Neutral Eris Lifesciences Ltd for the Target Rs. 1,520 by Motilal Oswal Financial Services Ltd

Segment-specific measures lead to a miss on earnings

Work-in-progress to build growth in domestic/international markets

? Eris Lifesciences (ERIS) reported lower-than-expected performance with a 4%/8%/11% miss on revenue/EBITDA/PAT for the quarter. ERIS witnessed strong growth in the international business. Domestic formulation (DF) business grew at a slower pace in 3QFY26. ? ERIS has re-evaluated its DF portfolio and decided to curtail products that are either not growing and/or not aligning with its core therapies. This kept growth under check in the DF segment in 3QFY26.

? While margins in the international business were lower during the quarter, this is largely due to the front-loading of opex to cater to future needs.

? ERIS’ order book has expanded 10x between 1QFY26 and 3QFY26. In addition to existing sites, ERIS’ third injectable site is expected to be commissioned in FY28, adding capacity for its CDMO business.

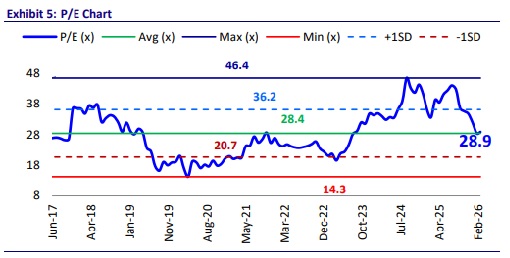

? We lower our earnings estimate by 5%/7%/6% for FY26/FY27/FY28, factoring in: a) the rationalization of portfolio in the DF segment, and b) increased operational costs in the international business. We value ERIS at 28x 12M forward earnings to arrive at TP of INR1,520.

? We expect a 14%/15%/31% CAGR in sales/EBITDA/PAT over FY26-28, backed by comprehensive offerings in the insulin segment, GLP product launch in India, and a healthy order book in the CDMO segment. That said, the current valuation captures this upside. Reiterate Neutral rating on the stock.

Stronger operating efficiency cushions the product mix effect

? ERIS’ 3QFY26 revenue grew 11% YoY to INR8.1b (vs our est: INR8.4b).

? The DF segment grew 10% YoY to INR7b (86% of the sales). The international market sales grew 45% YoY to INR1.1b (14% of sales).

? Gross margin contracted 330bp YoY to 72.3%.

? However, EBITDA margin expanded 50bp YoY to ~34.9% (our est. 36.4%), despite decreased gross margins. Employee costs/other expenses declined 10bp/declined 370bp YoY as a % of sales) for the quarter.

? DF EBITDA margin was stable at 36.5%. International market EBITDA margin was 29.7% vs 28.9% YoY.

? EBITDA increased 12.5% YoY to INR2.8b (vs our estimate: INR3b).

? Adj. PAT increased 34.7% YoY to INR1.1b (vs our estimate: INR1.3b).

? Exceptional item (INR172m) relates to one-time employee expense on account of changes in the labor code.

? For 9MFY26, Revenue/EBITDA/PAT grew 8.4%/10.7%/35.4% YoY.

Highlights from the management commentary

? The discontinuation of certain low-margin products has led to lower YoY growth in the DF segment in 3QFY26.

? ERIS has guided for FY27 revenue/EBITDA of INR5.5b-INR6b/INR1.8b-INR2b from the international business.

? ERIS is currently lagging market growth in oral anti-diabetes therapy but expects to stabilize over the next 2-3 quarters.

? The company has identified three key growth drivers for the next 3-4 quarters: its diabetes franchise, integration of biotech manufacturing, and ramp-up of the international business.

? ERIS has developed Esaxerenone in-house. The clinical data is favorable for reduction in hypertension as well as some benefits on the kidney side.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

.jpg)