Crude Compass: Geopolitical Risk Supports Premium by Choice Institutional

Developments over the past week:

* Brent price closed above USD 70/bl as geopolitical tensions intensified. Iranian forces conducted military drills in the Strait of Hormuz, the US deployed a second aircraft carrier to the region, while negotiators from Washington and Tehran are set to meet again in two weeks to work toward finalizing a deal.

* The second day of US-facilitated peace talks between Ukraine and Russia wrapped up after only about two hours without any significant progress. Zelensky said Moscow appeared intent on slowing the process, whereas Russian officials described the brief session as tough but conducted in a professional manner.

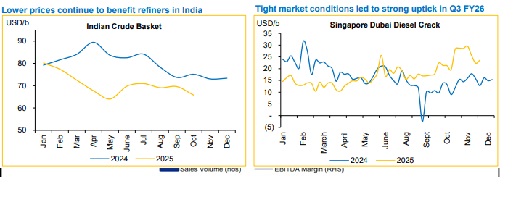

* Russia’s share in overall oil import by India shrank to 21.1%, lowest since Oct 2022. Middle East accounted for 55% while Latin America accounted for 10%.

In our opinion:

* Oil markets continue to bake in about USD6-8/b of geopolitical risk premium in the current prices. If tensions de-escalate or diplomatic progress occurs, the risk premium could unwind, pulling prices down. However, an escalation may lead to further spikes in oil prices from the current levels. For prices to stay elevated, there needs to be a permanent disruption to supply, which is not yet the case.

* The length of discussions between Russia and Ukraine has so far resulted in 140 million barrels of Russian crude at sea. This will continue to increase till the time negotiations continue and might only result in a sharper fall in oil prices provided there is a peace deal.

* Overall, we continue to expect Brent to average at USD 61.5/b in 2026 in the backdrop of increased competition as a result of (a) relentless supply of oil from the US, (b) gradual unwinding of cuts by OPEC+ and (c) possible removal of sanctions.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131