Buy Polycab India Ltd for the Target Rs. 8,808 By Prabhudas Liladhar Capital Ltd

Strong execution drives W&C margin expansion

Quick Pointers:

* W&C business reported 20.9% revenue growth in Q2FY26

* EBITDAM expands by 430bps YoY; W&C EBIT margin expand by 270bps YoY

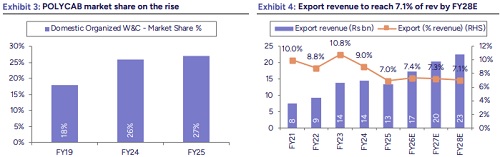

The Wires & Cables (W&C) segment reported volume growth in high teens, with cables bit higher than wires. Domestic W&C business grew by 20.6% YoY, driven by high government spending and improved project execution. The company's international business grew by 25% YoY in Q2FY26 and contributed 6.5% to the total revenue. In EPC segment reported an EBIT margin of 18.1% in Q2FY26, supported by a one-time gain of Rs 300mn. The company aims to increase export contribution to 10% by FY30. Its FMEG segment delivered another quarter of positive EBIT led by solar products and is expected to be the major contributor to the FEMG portfolio. Its new plant is expected to be commissioned by Q3FY27 and accordingly, revenue contribution from EHV sales is likely to commence from FY28. POLYCAB aims to achieve 1.5x sector growth in volume and EBITDA margin of 11-13% by FY30 through its Project Spring. We expect revenue/EBITDA/PAT CAGR of 18.6%/22.0%/20.9% over FY25-28E. We assign SOTP-based target price of Rs8,808 (Rs 8,718 earlier), implying PE of 40x FY28E.

W&C grows 20.9% YoY, domestic W&C business up 20.6%: W&C business reported revenue growth of 20.9% YoY in Q2FY26, with cables outpacing wires in volume terms. Emerging sectors like data centers, EVs, aerospace, defense and government expenditure have collectively created substantial opportunities for the domestic W&C industry. The company remains a leader in the W&C space in India with a market share of 27% in the domestic organized W&C industry. In case of international business, the US (contributes ~20% of exports), Europe, Australia and the Middle East are the key contributors, while other regions continue to exhibit strong demand. The company now exports to 80+ countries and plans to add more countries to expand revenue and minimize revenue concentration risk. International business revenue accounted for 6.5% of the consolidated revenue for the quarter.

Sales grows 17.8%, PAT up 55.9%: Sales grew 17.8% YoY to Rs64.8bn (PLe: Rs 66.2bn). W&C business grew 20.9% YoY to Rs56.3bn (PLe: Rs55.1bn). Export revenue grew by 25% YoY and contributed 6.5% to total sales. Gross margins expanded by 350bps YoY to 27.1% (PLe: 25.0%). EBITDA grew by 61.6% YoY to Rs10.2bn (PLe: Rs8.9bn). EBITDA margin expanded by 430bps YoY to 15.8% (PLe: 13.4%) due to improved pricing action and operational efficiency. PAT grew by 55.9% YoY to Rs6.9bn (PLe: Rs5.7bn). W&C EBIT grew by 47.0% YoY to Rs8.5bn and margins expanded by 270bps YoY to 15.1%. FMEG revenue rose by 14.3% YoY to Rs4.4bn (PLe: Rs 4.4bn) and reported positive EBIT of Rs 24mn vs loss of Rs 252mn in Q2FY25.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271

.jpg)