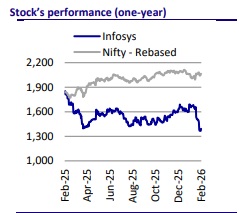

Buy Infosys Ltd for the Target Rs. 1,850 by Motilal Oswal Financial Services Ltd

Infosys AI Day 2026: Building the AI playbook

* We attended Infosys’ AI Day 2026 where management outlined its AI-first strategy and positioning for the next technology cycle. Key takeaways: 1) This AI tech transition is different from prior tech shifts, with foundational model innovation advancing faster than enterprise adoption (creating a deployment gap), while organizational complexity, legacy environments and data readiness remain key constraints. 2) Infosys sized the AI services opportunity at ~USD300– 400bn by 2030, although management did not quantify potential deflationary impacts from AI-driven productivity, which remain a key unknown to monitor. 3) Execution is centered around six AI value pillars, aided by the Topaz platform ecosystem to move clients from experimentation toward scaled deployment. 4) Talent transformation remains a core focus, with large-scale reskilling and new AI-aligned role structures. 5) Topaz Fabric was highlighted as a composable AI platform, integrating models, agents and enterprise systems.

* Infosys also continues to expand its partnership ecosystem across AI-native firms (such as Infosys-Cognition, Infosys-Cursor, Infosys-Anthropic), which we believe could strengthen solution breadth and support go-to-market execution as enterprise AI adoption scales. We see limited evidence for earnings cuts and believe cyclical recovery in core businesses is underway. However, concerns around terminal value and AI-led disruption may restrict near-term multiple rerating. We, therefore, value Infosys at 22x FY28E EPS, with a TP of INR1,850, implying 33% upside.

AI is a strong force but enterprise adoption is a different beast

* Infosys framed AI as a structural technology shift rather than another incremental innovation cycle. Management compared it with prior industry transitions (mainframe → PC → cloud → mobile) but noted that AI requires deeper changes in operating models, workforce structure and enterprise architecture, not just new technology adoption.

* While foundational AI capabilities are advancing rapidly, enterprise adoption is progressing more gradually, creating a gap between technology potential and practical deployment. We believe this reflects the complexity of real enterprise environments

* One key constraint is the brownfield nature of enterprise environments. Unlike greenfield demos that show strong productivity gains, most enterprises operate across fragmented legacy systems built over decades. With ~60-80% of IT budgets still allocated to maintenance, legacy modernization is increasingly becoming a prerequisite for scaling AI initiatives

* Faster model innovation cycles, rapid increases in model scale, and growing agent ecosystems increase the risk of technology obsolescence for enterprises. As a result, we believe enterprises need flexible, tool-agnostic architectures rather than committing to a single platform or vendor too early.

* Overall, we think execution capabilities, including AI-led modernization, data readiness, talent transformation and structured governance, are likely to determine which firms capture value as AI moves from experimentation toward scaled enterprise deployment.

Infosys AI playbook: Six-pillar framework to capture AI-first services opportunity

* Infosys outlined its “AI-first value framework” as the core playbook (Exhibit 5) to scale up enterprise AI adoption and capture the USD300-400b AI services opportunity by 2030.

* The strategy has two parts: building new AI-first services across six value pools and embedding AI across existing offerings to expand wallet share. Management indicated AI work is already embedded across ~90% of top 200 clients, with ~4,600 projects underway.

* The framework is structured around six pillars (see Exhibit 4): (1) AI strategy and engineering, focused on designing enterprise AI architectures and operating models; (2) data for AI, preparing structured and unstructured enterprise data for model readiness; (3) process AI, reimagining workflows using human + agent collaboration; (4) agentic legacy modernization, using AI to accelerate transformation of brownfield environments; (5) physical AI, embedding intelligence into products and edge environments; and (6) AI trust, covering governance, security and responsible AI deployment.

* Execution is supported by the Topaz Fabric platform, which acts as a modelagnostic orchestration layer, integrating proprietary agents, third-party tools and enterprise systems. We think Infosys appears to be positioning itself more as an ecosystem orchestration layer, given rapid model innovation cycles and client preference for flexibility.

Topaz Fabric: AI suite helping enterprise adoption beyond pilots

* Infosys positions Topaz as a composable AI platform rather than just another tool, helping clients move from scattered experiments to scaled, real-world deployment. Its five-runway framework combines consulting, industry expertise and engineering support to turn individual use cases into enterprise-wide programs.

* Topaz Fabric works as a flexible layer that connects across different AI models, cloud platforms and enterprise systems, allowing clients to build on their existing technology investments instead of replacing them. With around 600 pre-built agents and integrations with major enterprise software, it offers flexibility compared to tightly bundled AI stacks.

* As companies expand AI adoption, they need governance models that allow experimentation while running production systems. Topaz includes built-in safeguards around model usage, data access and risk management, enabling faster execution while maintaining enterprise-level security, compliance and stability.

* Infosys is also aligning Topaz with emerging AI-native partners. It is working with platforms such as Devin to support autonomous engineering workflows, while Fabric agents using models like Claude are being integrated into developer tools such as GitHub Copilot. This helps clients adopt new AI capabilities without disrupting existing engineering workflows.

Talent transformation: Evolving structure for career progression

* Infosys is shifting to a dual-track talent operating model that combines premium lateral hiring and top-campus recruitment with scaled internal conversion programs. Structured bridge programs, AI-led assessments and CQbased skill mapping shift the focus to skills as the core currency, enabling a better alignment of talent supply with changing demand.

* Career architecture is being redesigned from a uni-dimensional into a multitrack structure (Y architecture), where broad AI-enabled roles coexist with deep specialist paths and a flat expert layer (see Exhibit 8). New AI-centric roles (e.g., AI strategists, responsible AI engineers and catalyst engineers), alongside human-AI workflow design, are expected to reshape career progression and delivery models.

* AI is changing the nature of work rather than simply reducing workforce demand, with roles gradually shifting from traditional development and testing toward orchestration, integration, deployment and governance. Infosys highlighted large-scale reskilling as a key enabler, supporting emerging roles across AI engineering and enterprise integration.

* AI adoption is beginning to improve RPE without yet translating into headcount compression, suggesting gradual non-linearity rather than abrupt disruption. Infosys expects productivity gains to surface first in output metrics, while workforce expansion remains linked to demand visibility.

Valuation and view

* AI-native enterprise applications are likely to depend on legacy service vendors’ deep client relationships and delivery capabilities to scale effectively, which could support a gradual sector recovery. A partnership ecosystem is emerging - for example, Infosys-Cognition, Infosys-Cursor and Infosys-Anthropic - which we believe will be critical for enabling AI diffusion across enterprises. These collaborations should become increasingly important as organizations move toward scaled adoption.

* We believe CY26 should represent the bottoming of the growth cycle, setting the stage for a more meaningful acceleration in 2HFY27 and FY28 as AI services move into scaled deployment.

* We see limited evidence for earnings cuts and believe cyclical recovery in core businesses is underway. However, concerns around terminal value and AI-led disruption may restrict near-term multiple re-rating. We, therefore, value INFY at 22x FY28E EPS, with a TP of INR1,850, implying 33% upside. Reiterate BUY.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412