MCX Natural gas Oct is expected to hold above Rs.295 level and rise towards Rs.314 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

* Spot Gold is likely to trade higher amid tariff concerns and uncertainty over U.S Government shutdown. Further, increase in prospects of lower interest rate would push prices higher. Furthermore, strong ETF inflows would also support prices. In September global ETF inflows stood at $17.3 billion. In this year Indian gold ETF inflows almost doubled to $2.18 billion compared to $1.29 billion in 2024. Meanwhile, most of the economic data release from US will be delayed and investors will eye on comments from the Fed members and FOMC meeting minutes to get more clarity in quantum of rate cuts this year. Spot gold is hovering near $4000 per ounce. Above $4000 per ounce it would open the doors towards $4100.

* MCX Gold December is expected to rise towards Rs.122,000 level as long as it stays above Rs.119,600 level

* MCX Silver Dec is expected to remain volatile. It may find support near Rs.144,000 level and rebound towards Rs.148,000 level.

Base Metal Outlook

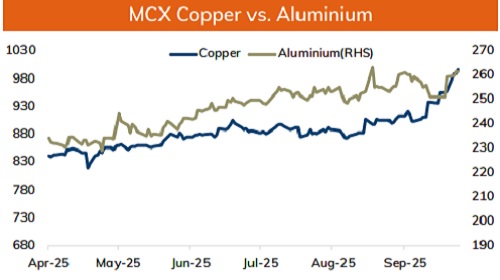

* Copper prices are expected to hold its ground and trade with a positive bias amid supply concerns. Prolonged supply disruption in Indonesia and Chile has fueled persistent shortage concerns. Further, drop in LME inventory levels by almost 11% last month indicates tightness in the physical market. Additionally, price would also get support amid growing bets of further monetary policy easing from the US Fed. Meanwhile, US government shutdowns, tariff concerns and a stronger dollar would restrict its upside.

* MCX Copper Oct is expected to find support near Rs.980 and move back towards Rs.1000 level.

* MCX Aluminum Oct is expected to rise towards Rs.264 level as long as it stays above Rs.260 level.

* MCX Zinc Oct looks to rise towards Rs.298 as long as it holds key support at Rs.292. Depleting inventory levels in LME would provide support to prices..

Energy Outlook

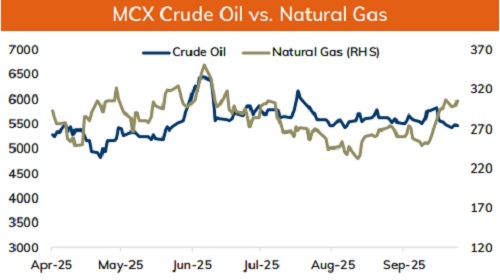

* Crude oil is likely to trade higher amid escalating conflict between Russia and Ukraine. Attacks on Russian oil refineries with the help of long-range drones has caused a meaningful disruption to Russia’s refinery as well as export capacity. Additionally, concerns over further sanction on Russian oil purchase would also bring volatility in price. Meanwhile, rise in US API crude oil inventory levels and extension of US Government shutdown would restrict any major up move in oil prices. US crude oil inventories rose by 2.78 million barrels last week against market expectation of 2.25 million barrels rise.

* MCX Crude oil Oct is likely to hold Rs.5380 level and move back towards Rs.5640 level. A move above Rs.5640 would open the doors towards Rs.5750. NYMEX crude oil is likely to hold $61 per barrel and rally towards $63 per barrel mark. A strong put base at $60 strike indicates strong support.

* MCX Natural gas Oct is expected to hold above Rs.295 level and rise towards Rs.314 level.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631