector

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412