Buy Infosys Ltd For Target Rs1,680 By Elara Capital

No near-term AI disruption; recommend Buy

During its Investor AI Day, Infosys (INFO IN) affirmed it is primed to tap into new USD 300- 400bn AI services market by CY30, as it already serves 90% of its Top 200 clients. Enterprises’ technical debt (undocumented code dependency and data silos) would hinder AI adoption in Brownfield environment vs Greenfield, shielding its traditional services model from immediate disruption, which is comforting. We cannot rule out revenue compression in the near term, as AI-led productivity is passed on to clients, but clients are likely to reward higher wallet share in the long run, creating a positive net impact on revenue. We revise INFO to Buy, as we do not expect any major growth threat, with a lower TP of INR 1,680.

New AI services opportunity of USD 300-400bn by CY30 at the gross level: INFO says it is well positioned to capture new AI services opportunity of USD 300-400bn at the gross level. At the net level, in the near term, this number could change either way depending on how much AI-led productivity it is sharing with clients and whether clients are willing to offer incremental scope of work, helping wallet share gain for service providers. INFO says this is still an evolving situation, but in the medium to long term, it expects this number to be net positive, fueling growth. INFO also expects an improvement in the macro environment, especially in the US, due to a recent interest rate cut. On Enterprise Resource Planning (ERP), management says it does not see any shrinking in the implementation cycle. It says ERP implementation timeline reducing from a few years to few weeks looks misleading. INFO generated 5.5% revenue from AI in Q3FY26. Management mentioned that new pricing models are evolving in terms of outcome based pricing compared to traditional fixed price and T&M.

Widening gap between AI progress vs deployment: Management says AI is evolving at a high speed, led by a hyper competitive market, large capital access, and rapid R&D. As a result, models are capable of training trillions of parameters in CY25 vs a few billions in CY23. However, the gap between AI models and their deployment is increasing, as Greenfield AI development is easier than Brownfield. Enterprises are sitting on a high technical debt and delaying modernization due to financial drain (60-80% of IT budget are spent on maintaining legacy systems), security vulnerabilities (average breach detection exceeds 200 days in the legacy environment), and innovation paralysis (legacy systems are sitting on data silos). This is likely to drive AI adoption demand in the near to medium term, as modernization of legacy systems cannot be deferred anymore.

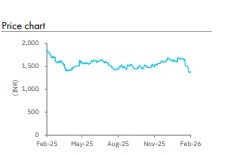

Revise to Buy with a lower TP of INR 1,680: We build in AI-led compression in revenue, with 5% revenue growth for FY27E and 6% for FY28E. We expect earnings growth of 7-8% during FY27-28E. We are rolling forward our numbers to FY28. We value INFO at 20x (from 22x) FY28E earnings (10-year mean). The stock has corrected 16.4% in the past month vs the Index down 15.4%, on likely threat to revenue growth, which we do not see materializing at this moment. Hence, we revise to Buy from Accumulate with a revised TP of INR 1,680 from INR 1,770. Key risk is slower-than-expected growth.

Please refer disclaimer at Report

SEBI Registration number is INH000000933