Hawkish pause : FOMC Signals Two-Way Policy Risks by Choice Broking

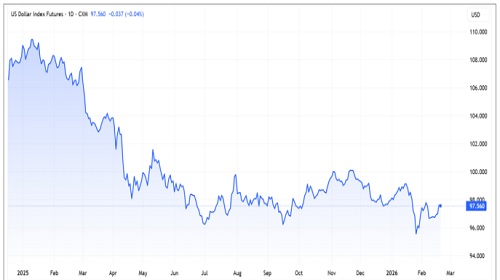

Minutes from the Federal Open Market Committee showed that most members supported keeping interest rates steady at 3.50-3.75%, though views differed on future rate moves. While a majority saw reduced downside risks to employment, concerns remain about persistently high inflation. Ten of twelve voting members, including Chair Jerome Powell, backed the pause, while two favored a 25 basis point cut. Policymakers emphasized a data-dependent approach, indicating that rate cuts may not occur until clearer signs of sustained disinflation emerge. Strong US economic data, including solid manufacturing output, steady job growth, and resilient GDP expansion, further supported the dollar. Traders have slightly reduced expectations for aggressive easing. Meanwhile, global developments, including Japan's policy outlook and geopolitical tensions, continue to influence overall dollar sentiment.

Major Highlights

Federal Open Market Committee held rates steady at 3.50-3.75%.

Policymakers signaled flexibility but maintained a hawkish tone.

Some members supported a possible rate hike if inflation remains elevated.

Traders still expect two 25 bps rate cuts later this year.

US manufacturing output rose 0.6%, strongest in 11 months.

Unemployment fell to 4.3%, signaling labor market stability.

GDP expanded 4.4% in Q3 2025, above expectations.

Inflation forecast to ease to 2.5% year-on-year.

Rate cuts unlikely until clear evidence of sustained disinflation appears.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131