Spot gold is likely to rise towards $5100 as long as it holds above $4900 - ICICI Direct

Metal’s Outlook

Bullion Outlook

* Spot gold is to expected to hold its ground and move higher amid safe haven buying. Tension between US and Iran remained at a critical point after the Geneva talk. U.S. has reportedly given Iran two weeks to submit a detailed written proposal for resolving the nuclear standoff. Despite “guiding principle” core disagreement remains. The US demand end to all Uranium enrichment and missile programs, while Iran refuses to halt enrichment and demands safe sanction relief. Meanwhile, a stronger dollar and expectation of better economic numbers would limit the upside in the bullions. Furthermore, investors will also eye on comments from the Fed members to get more clues on rate cut.

* Spot gold is likely to rise towards $5100 as long as it holds above $4900. MCX Gold April is expected to move higher towards 158,500 as long as it trades above 152,000.

* MCX Silver March is expected to move in the range of 240,000 and 248,500. Only a move above 248,500 it would rise towards 252,000.

Base Metal Outlook

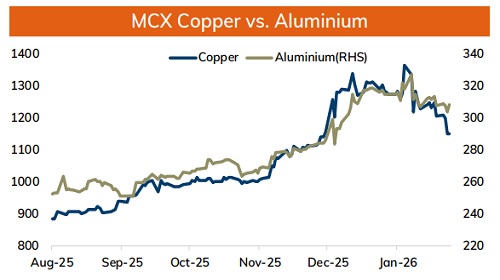

* Copper prices are expected to trade with negative bias amid firm dollar and signs of weak demand in China amid Lunar New Year holidays. Additionally, persistent rise in inventories at LME registered warehouses would hurt prices. Furthermore, Yangshan copper premium, which reflects Chinese appetite for imported copper, was at $33 a ton, still too low to indicate strong demand. Additionally, investors will remain cautious ahead of slew of economic data from durable goods orders to housing data from US to gauge economic health of the country and demand outlook

* MCX Copper Feb is expected to slip towards Rs.1150 level as long as it stays below Rs.1200 level. A break below Rs.1150 level prices may be pushed towards Rs.1125-Rs.1120 level

* MCX Aluminum Feb is expected to slip towards Rs.302 level as long as its stays below Rs.314 level. MCX Zinc Feb is likely to face stiff resistance near Rs.328 level and slip further towards Rs.315 level

Energy Outlook

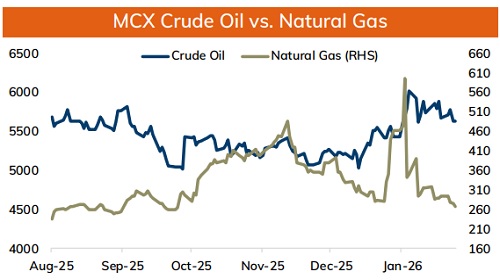

* NYMEX Crude oil is expected to trade higher amid intensifying geopolitical risk premium centered on the Middle East. Fear over Imminent US-Iran conflict would likely to bring risk premiums to oil prices. A massive U.S. military buildup including 150 cargo planes and two aircraft carrier strike groups has signaled that a "weeks-long" campaign could be imminent. Investors are pricing in potential disruptions to the Strait of Hormuz, a critical chokepoint through which 20% of the world's oil flows.

* On the data front, closer of OI in ATM and OTM call strike indicates prices to move higher. MCX Crude oil March is likely to rise towards 6000 mark, as long as it trades above 5800. Only close above 6000 it would turn bullish and open the doors towards 6200.

* MCX Natural gas February future is expected to move in the band of 264 and 280. Only a move below 264 would bring further weakness .

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631