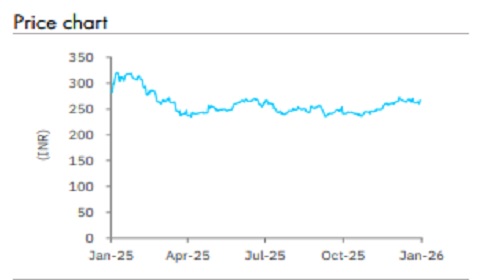

Sell Wipro Ltd for Target Rs220 by Elara Capitals

2.jpg)

Slow deal ramp-up

Wipro (WPRO IN) Q 3 revenue numbers were better than our expectations , driven by Harman DTS integration. T otal contract value ( TCV ) wi tnessed a moderation from the peak achieved a couple of quarters ago . The company says some large deals won in the previous quarters are not ramping up , as per guidance, and there would be a possible delay . This is likely to impact revenue in the up coming quarters , in our view. Management says the margin profile for Harman DTS acquisition is lower than the company ’s; consequently , margin may not sustain at the current level and is likely to see moderation here after. Near -term guidance is in the range of 0% to + 2% in CC terms for Q 4FY26 . We reiterate Sell with a higher TP of INR 220, given: 1) lack of growth compared to peers , and 2 ) downward pressure on margin , and the margin gap is likely to widen compared to large caps

Americas 2 market remains under pressure: In Q 3, revenue grew closer to the upper end of the guidance range. Management had set a revenue growth target in the range of -0.5% to +1.5% in CC terms, but WPRO reported a 1.4% QoQ CC increase , including 0.8% contribution from Harman DTS acquisition. In USD terms, revenue grew 1.2% QoQ while in INR terms, it rose 3.8% QoQ, due to the INR depreciation. Growth in Q2 was driven by the EU, up 2.7% QoQ, due to ramp ?up of a previously announced mega deal , while Americas 1 grew 1.9% QoQ. The Asia -Pacific, the Middle East and Africa (APMEA ) market rose 1.1% QoQ , with robust performance in India, Australia , and Southeast Asia. Americas 2 market was down 1% QoQ. TCV came in at ~ USD 3.3bn, down 5.1% YoY, while large deal TCV was at USD 871 mn , down 9.4% YoY . Last Twelve Mont hs (LTM ) attrition was down 70bp QoQ to 14.2%, while headcount rose by 6.5K , due to Harman DTS acquisition consolidation and a large deal ramp -up

IT services margin expands QoQ: IT services margin was up 90bp at 1 7.6%, supported by the INR depreciation , improved utilization, attrition management , and cost contro l despite ongoing furlough impact and early dilution from the Harman DTS acquisition . Looking ahead to Q4, management expects incremental margin dilution from the Harman DTS acquisition, alongside growth investments, large -deal margin mix, and potential wage hikes, but remains confident of sustaining operating margin in the range of 17.0– 17.5%. W PRO incurred INR 2,630mn one ?time restructuring cost in Q3FY26, primarily in the EU and Capco , with no additional restructuring charges expected .

Reiterate Sell with a higher TP of INR 220: Q4FY26 positive guidance of 0% to +2% in CC terms is helped by Harman DTS while organic growth could continue to be weak , in our view . The company is seeing recovery in BFSI ; however , other verticals continue to face challenges. The energy vertical continues to face tariff s-related challenges while the consumer vertical is impacted due to a client pausing a large deal , which is yet to restart. We reiterate Sell with a higher TP of INR 2 20 from INR 2 10 on 17x (unchanged) FY27E P/E. We revise our revenue estimates by 2 -4% during FY27 -28E to integrate Harman DTS in to our numbers . Key upside risks are better -than -expected revenue growth and margin expansion.

Please refer disclaimer at Report

SEBI Registration number is INH000000933