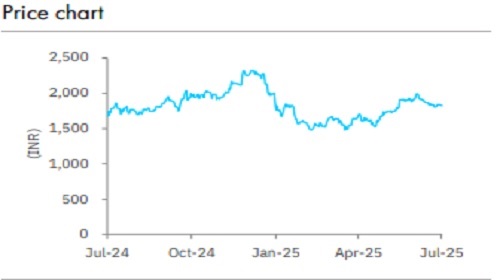

Buy Oberoi Realty Ltd for Target Rs2,500 by Elara Capitals

Q1 delivery setting stage for a strong FY26

Presales for Oberoi Realty (OBER IN) were broad-based and in-line at INR 16.4bn. This was aided by the launch of a new tower at Goregaon (INR 11.2bn). The key positive was the strong offtake in sales at Mulund (annualized run-rate of INR 6bn versus INR 4 / 5bn in Q4 / Q1 FY25 respectively), aided by higher average realization, up 15% QoQ. We expect this run-rate to rise, with the release of higher floor inventory at Eternia, following the receipt of the final occupancy certificate anticipated in the near-term. Thane sustains its quarterly contribution run-rate at INR 1bn, while in 360 West, a unit was sold for INR 2.1bn. Profitability across office assets improved sequentially (EBITDA margin up 200-300bps) on account of stable-toimproving occupancies. Average occupancy at the Sky City mall was at 50% in its first trading quarter. Also, the developer-led consortium won the bid (via NCLT – pending approval) to acquire Horizon Hotel that houses a ~2acre prime land parcel in one of the posh micro markets of Mumbai – Juhu. This has taken the overall business development to >INR 500bn since FY23. Overall, FY26 features key high-value launches. Reiterate Buy

Impressive offtake in Goregaon; traction in Mulund promising: OBER reported strong presales of INR 16.4bn in Q1FY26, up 92% QoQ and 54% YoY, led by the successful launch of Goregaon Elysian Tower D, which contributed INR 11.2bn. This is commendable, given that >50% of the call money from buyers is expected within 120 days, driven by the fact that nearly half the tower is already constructed. Also, sales traction at Mulund implies robust demand, even at higher pricing – average realization in Enigma is up 15% QoQ. Elsewhere, Thane sustains its quarterly run-rate of INR 1bn, while 360 West sold a unit (scope for significant improvement in traction). Overall, FY26 is geared for key launches, including Borivali (Q3) and Gurugram (Q4), fueling our full-year presales forecast of INR 71.5bn (+35% YoY).

Strong show in annuity business, but relatively softer performance in hospitality: Occupancy in Commerz III improved 2ppt QoQ, while in Commerz I and II was steady QoQ at 96%. Mall revenue rose 74% QoQ on account of the first trading quarter for the Borivali mall. Improving occupancies aided an uptick in EBITDA margin to 92% (85% in Q4FY25). Average occupancy for the hospitality segment stood at 72% (83% in Q1FY25), with higher ARR supporting performance. ARR rose 22% YoY but dropped 16% QoQ, resulting in RevPAR growth of 4% YoY and a 24% drop QoQ. EBITDA margin came in at 38%, versus 44% in Q4FY25 and 40% in Q1FY24.

Reiterate Buy; March 2026E TP retained at INR 2,500: We view OBER as a low risk compounder, given: 1) its prudent underwriting through cycles – land cost at <5% of GDV, 2) deep micro market presence – 25% / 15% / 10% volume market share at Goregaon / Borivali / Mulund micro markets, respectively through FY21-25, and 3) convergence to a multi-regional play with its entry into Gurugram. The stock is trading attractively - near March ’26E NAV, while EV / core FCFF for the development business at 10x / 8x on FY26E / FY27E, respectively. Key downside risks include delays in project launches and regulatory setbacks. We align our presales estimates to launch timelines, driving FY26-FY27 EPS down by 10-12%.

Please refer disclaimer at Report

SEBI Registration number is INH000000933

.jpg)