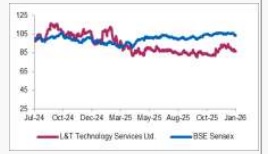

Hold L&T Technology Services Ltd For Target Rs. 4,600 By Axis Securities Ltd

Margin Expansion Supports Growth; Focus on Restructuring-Led Transformation

Est. Vs. Actual for Q3FY26: Revenue – MISS; EBIT – INLINE; PAT – MISS

Change in Estimates YoY post Q3FY26:

FY26E/FY27E: Revenue: 0%/4%; EBIT: 1%/11%, PAT: -5%/10%

Recommendation Rationale

* AI and Innovation: The company is pivoting from "AI" to full-stack "Engineering Intelligence". LTTS is implementing an AI-first strategy and has filed 229 patents in AI and Gen AI. It aims for near-universal AI literacy within the workforce in the next three quarters. Furthermore, LTTS has built a scalable, enterprise-ready platform called Agentic IQ. This platform enables the rapid creation, orchestration, and governance of AI agents across the engineering lifecycle.

* Deal Wins/Pipeline: The company secured large deals with a TCV of $180 Mn, maintaining a trajectory of near $200 Mn for five consecutive quarters. New wins include a high-value engineering centre for an Australian enterprise and expanded partnerships in the energy sector.

* Growth Outlook: Management maintains a mid-single-digit growth guidance for FY26 and aspires for around 16% EBIT margins by Q4FY27 or Q1FY28, driven by capital allocation to high-margin segments (Sustainability and Mobility segment), exiting low-margin areas, and operational efficiencies via AI

Sector Outlook: Cautiously Optimistic

Company Outlook & Guidance: The company is pivoting towards "Engineering Intelligence" (EI) and AI-led solutions in preparation for its next 5-year "Lakshya" strategy, beginning in FY27. The company aims to increase its large deal win rate from the current $200 Mn per quarter to $300 Mn to accelerate growth.

Current Valuation: 26x Dec’27E P/E (Earlier Valuation: 28x Mar’27E)

Current TP: Rs 4,600/share (Earlier TP: Rs 4,650/share)

Recommendation: We recommend a HOLD rating on the stock.

Financial Performance

In Q3FY26, LTTS reported revenue of Rs 2,924 Cr vs Rs 2,653 Cr, up 10.2% YoY but down 1.9% YoY due to discontinuation of non-strategic accounts. EBIT stood at Rs 427 Cr vs Rs 422 Cr, up 1.2% YoY and 7.3% QoQ, led by lower other expenses. The company reported net income of Rs 303 Cr vs Rs 320 Cr, down by 5.1% YoY and 7.9% QoQ, primarily due to exceptional costs related to labour codes. However, in CC terms, revenue was up 4.6% YoY. Attrition levels show some improvement, standing at 14.4% vs 14.6% YoY.

Valuation & Recommendation

The management aims to improve revenue verticals by pivoting towards higher-margin, futuristic technologies (Engineering Intelligence) and exiting commoditised, low-margin businesses. However, Q4FY26 is expected to have a wage impact with restructuring expenses. We value the company at 26x of Dec’27E EPS and recommend a HOLD rating on the stock, with a target price of Rs 4,600/share, implying an upside of 8% from the CMP.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633